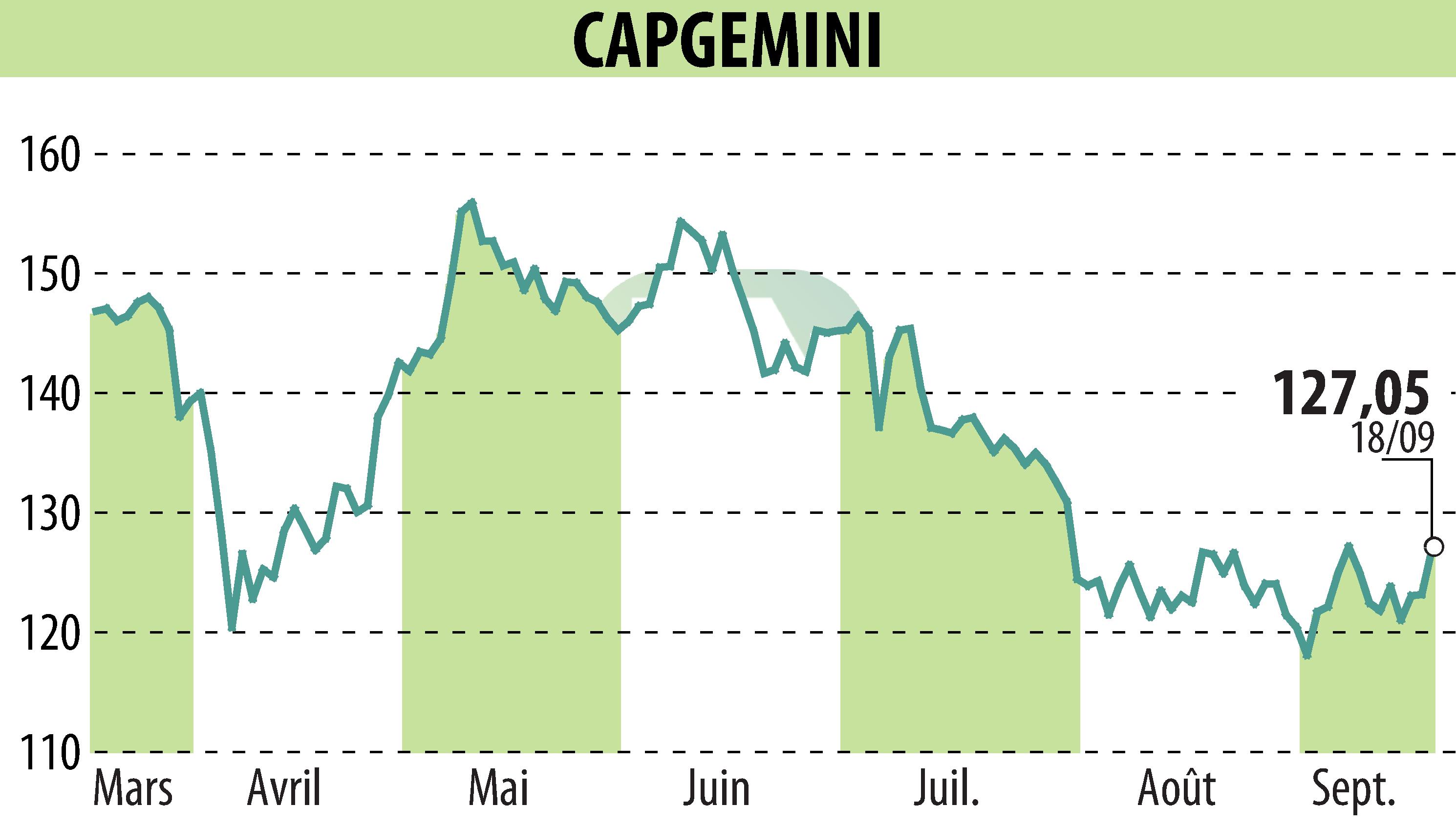

on CAPGEMINI (EPA:CAP)

Capgemini Prices €4 Billion Bond Issuance Successfully

On September 18, 2025, Capgemini announced the successful pricing of a €4 billion bond issue in Paris. The issuance comprised four tranches: €1 billion in 2-year notes at a floating-rate, €0.5 billion in 3-year notes at a 2.50% coupon, €1.25 billion in 6-year notes at a 3.125% coupon, and another €1.25 billion in 9-year notes at a 3.50% coupon. Demand for these bonds was notable, with subscriptions exceeding supply by 3.2 times.

The funds are earmarked for financing Capgemini's acquisition of WNS and refinancing debt, as well as general corporate purposes. This allows the cancellation of a bridge loan related to the acquisition. Standard & Poor's is expected to rate the new bonds at BBB+, aligning with Capgemini's corporate rating.

R. E.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all CAPGEMINI news