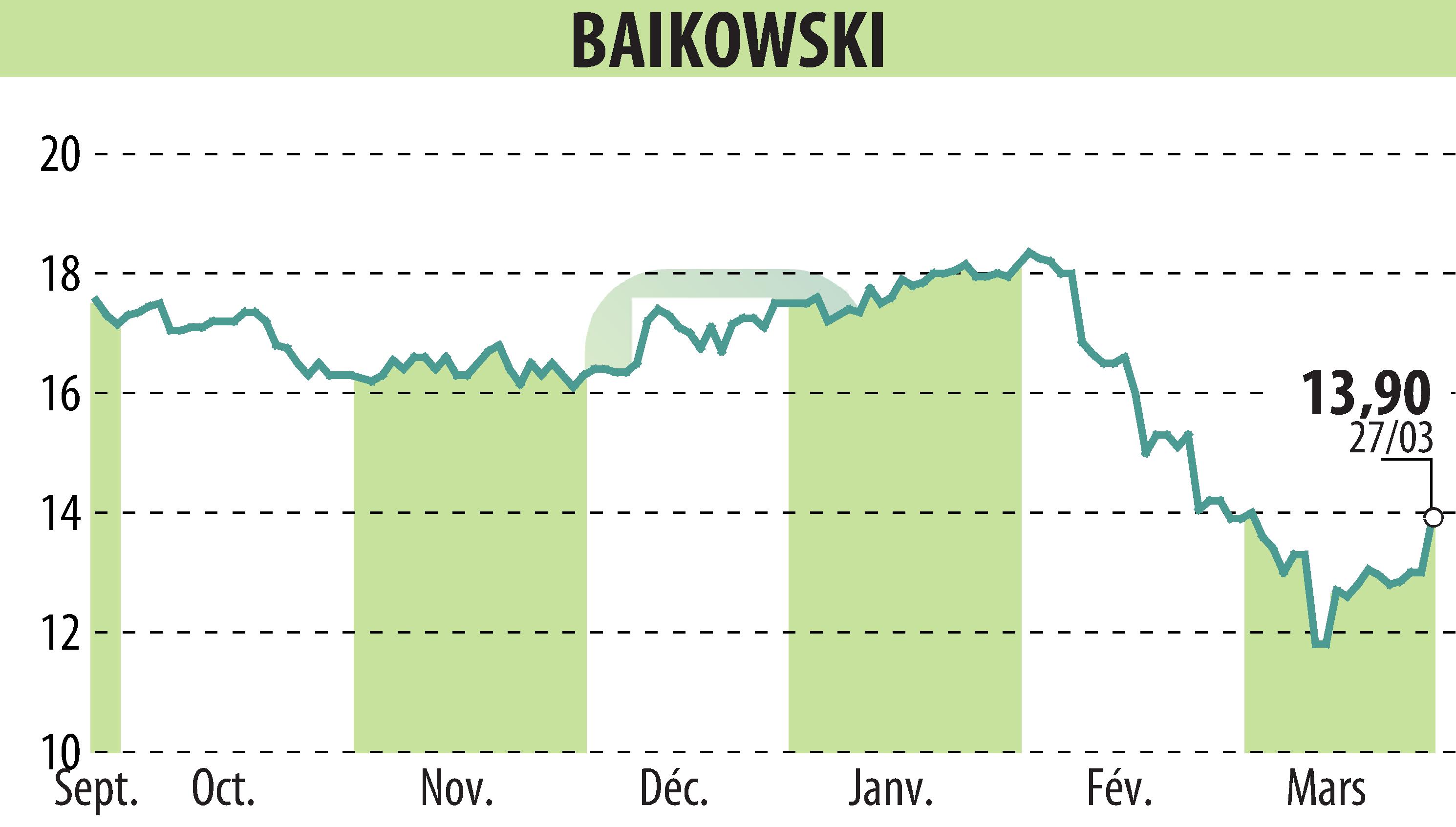

on BAIKOWSKI (EPA:ALBKK)

BAIKOWSKI Reports Challenging 2023 Financial Results With an Optimistic Outlook for 2024

Baikowski®, a key player in specialty industrial minerals, disclosed its 2023 financial results, acknowledging the economic downturn's impact on its performance. Despite a significant downturn, with revenues dropping to €36.0 million, a -32.1% year-on-year decline, the company managed to maintain a net income of €0.9 million. The decrease in business activity was attributed to lower demand across its main segments and deferred orders, a stark contrast to the record growth experienced in 2022.

Investing 8.1% of its revenue in research and development, Baikowski® is committed to diversification and innovation. This strategic focus aimed at boosting future growth potential was evident even as the company navigated a tricky economic and geopolitical landscape. Its EBITDA fell to €5.1 million, reflecting a -58.9% change, highlighting the challenges faced over the past year.

The financial structure remains stable, with shareholders’ equity at €41.9 million and net financial debt at 20% of shareholders’ equity by year-end. In light of preserving its financial health for strategic investments and growth initiatives, Baikowski® has decided to forego dividend payments for 2023. With signs of recovery in the electronics market and new application developments, Baikowski® is optimistic about 2024, expecting revenue growth and improved profitability.

R. E.

Copyright © 2024 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all BAIKOWSKI news