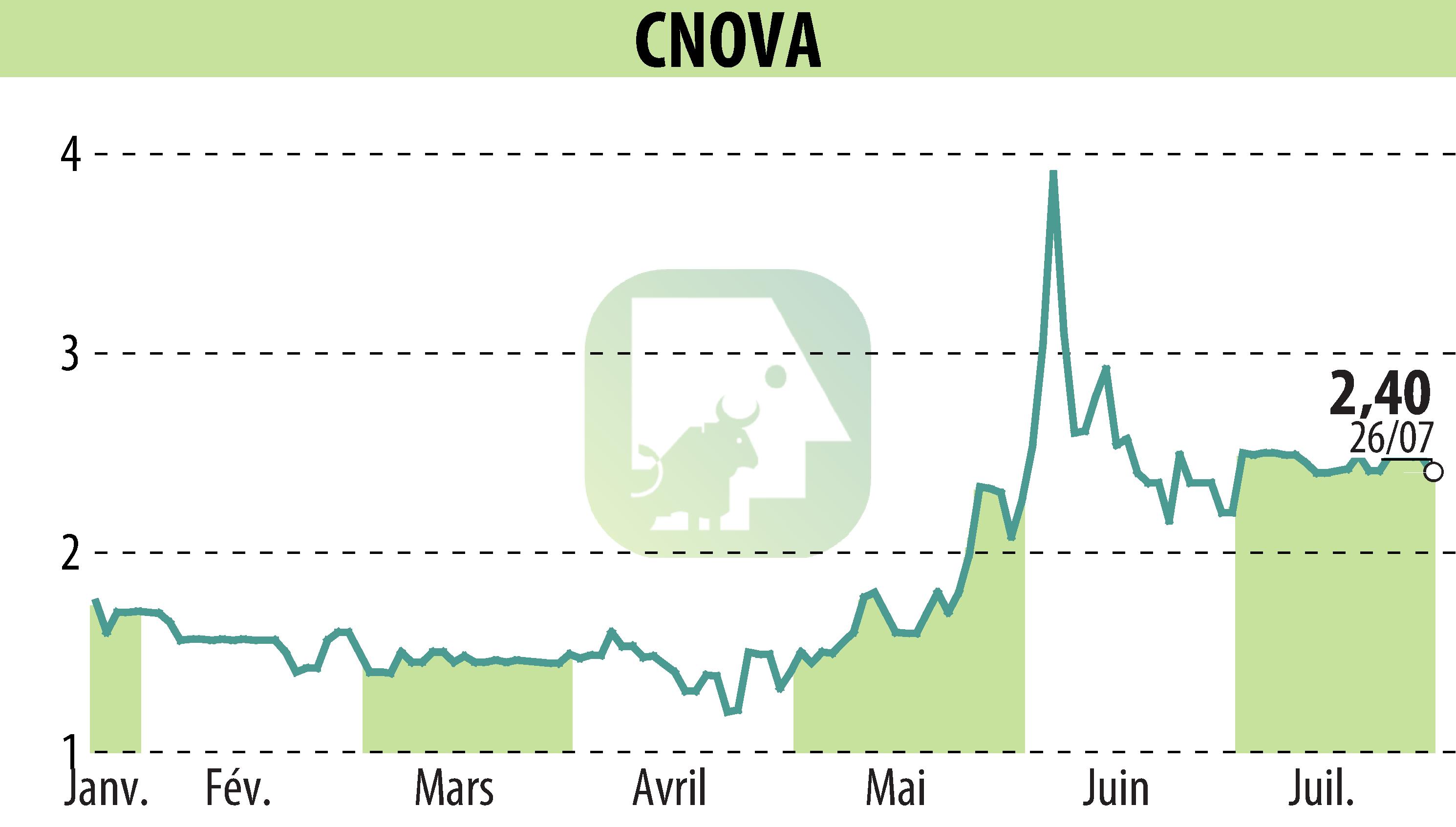

on CNOVA N.V. (EPA:CNV)

CNOVA NV Reports Improved Financial Performance in First Half of 2024

Cnova N.V. announced significant progress in its pursuit of operational profitability during the first half of 2024. The company's EBITDA after rents improved by €2 million, and free cash flows saw a notable increase of €101 million compared to 2023.

Product GMV showed positive trends, particularly in the marketplace segment, which grew by 7% in July. However, direct sales still faced challenges, showing a smaller decline of 9% in July. Overall, the product GMV for the first half declined by 12% year-on-year, showing an improvement over the FY23 trend.

Services revenue was a bright spot, amounting to €158 million for the first half, representing a 5% increase from the previous year. Notably, B2B revenues saw an 87% rise, bolstered by strong logistics services.

The gross margin rate grew by 7 points compared to 2023, attributable to Cnova’s focus on high-margin services. The free cash-flows improved due to consistent supplier payments and effective monitoring, recovering from conciliation proceedings in the previous year.

Cnova also made progress in its CSR strategy, with sustainable products accounting for 22.7% of the second quarter’s Product GMV, a significant increase from 2023. Customer satisfaction also showed an uptick, with the NPS growing by 2.1 points in the first half of 2024.

R. E.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all CNOVA N.V. news