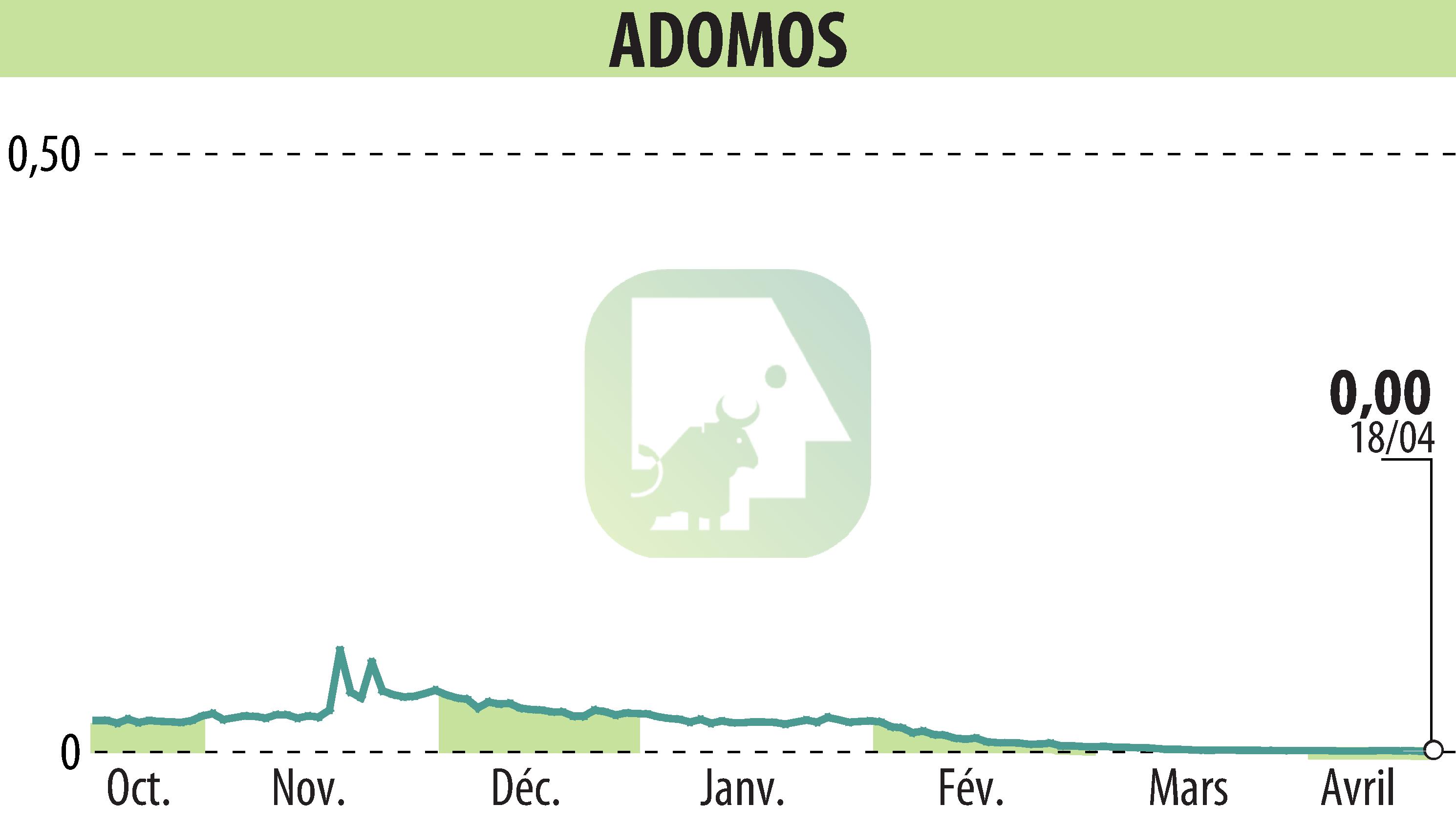

on ADOMOS (EPA:ALADO)

ADOMOS 2023 annual results, impacted by the real estate crisis

ADOMOS published its annual results for the 2023 financial year, marked by a significant decline. Operating income fell by 62.97% to reach €2,352 thousand, compared to €6,352 thousand in 2022. Gross operating surplus (EBE) also saw a considerable drop, going from €895 thousand in 2022. 2022 to -€1,091 thousand in 2023, i.e. a variation of -221.90%.

Furthermore, the group's consolidated net income worsened, with a loss of €6,206 thousand, compared to a loss of €3,270 thousand the previous year, representing an increase in the net loss of 89.79%. This deterioration of results is mainly due to the amortization of technological investments made in recent years and to an unfavorable market environment, marked by the collapse of real estate loans.

The financial situation of ADOMOS is also worrying, with shareholders' equity increasing from €16,537 thousand in 2022 to €9,293 thousand in 2023, and a substantially increasing net debt reaching €6,297 thousand at the end of the year. exercise. Gross cash also decreased, standing at €180 thousand, down €484 thousand compared to the end of 2022.

R. H.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all ADOMOS news