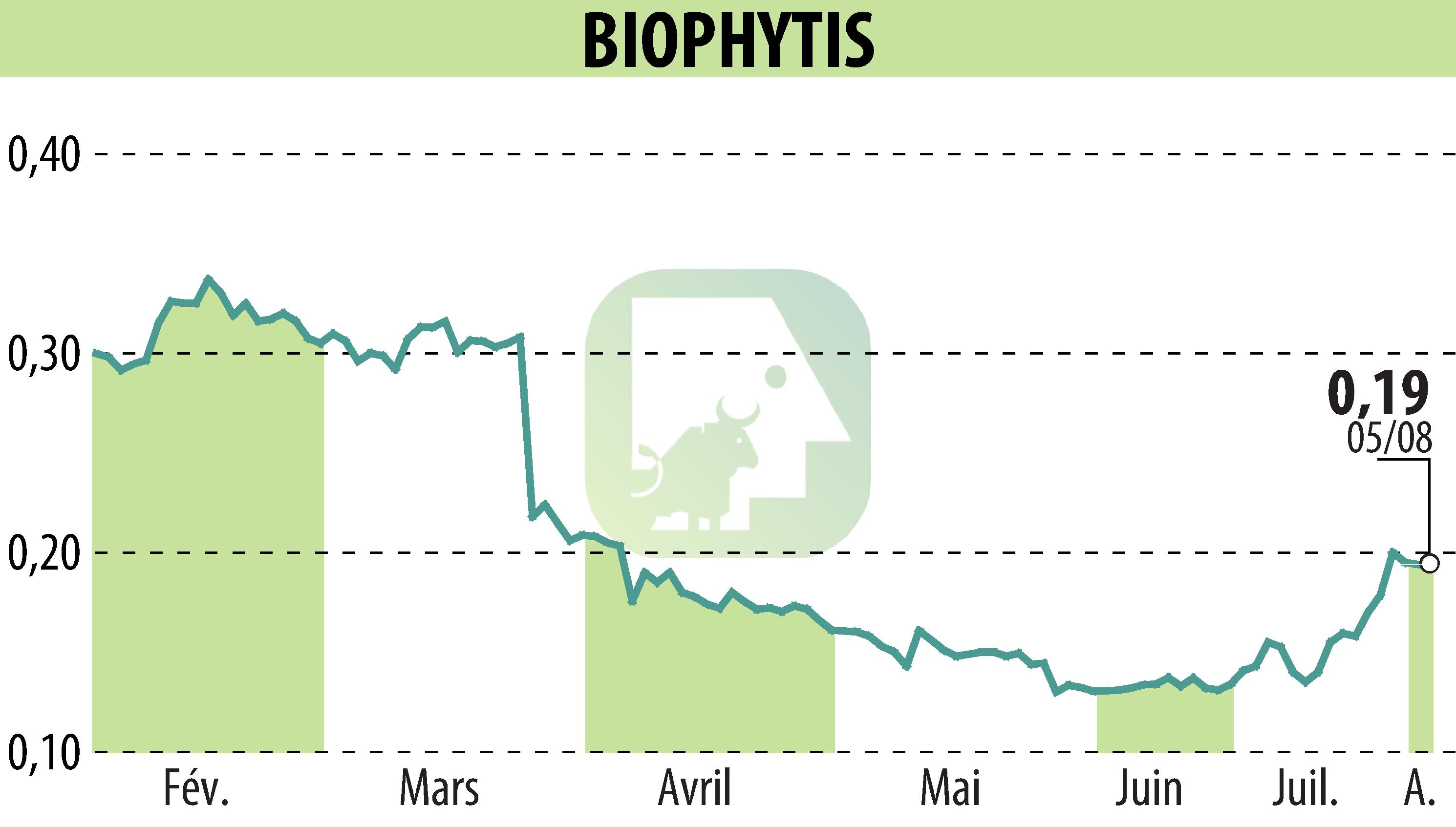

on Biophytis (EPA:ALBPS)

Biophytis Secures €1 Million Non-Dilutive Bond Financing

Biophytis SA has established a non-dilutive bond financing line of up to €1 million with Hexagon Capital Fund. The initial subscription is €100,000, offering resources to support ongoing operations, particularly the OBA101 clinical program. This move strengthens Biophytis' financial position until Q1 2026.

The bond issues have a nominal value of €1,000 and can be subscribed in minimum tranches of 100 bonds between August 5, 2025, and July 31, 2026. With a 24-month maturity, the bonds carry a 12% annual interest rate, payable bi-monthly. Early repayment is allowed, and no collateral is needed.

If default occurs, repayment may convert bonds to shares at a 20% discount. This would slightly dilute shareholder ownership from 1% to 0.89% if 1,000 bonds are converted.

R. P.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all Biophytis news