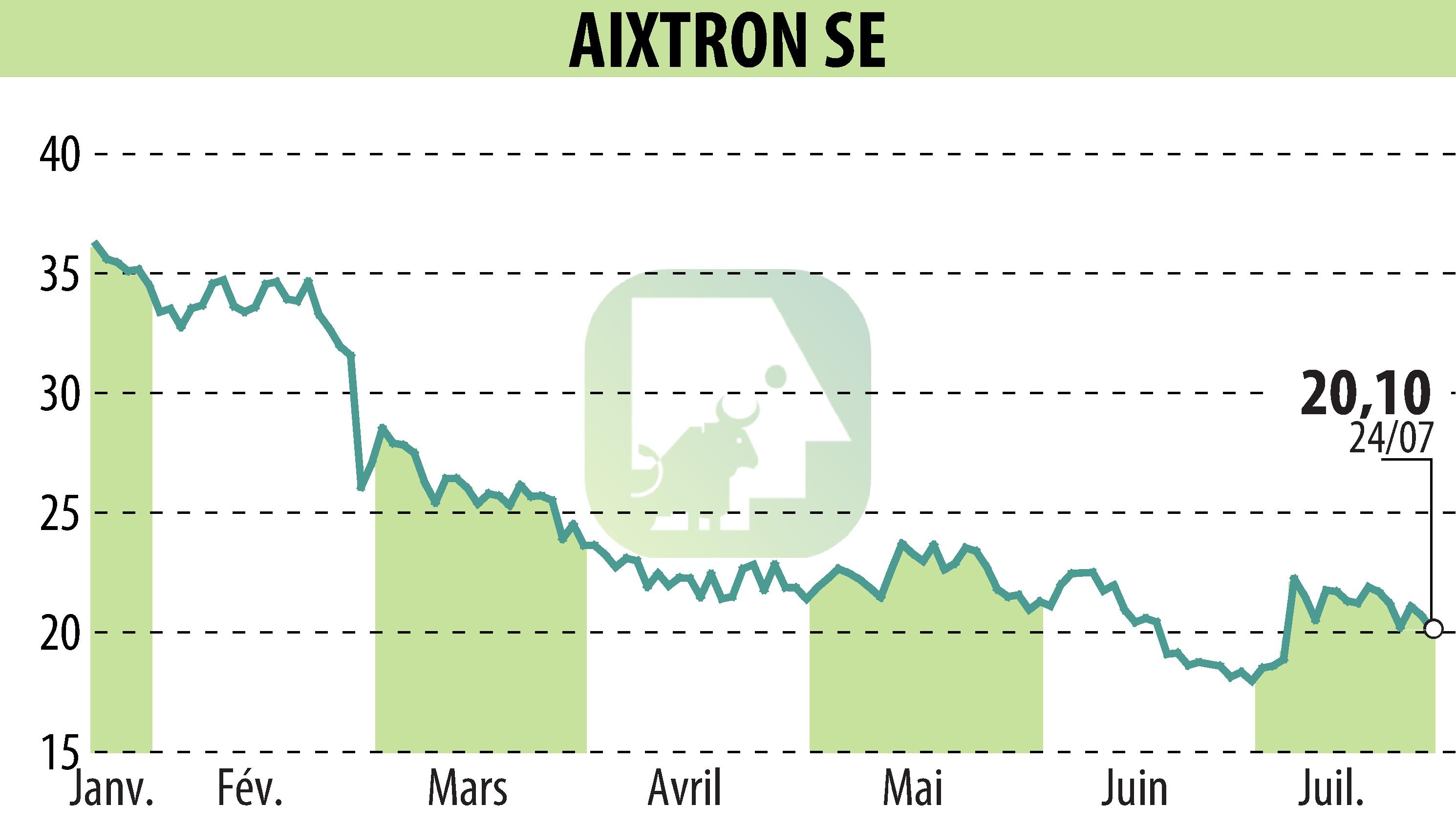

on AIXTRON SE (isin : DE000A0WMPJ6)

AIXTRON Reports Strong Order Intake in Q2 2024

AIXTRON SE achieved robust financial results in the first half of 2024, with revenues amounting to EUR 250.1 million, in line with the previous year despite weaker market dynamics. The company’s G10 product family was a key driver, and order intake reached EUR 175.7 million in Q2 2024, similar to Q2 2023. High demand from the power electronics sector, especially for SiC and GaN systems, contributed significantly.

In June, AIXTRON expanded its production capacities by acquiring a new site near Turin, Italy, aiming to double its output in the future. Additionally, the construction of a new innovation center in Herzogenrath is progressing, with an investment of around EUR 100 million.

The company recorded a system order backlog of EUR 400.6 million by June 30, 2024. Despite a slight decrease in gross profit to EUR 92.9 million and a lower EBIT, investments in R&D remained high, emphasizing a strategic focus on future growth opportunities. Full-year revenue guidance for 2024 has been revised to EUR 620.0 million to EUR 660.0 million.

R. E.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all AIXTRON SE news