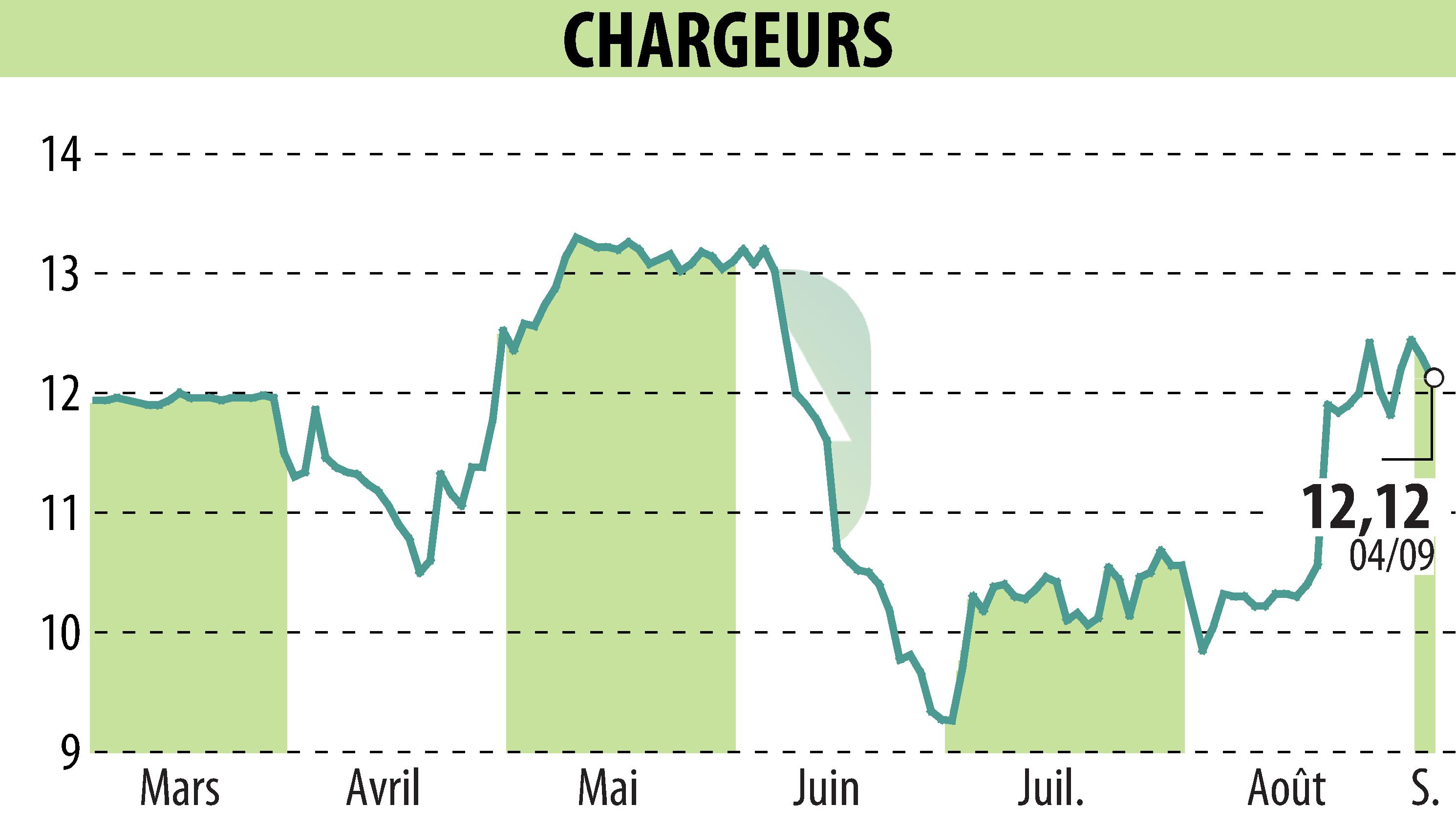

on CHARGEURS (EPA:CRI)

CHARGEURS Reports Strong First-Half 2024 Performance

CHARGEURS has recorded a robust H1 2024, marked by solid operational acceleration across all business lines and notable cash generation. Following a successful tender offer by Groupe Fribourg and its partners, the group's revenue increased by 11% on a like-for-like basis, reaching €374 million. The recurring operating profit saw a significant rise of nearly 34%, totaling €17 million.

Novacel demonstrated a strong rebound with a 7.6% revenue growth, particularly excelling in Q2 with a 12.2% rise. Museum Studio also posted impressive figures, with a 26.8% like-for-like revenue increase to €66.3 million, alongside a 33.3% growth in recurring operating profit.

The other key segments, Chargeurs PCC and Luxury Fibers, reported growth rates of 9.4% and 7.6% respectively. Personal Goods segment’s revenue surged by 12.1%. Operating cashflow for the period stood at €39.6 million, reflecting efficient working capital management.

CEO Michaël Fribourg highlighted the company’s strategic positioning and optimistic outlook for continued acceleration towards the end of 2024 and into 2025. Chargeurs aims to unlock the value potential of its diversified asset portfolio.

R. P.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all CHARGEURS news