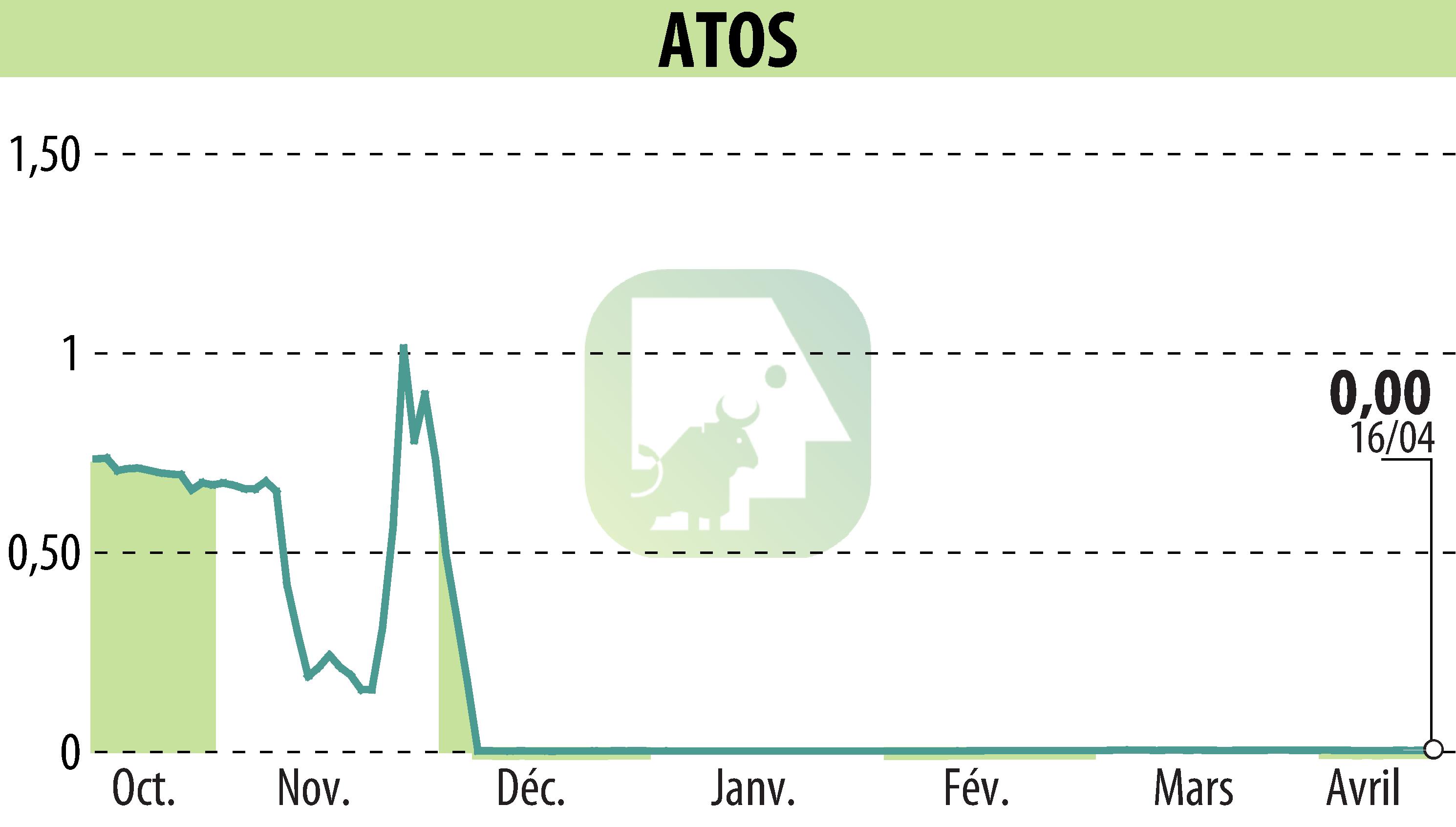

on ATOS ORIGIN (EPA:ATO)

Atos Q1 2025 Results: Recovery, Revenue Decline, and Cash Management

Atos has released its Q1 2025 results, showing a continued commercial recovery post-financial restructuring. The company reports an order entry of €1.7 billion, with a book-to-bill ratio of 81%, a 17-point improvement from Q1 2024. This growth is largely driven by multi-year contract renewals and new revenue streams.

Revenue for Q1 2025 was €2,068 million, marking a 15.9% organic decline compared to Q1 2024. This decrease is attributed to lower order entry and completed contracts in 2024 before the December 2024 restructuring. Both Eviden and Tech Foundations saw significant revenue drops.

Cash consumption was reduced to approximately €40 million, a significant improvement from the €415 million consumed in Q1 2024. Liquidity stood at €1,958 million as of March 31, 2025.

The company's strategic focus and operational adjustments are set to be discussed at the Capital Markets Day on May 14, 2025.

R. P.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all ATOS ORIGIN news