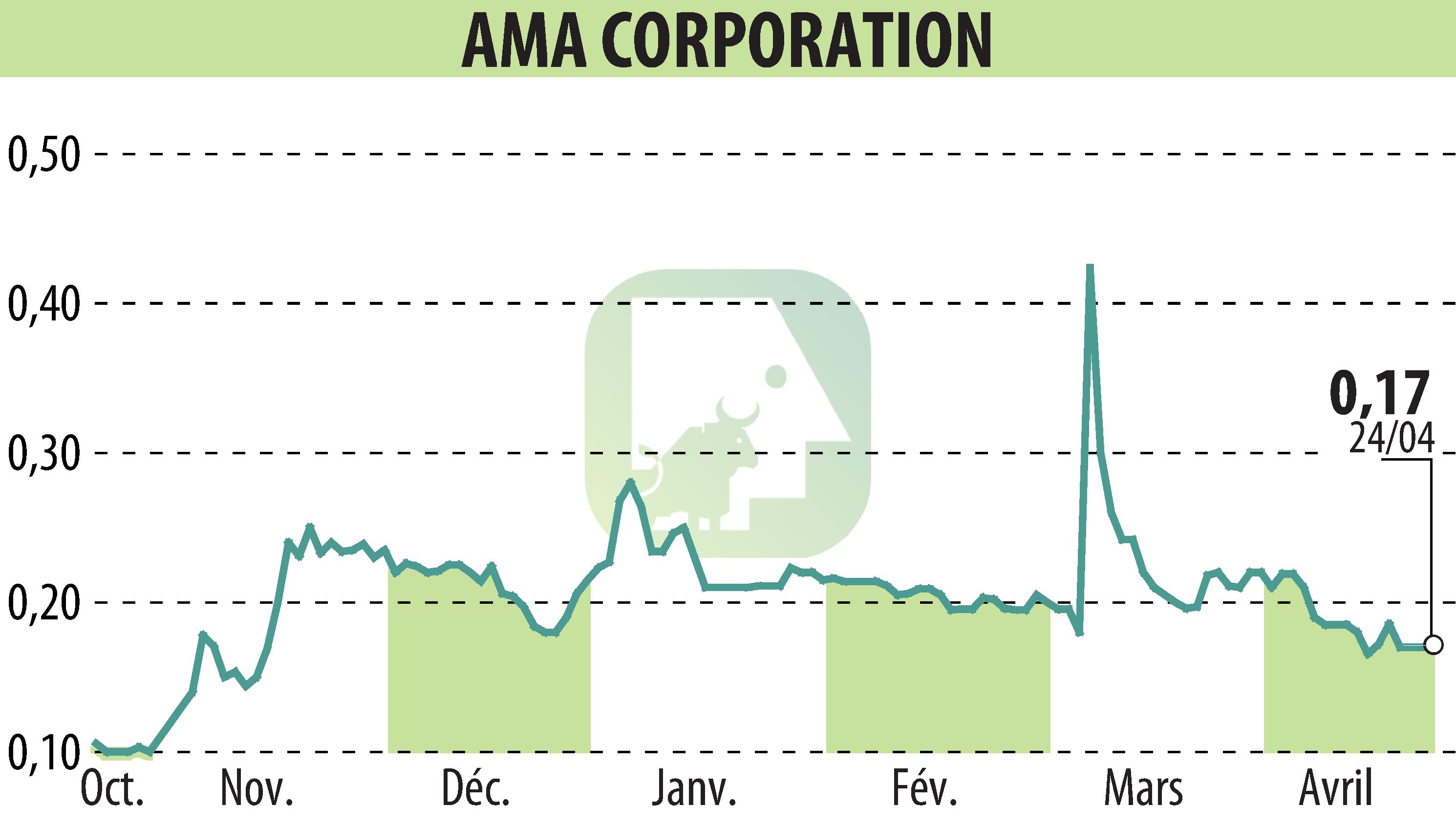

on AMA Corporation (EPA:ALAMA)

AMA Corporation Reports Revenue Decline but Strong Recovery Efforts in 2023

AMA Corporation announced a 30% decrease in revenues in 2023 compared to the previous year, totaling €3.0 million. Despite this, the company reported significant strides in reducing losses, attributed to an effective cost management strategy initiated in 2022. The adjusted EBITDA and consolidated net income showed improvements of 26% and 62%, respectively.

In response to the evolving market needs, AMA introduced strategic innovations including the development of new AI-integrated products and enhanced versions of its XpertEye solution. These moves are aimed at bolstering client engagement and technological deployment moving forward. During this period, AMA retained over 450 clients, albeit with a reduced investment capacity highlighted by a 9% churn rate in revenues.

Looking ahead to 2024, AMA outlined plans to continue its focus on innovation and cost management, aiming to leverage emerging opportunities particularly in artificial intelligence (AI) and computer vision technologies. These strategies are framed within AMA's broader commitment to maintaining sustainable practices as a B Corp certified enterprise.

R. E.

Copyright © 2024 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all AMA Corporation news