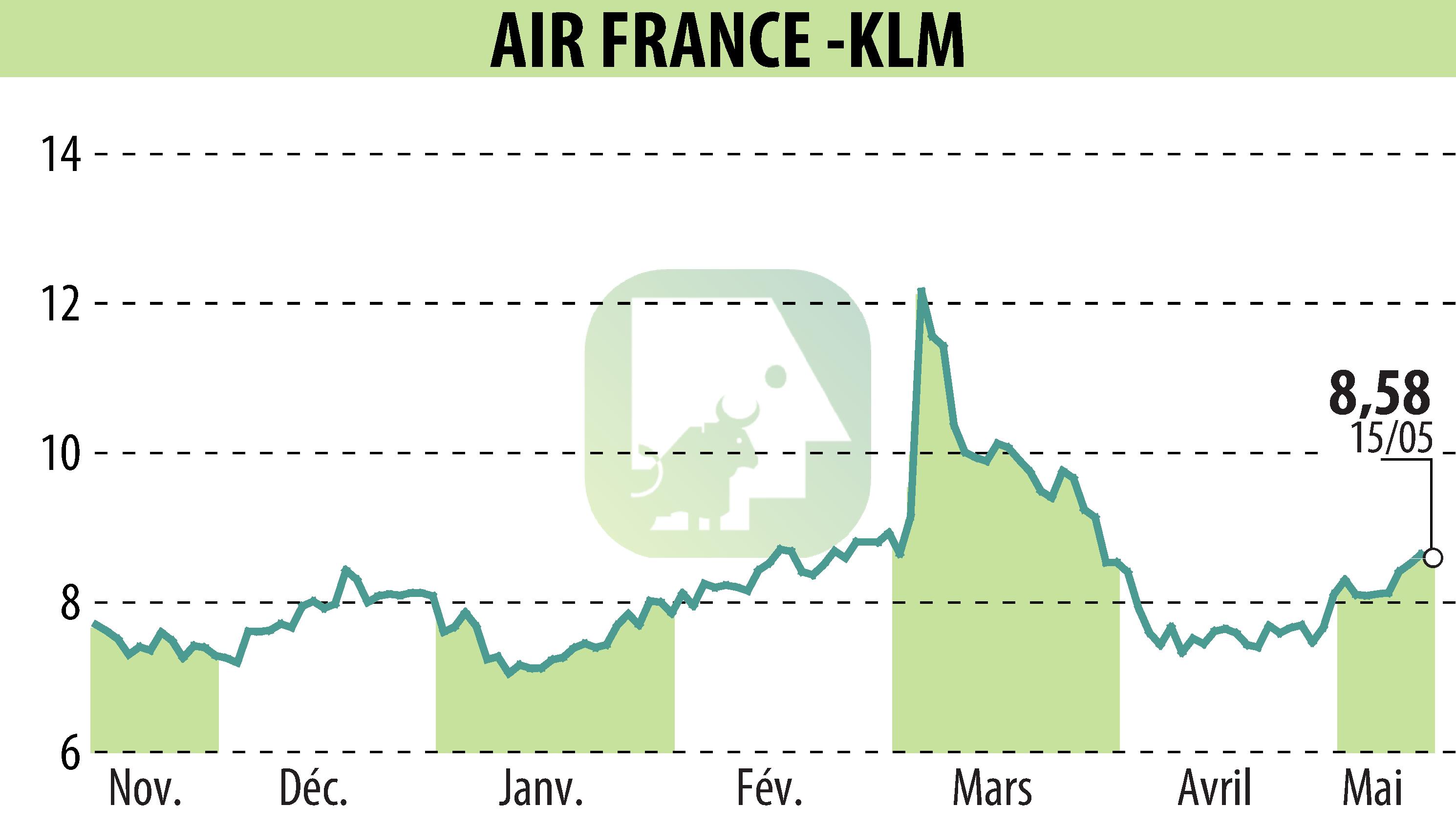

on AIR FRANCE-KLM (EPA:AF)

Air France-KLM Successfully Issues €500 Million Hybrid Bonds

Air France-KLM announced the successful issuance of €500 million in hybrid bonds, offering an annual fixed coupon of 5.75% until the first reset date. These undated, deeply subordinated bonds are rated BB by Fitch and B+ by S&P, qualifying for 50% equity credit with both agencies. Fitch and S&P have reaffirmed Air France-KLM’s long-term issuer rating at BBB- and BB+, both maintaining a stable outlook.

The issuance received a strong market response, with an order book exceeding €1.75 billion, indicating an oversubscription rate of 3.5 times. This high demand reflects investors' confidence in Air France-KLM’s strategic direction and creditworthiness.

Proceeds from this issuance will support general corporate purposes, including potential refinancing of existing instruments, thereby simplifying the company's balance sheet and optimizing financing costs while ensuring financial flexibility. An application for trading on Euronext Paris will be made.

R. E.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all AIR FRANCE-KLM news