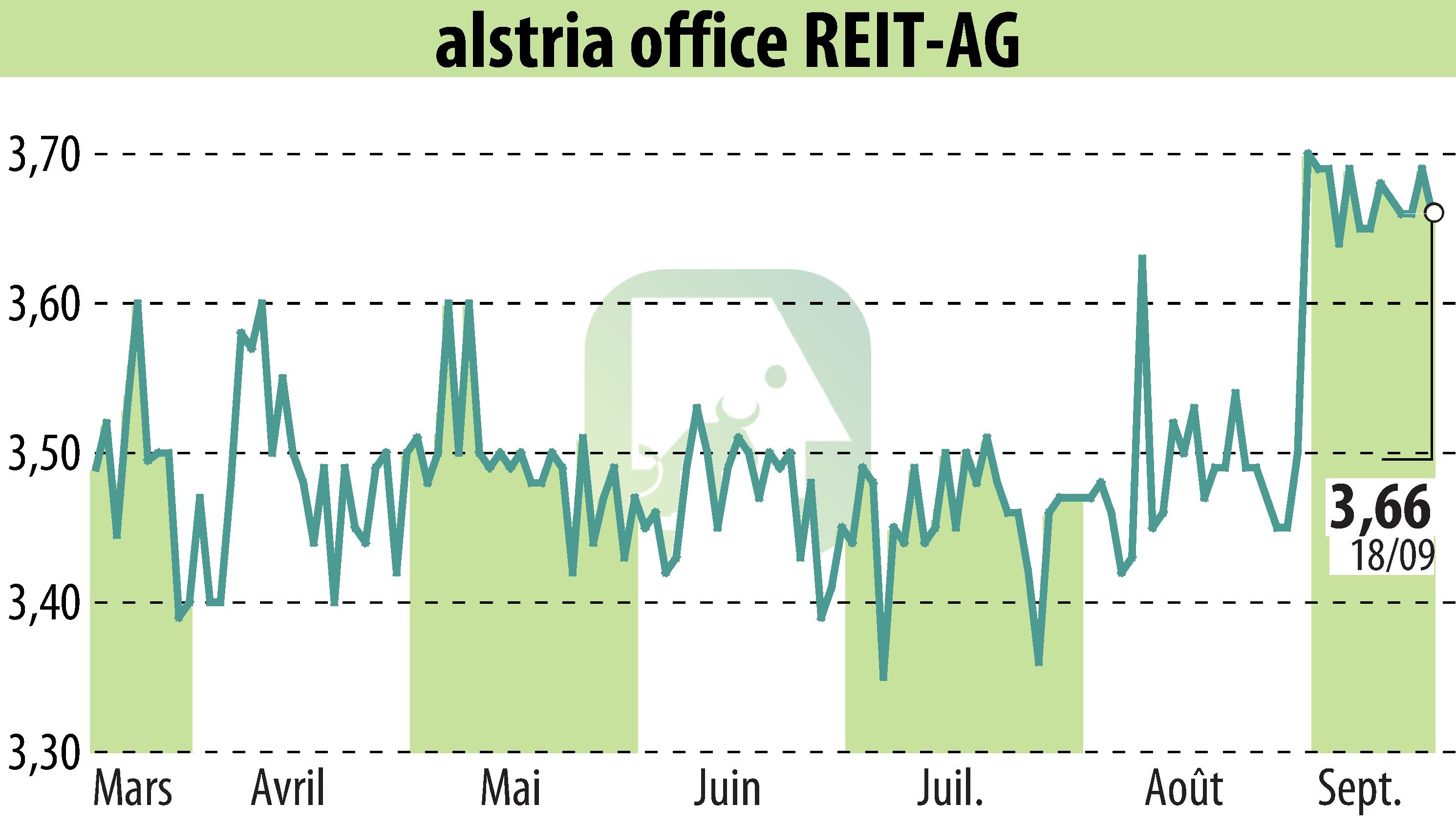

on Alstria Office REIT-AG (isin : DE000A0LD2U1)

Alstria Office REIT-AG Faces Significant Changes: Squeeze-Out and Loss of REIT Status

Alstria Office REIT-AG, based in Hamburg, has announced a series of significant changes. The company received a squeeze-out demand from its majority shareholder, BPG Holdings Bermuda Limited, a subsidiary of Brookfield Corporation. This move will transfer the shares of minority shareholders to BPG Holdings Bermuda Limited for cash compensation, expected to be finalized in the first quarter of 2025.

Additionally, Alstria has amended its investment agreement with entities controlled by its majority shareholder. This amendment permits a squeeze-out before the agreement's original termination in February 2025. Consequently, Alstria will lose its REIT status by the end of 2024, leading to non-cash deferred tax liabilities estimated between EUR 150 million and EUR 400 million.

The company’s stock is traded on multiple exchanges, including Frankfurt and London. Alstria emphasizes the implications of these changes on its financials, with further details available in its half-year financial statement for 2024.

R. H.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all Alstria Office REIT-AG news