on COMPAGNIE BOIS SAUVAGE (EBR:COMB)

Compagnie du Bois Sauvage Announces First Half 2024 Results

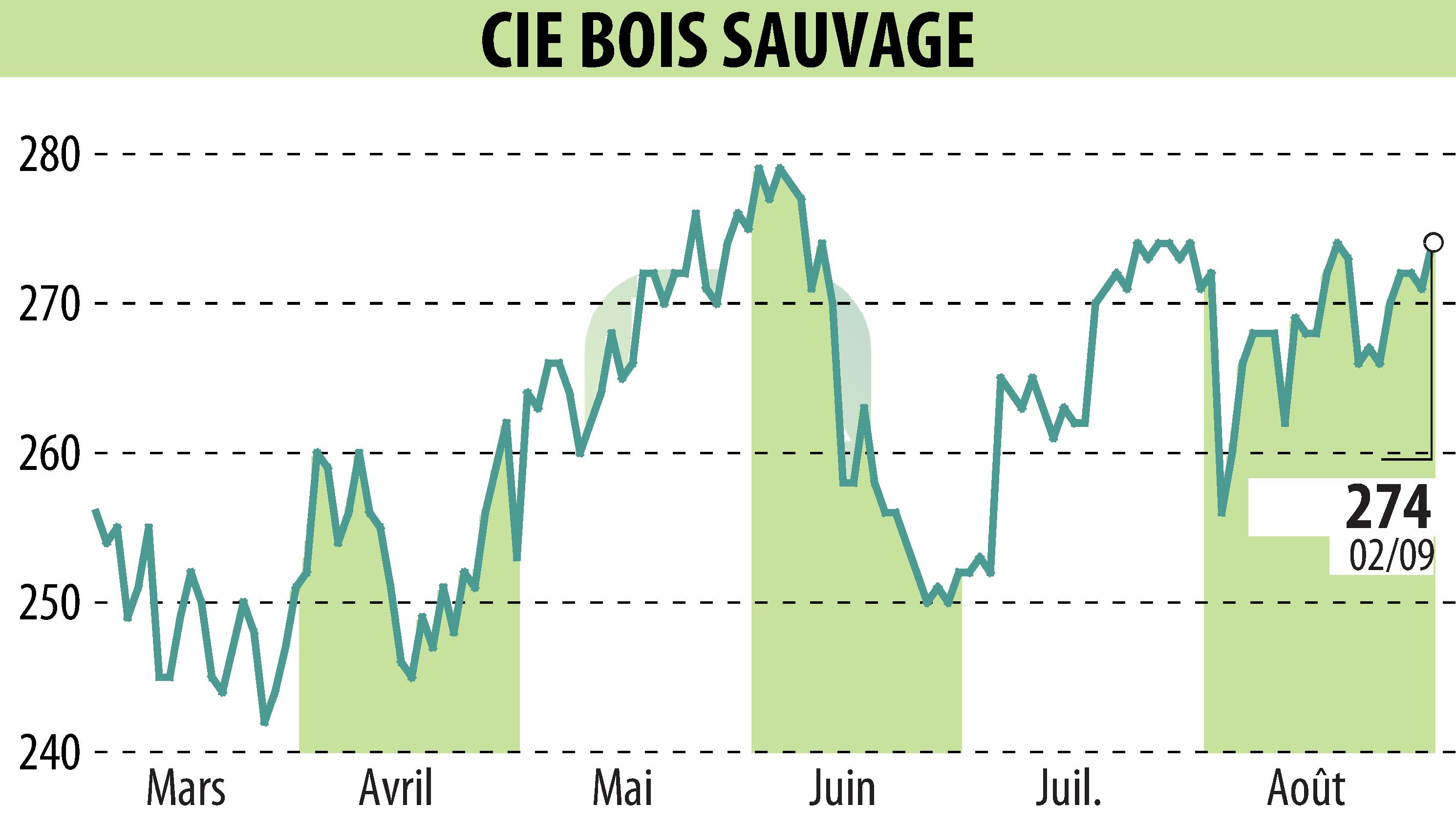

Compagnie du Bois Sauvage (COMB), a family-owned investment company listed on Euronext Brussels, announced its H1 2024 results. Chocolate Division sales increased by 6.8%, driven by brands like Jeff de Bruges and Neuhaus. In contrast, the Property Division saw a slowdown in sales, prompting a cautious approach.

For the six months ending June 30, 2024, Compagnie du Bois Sauvage reported an operating income of EUR 4.4 million, compared to EUR 6.9 million in 2023. The Group’s net loss widened to EUR 57.1 million from EUR 29.6 million in 2023. Shareholder’s equity declined to EUR 520 million from EUR 597 million at the end of 2023, and market capitalization fell to EUR 415 million from EUR 461 million.

Intrinsic value per share dropped to EUR 497.7 from EUR 543.7. Financial challenges included a slowdown in demand for electric vehicles affecting the Industry and Services division, specifically Umicore. The Group’s net debt improved to EUR 13 million from EUR 17 million at year-end 2023.

The Board remains confident in the quality of its assets but is cautious regarding the short and medium-term outlook.

R. P.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all COMPAGNIE BOIS SAUVAGE news