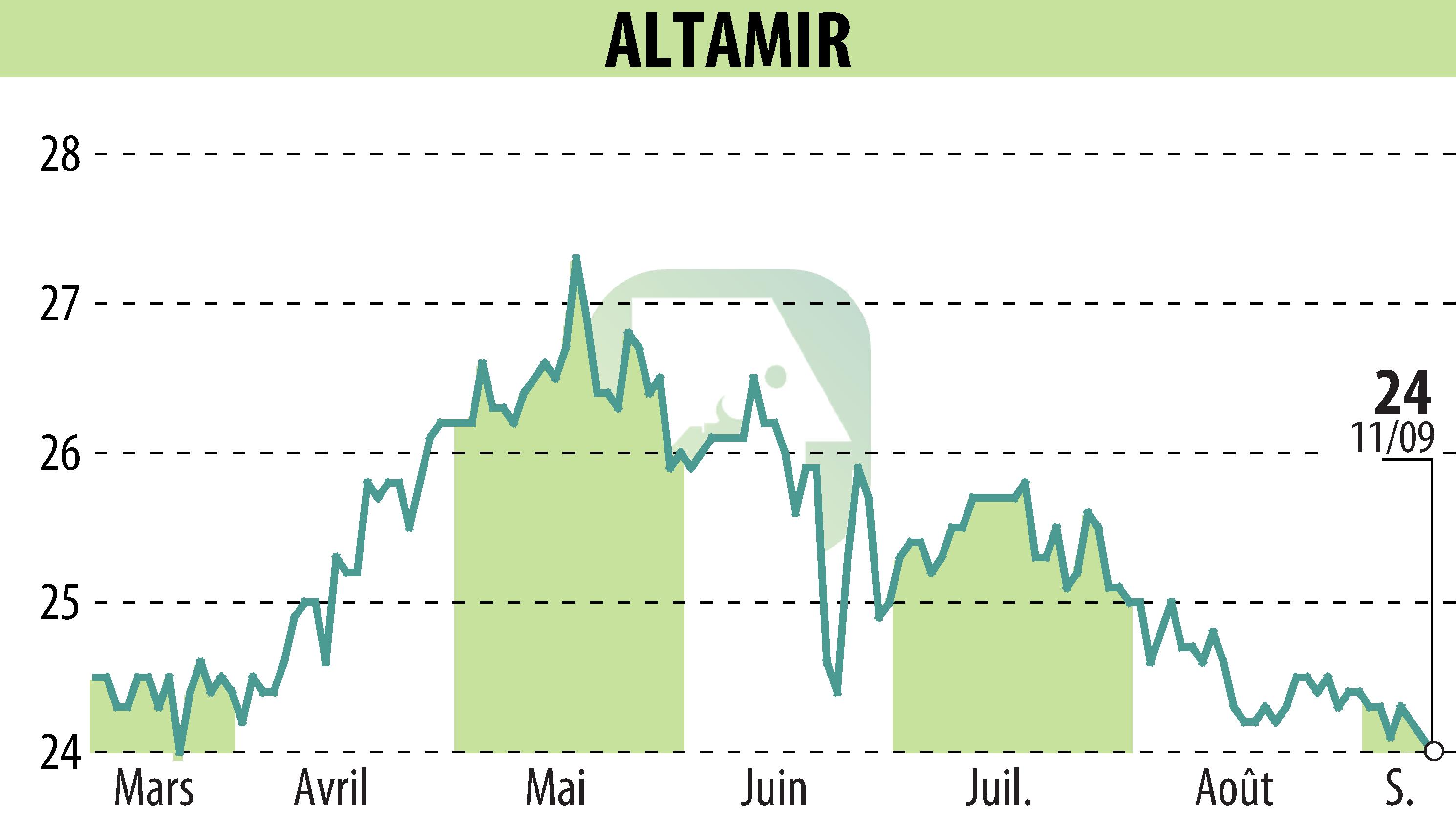

on ALTAMIR (EPA:LTA)

ANR up 2.7% over the half-year, resumption of investment activities and divestment for Altamir

On June 30, 2024, Altamir's Net Asset Value (NAV) per share reached €35.52, up 2.7% despite the distribution of a dividend of €1.08 per share in May. This performance translates into a portfolio valuation of €1,662.1 million, marked by an increase in the companies' weighted average EBITDA of 13.1%, despite a difficult economic context.

Altamir recorded €151.7 million in disposal proceeds in the first half of 2024, with investments of €69.8 million. The Consumer (+€37.1 million) and Tech & Telco (+€35.5 million) sectors contributed significantly to this growth.

The maximum amount of Altamir's commitments amounts to €538.5 million, mainly distributed between the Apax XI LP and Seven2 MidMarket X funds. Altamir is showing a notable recovery in its activities while achieving its medium-term objectives in investments and disposals.

Since June 30, 2024, Altamir has completed several significant transactions, including the sale of Europe Snacks and the acquisition of Lumion by Seven2 MidMarket X.

Altamir's half-yearly financial statements were closed on September 10, 2024 and audited by the statutory auditors, confirming its solid financial performance.

R. P.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all ALTAMIR news