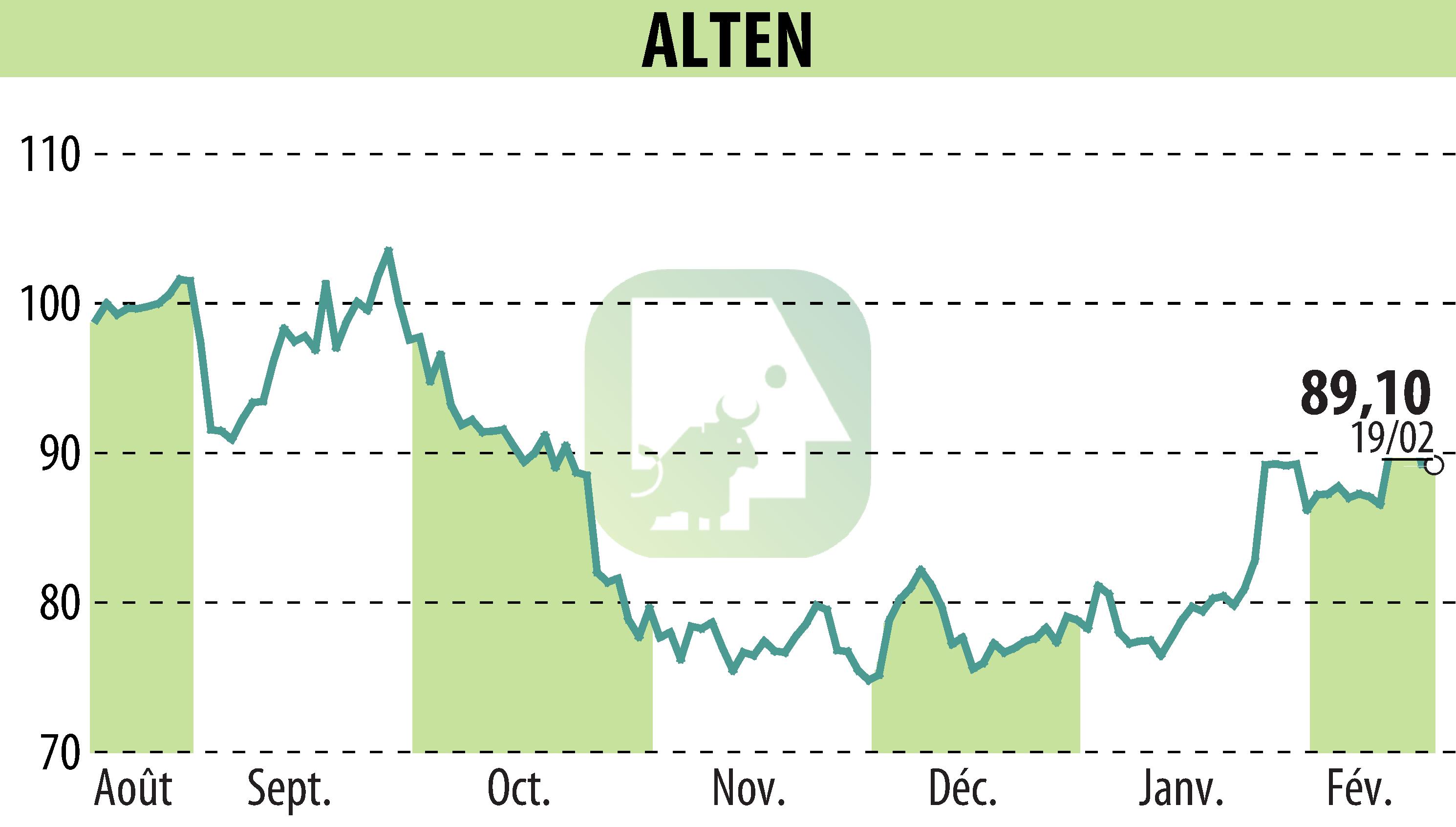

on ALTEN (EPA:ATE)

ALTEN Reports Mixed 2024 Financial Results

ALTEN, a leader in Engineering and Technology Consulting, released its 2024 annual results, showing a slight organic decline but stable overall revenue. Revenue reached €4,143.3 million, marking a 1.8% year-over-year increase. In France, revenue grew by 4.8%, while international revenue rose by 0.4%. However, on a like-for-like basis, there was a minor decline of 0.2%.

The operating margin on activity was 9.1%, slightly down from 9.4% in 2023. Operating profit fell to €277.0 million, which is 6.7% of revenue, impacted by goodwill impairments and restructuring costs, especially in the UK and Germany.

The company experienced a 20.1% decrease in net income, group share, totaling €186.4 million, while free cash flow surged by 81.4% to €333.2 million. Despite challenges, ALTEN's net cash stood at €275.5 million at year-end, with investments maintaining its capacity for self-funded growth.

R. H.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all ALTEN news