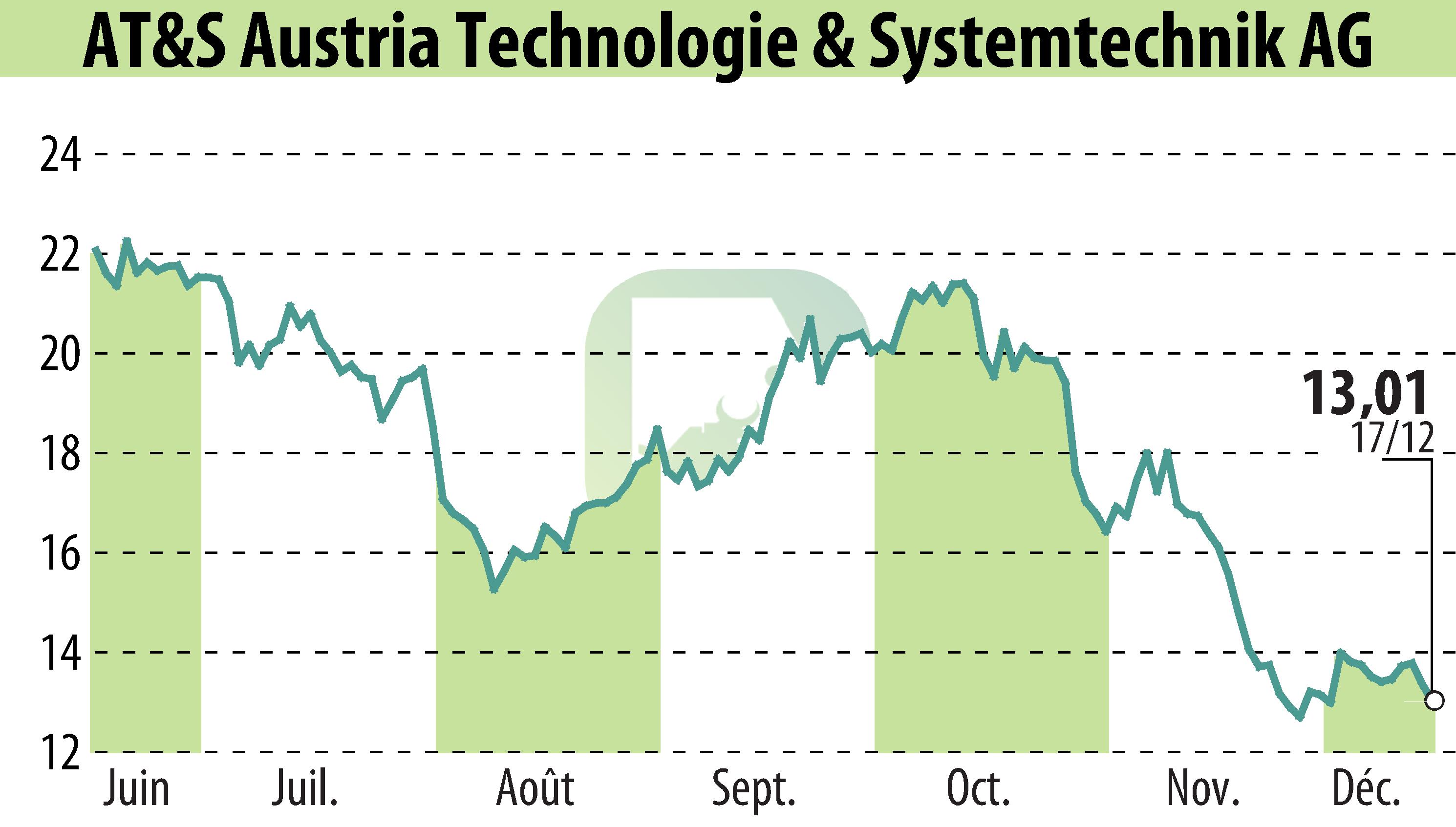

on AT&S Austria Technologie & Systemtechnik AG (ETR:AUS)

AT&S Adjusts Financial Outlook for 2026/27

AT&S Austria Technologie & Systemtechnik AG has revised its financial outlook for the fiscal year 2026/27 due to ongoing market challenges. The company now forecasts annual revenue between €2.1 and €2.4 billion, a reduction from the previous estimate of approximately €3.0 billion. The EBITDA margin is expected to be around 24‒28%, down from the earlier projection of 27‒32%.

Despite keeping the net debt/EBITDA ratio below 3, AT&S anticipates a return on capital employed (ROCE) below 12%, revising it from the previous target of over 12%. The equity ratio, considering hybrid capital repayment at the financial year's end, is projected to be temporarily below 20%.

These changes are attributed to continued market weakness and overcapacity issues in printed circuit boards and IC substrates, exerting price pressures on the firm. AT&S is intensifying cost-cutting efforts and scrutinizing all investments under these conditions.

R. E.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all AT&S Austria Technologie & Systemtechnik AG news