on WEDIA (EPA:ALWED)

Cathay Capital Private Equity and Wedia in exclusive negotiations for the acquisition of a controlling stake

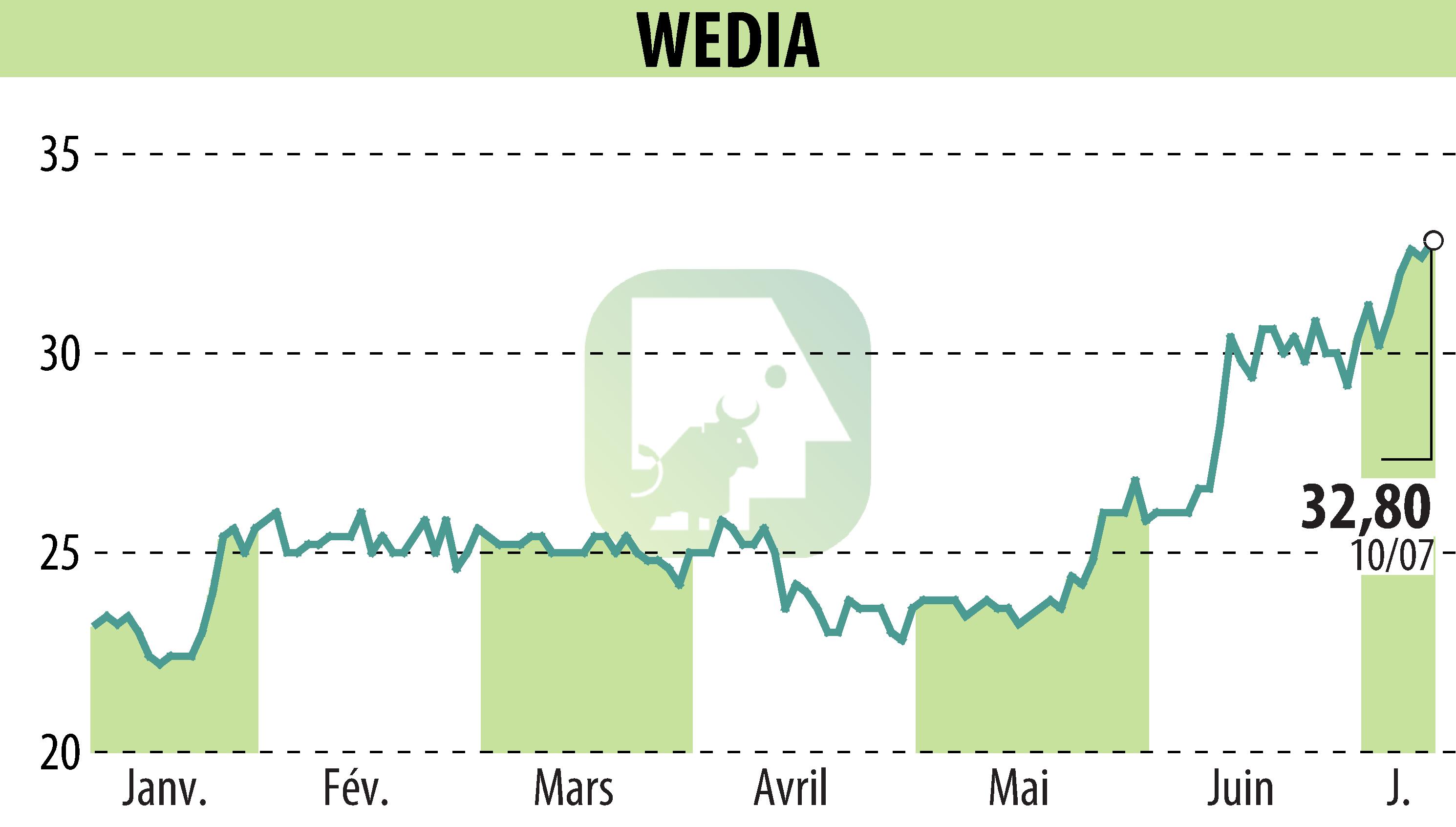

Cathay Capital Private Equity has made a firm offer to Wedia's main shareholders, including NextStage and Amplegest, holding 19.6% and 8% of the capital respectively. The objective is to acquire a controlling block representing 58% of the share capital and voting rights of Wedia, at a price of 30.50 euros per share.

Nicolas Boutet, founder of Wedia, will continue to lead the company with the management team. They will contribute part of their shares to the company Mercure, created jointly with Cathay. The price offered includes a premium of up to 19.5% in the event of payment of a price supplement of 1.25 euros per share when a squeeze-out threshold of 90% is reached.

The acquisition places the total valuation of Wedia between 26 and 27 million euros, depending on whether the additional price is reached. Cathay and Wedia aim to strengthen the company's development in the areas of Digital Asset Management and Social Media Management, while capitalizing on their current customer bases and advanced software offerings.

R. H.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all WEDIA news