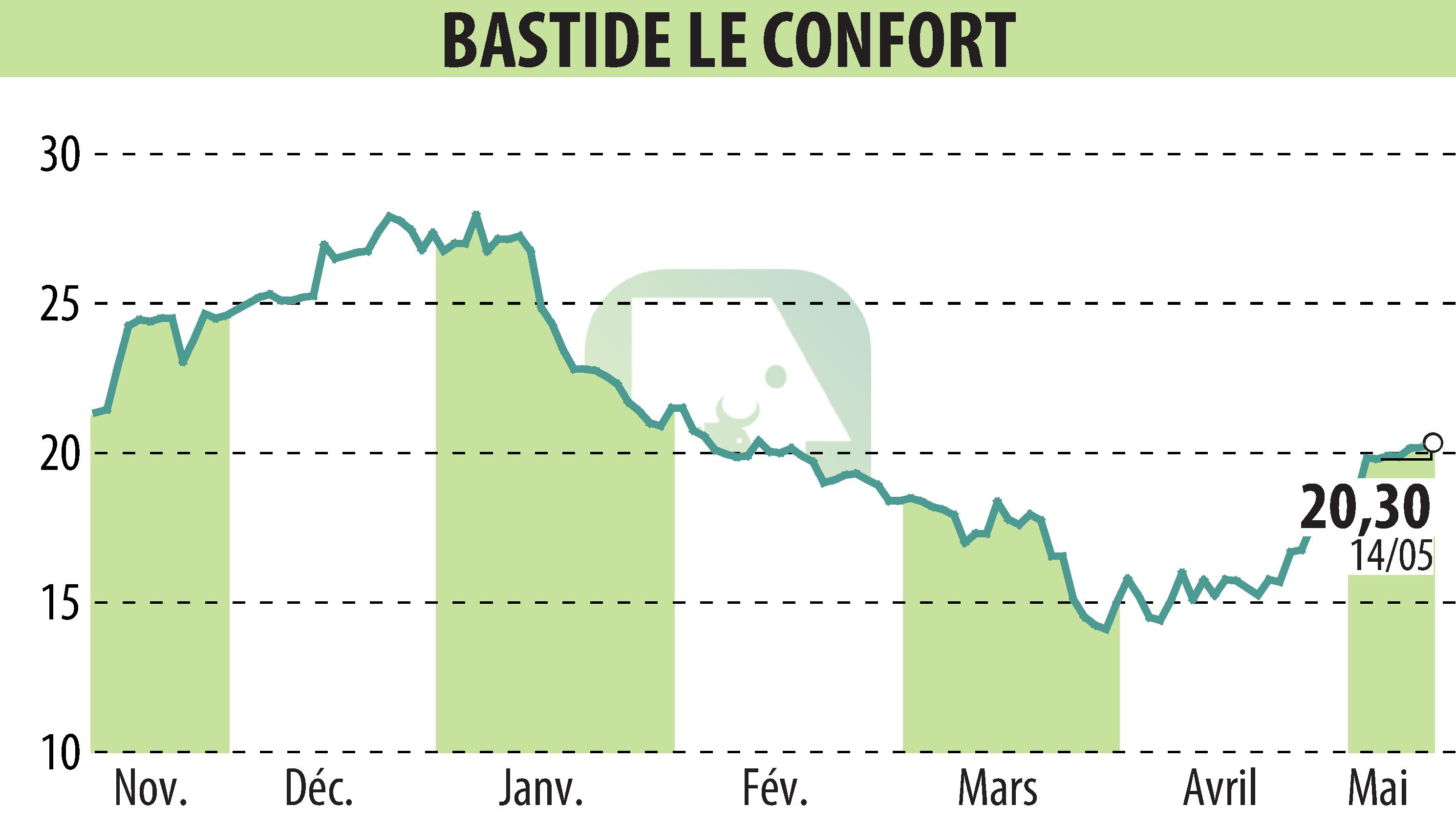

on BASTIDE (EPA:BLC)

Bastide announces accelerated organic growth and the sale of its activities in Switzerland

Bastide recorded an increase in its turnover of 8.2% in the third quarter of 2023-2024, reaching 134.7 million euros. This performance includes organic growth of 7.5%. The company justifies these results by the solidity of its Respiratory, Nutrition-Perfusion-Stomatherapy sectors, which represent more than half of its quarterly turnover.

Furthermore, Bastide is in the process of selling its subsidiaries Sodimed and Promefa in Switzerland, specializing in the sale of medical equipment. This operation, scheduled to be finalized in the first half of 2024-2025, is part of a strategy to reduce less profitable activities. These entities were already subtracted from the consolidated turnover following their classification as assets held for sale.

Bastide also confirms its adjusted annual forecasts, anticipating a turnover of 520 million euros for the 2023-2024 fiscal year, with a current operating margin equivalent to the previous financial year. The company continues to focus on deleveraging through targeted asset sales and also hopes to renegotiate its credit terms in order to continue its growth.

R. P.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all BASTIDE news