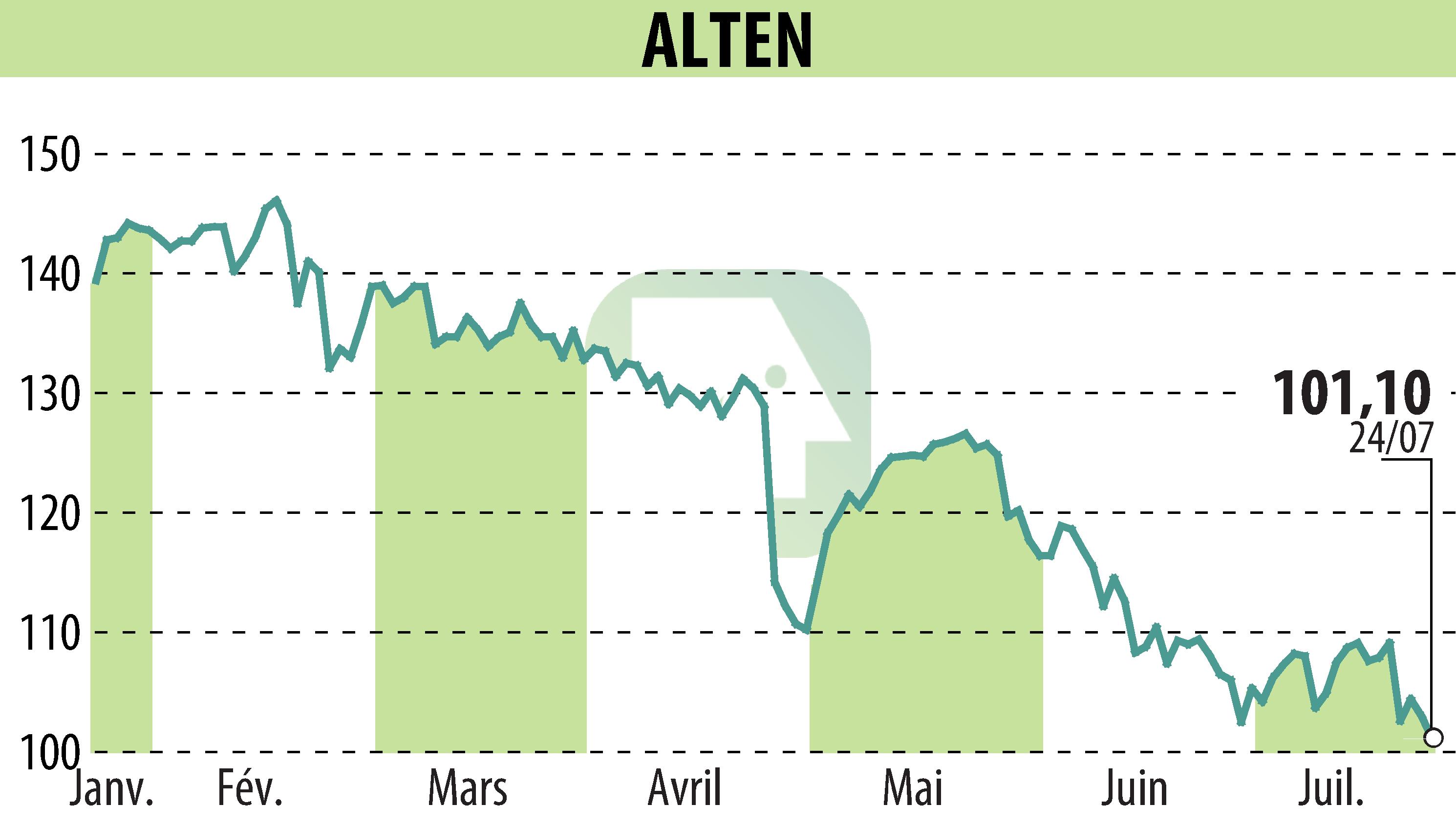

on ALTEN (EPA:ATE)

ALTEN: Business in First Half 2024

ALTEN reported a moderate revenue growth of 2.9% in the first half of 2024. Organic growth contributed 0.9% to this increase, while two overseas acquisitions boosted overall performance. The company posted revenues of €2,108.0 million, compared to €2,047.9 million in H1 2023.

France showed a robust growth rate of 5.7%, accounting for 32.8% of total revenue, while international markets grew by 1.6%, representing 67.2% of total revenue. Sectors such as Defence & Security, Civil Aeronautics, Automotive, and Rail continued to expand.

ALTEN made two key acquisitions: a software development firm in Asia and an IT services company in Poland. Additionally, the company is in exclusive negotiations to acquire Worldgrid, a leader in Energy and Utilities solutions in Europe.

Despite the stable trends in North America and Asia, and declines in Germany and other regions, ALTEN expects organic growth between 1.1% and 1.4% for the year. The operating margin is projected to range between 8.7% and 8.9% for 2024.

R. P.

Copyright © 2024 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all ALTEN news