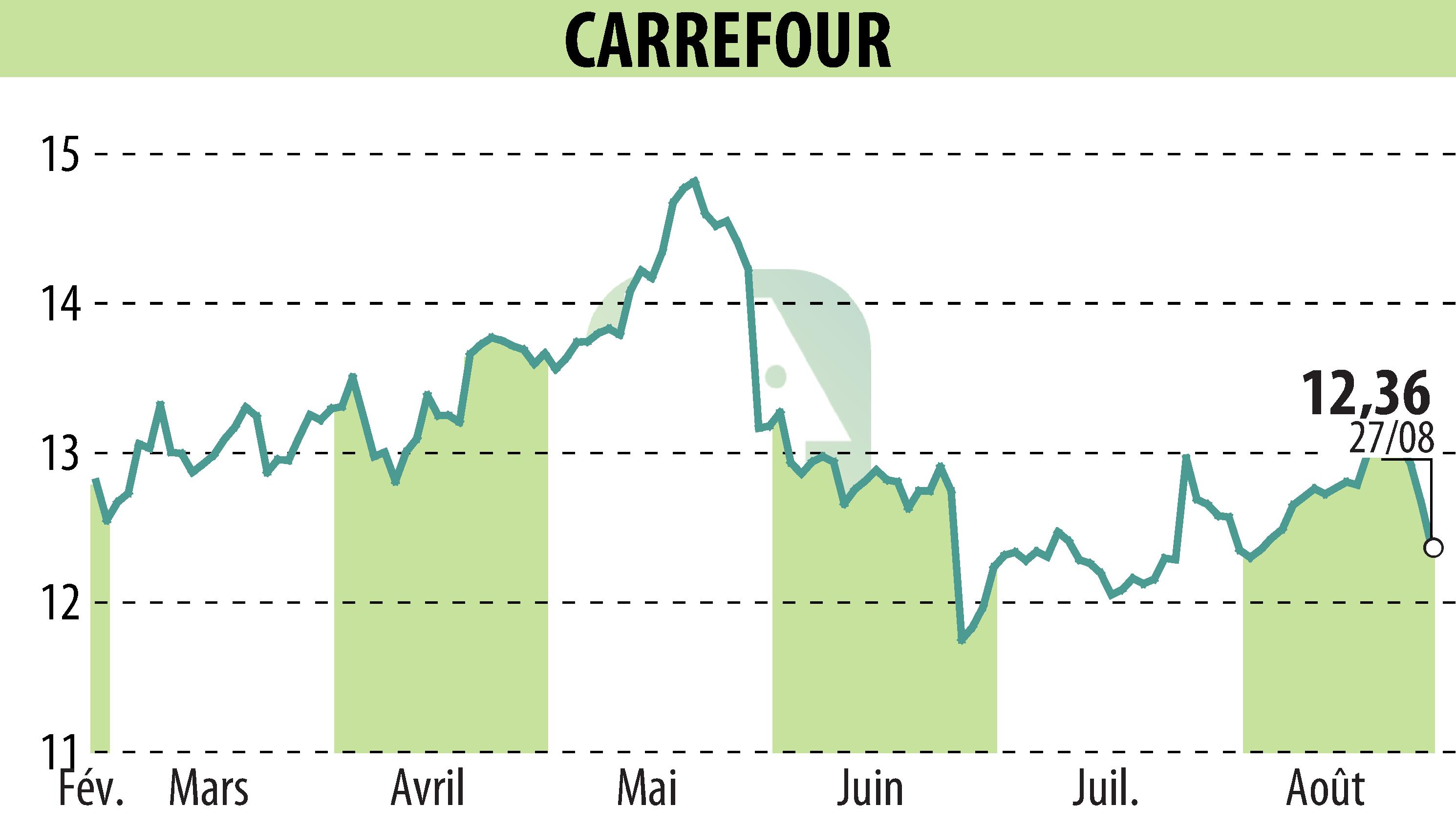

on CARREFOUR (EPA:CA)

Carrefour Successfully Issues €500 Million Bond

On August 28, 2025, Carrefour completed the issuance of a €500 million bond. The bond, maturing in December 2028, carries a fixed coupon rate of 2.875% per annum with a bullet repayment format. The issuance was oversubscribed nearly sevenfold, reflecting investor confidence in Carrefour’s creditworthiness, which is supported by a "BBB" rating from Standard & Poor's.

The funds are earmarked for restructuring the debt of Carrefour's Brazilian subsidiary. Since the announcement on July 24, 2025, the group has refinanced over €1.4 billion of its Brazilian debt in euros. This restructuring is projected to enhance Carrefour's net free cash flow by approximately €100 million annually from 2026, also reducing financial expenses by €20 to €25 million in 2025.

R. P.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all CARREFOUR news