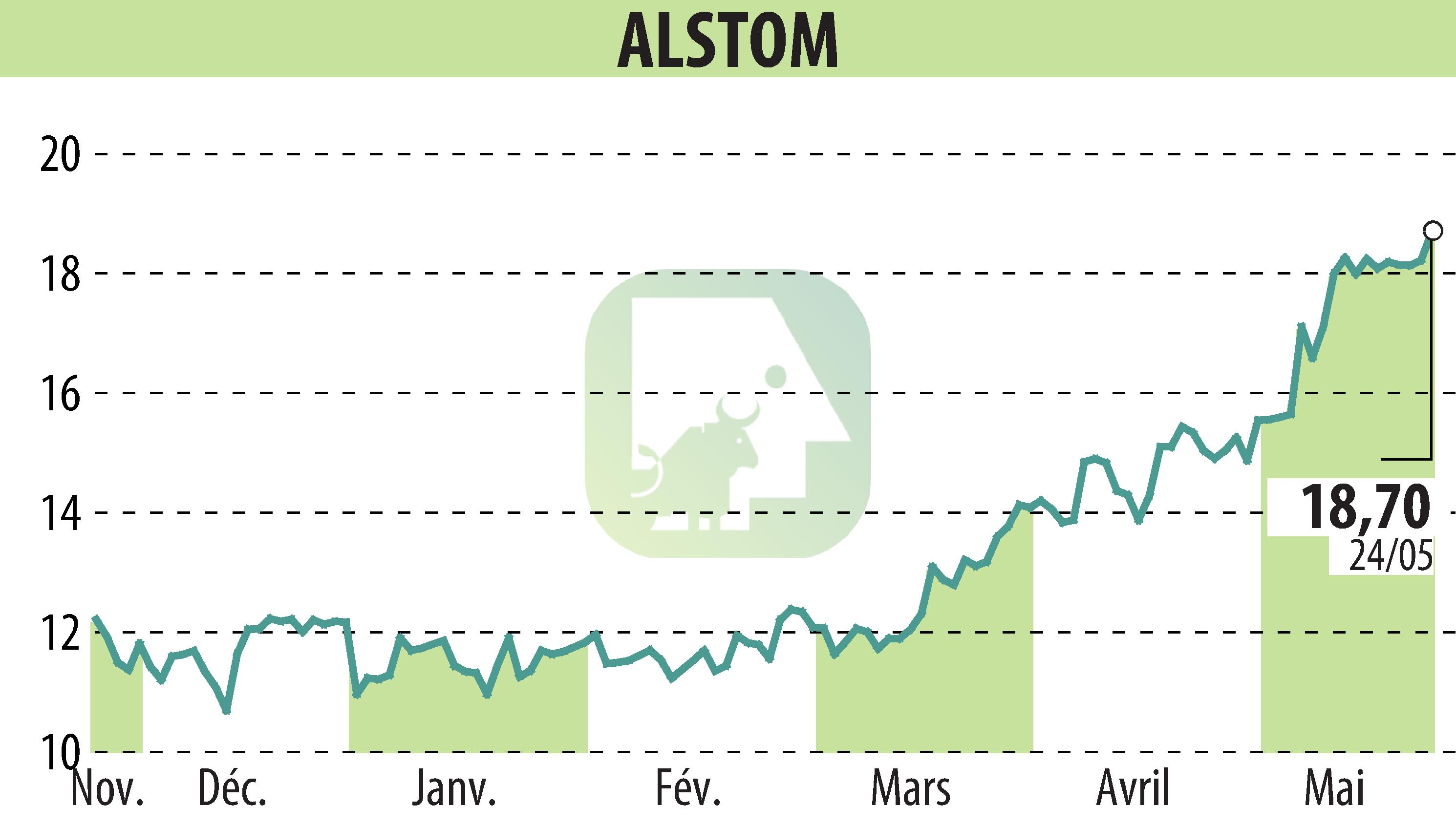

on ALSTOM (EPA:ALO)

Alstom Executes Final Step of €2 Billion Deleveraging Plan with €1 Billion Capital Increase

On 27 May 2024, Alstom announced the launch of a share capital increase with preferential subscription rights amounting to approximately €1 billion. This move marks the final step in the company's €2 billion deleveraging plan.

The subscription ratio is set at 1 new share for 5 existing shares, with a subscription price of €13.0 per new share. Key stakeholders, such as CDPQ and Bpifrance Investissement, have committed to participating in the capital increase pro-rata to their shareholdings.

The deleveraging plan also includes divestments worth around €700 million and the successful placement of €750 million in hybrid bonds. Moody's has reaffirmed Alstom's Baa3 long-term issuer rating, promising a stable outlook upon the plan's successful execution.

The rights issue will be traded on Euronext Paris from May 28th to June 6th, 2024.

R. E.

Copyright © 2024 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all ALSTOM news