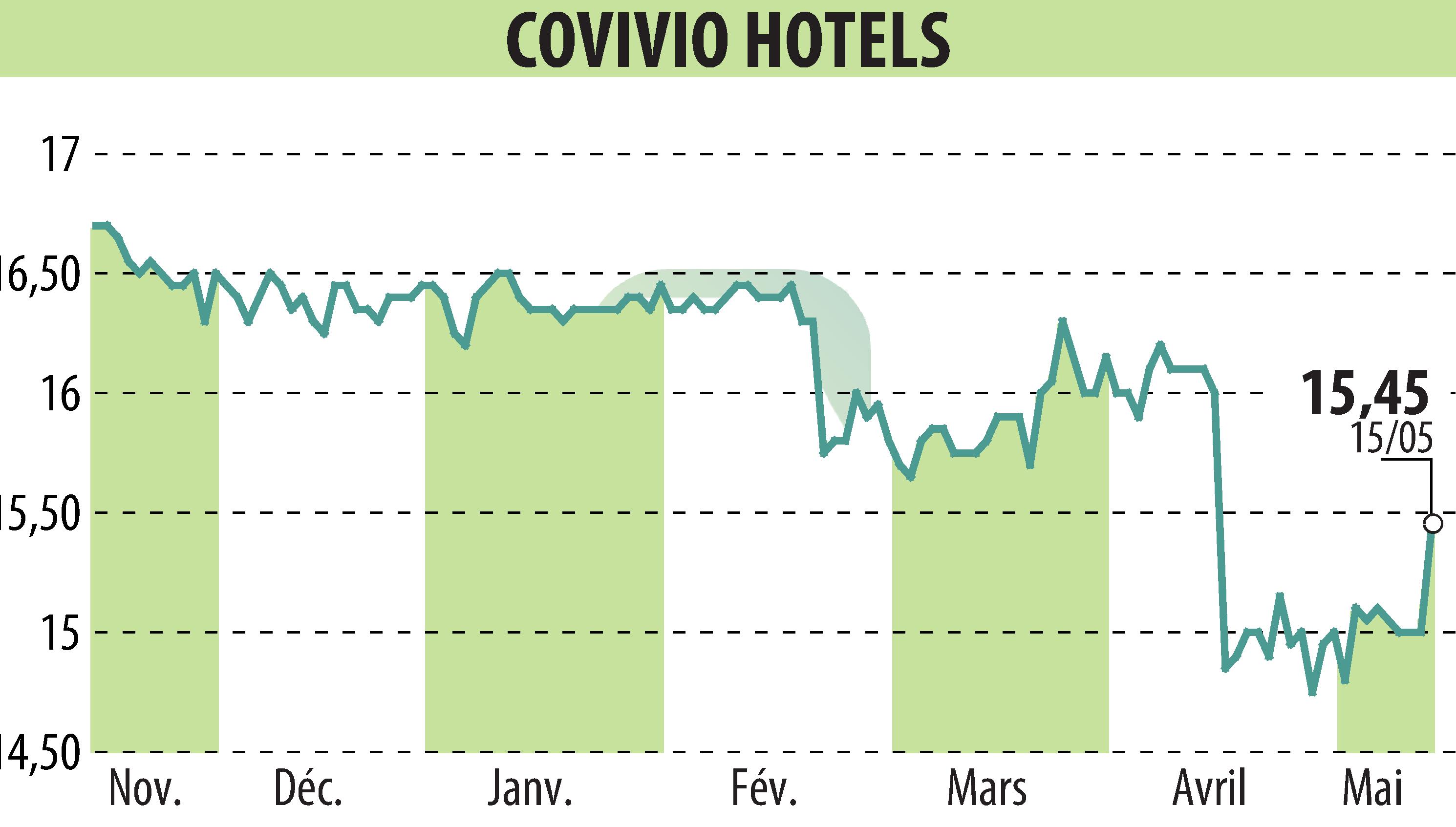

on Covivio Hotels (EPA:COVH)

Covivio Hotels Announces Successful €500 Million Green Bond Issuance

Covivio Hotels, a subsidiary of Covivio dedicated to Hotel Real Estate, has successfully issued a €500 million Green Bond, set to mature in May 2033. The bond was significantly oversubscribed, with demands nearly four times the initial offering, underscoring investor confidence and interest in Covivio's strategic approach and its robust hotel portfolio predominantly situated in key European cities.

The funds raised will support the financing or refinancing of properties under the Eligible Green Hotel portfolio, aligned with the company's Green Financing Framework. The bond issuance featured a spread of 148 basis points at a 9-year maturity, transitioning mostly to a floating rate through swaps, leveraging Covivio Hotels' strong hedging position.

The transaction is strategically positioned to bolster Covivio Hotels' financial health by extending debt maturities. Following this financial move, Standard & Poor's reaffirmed Covivio Hotels' BBB+ rating with a stable outlook in April 2024. Moreover, the newly issued bonds are set to begin trading on Euronext Paris on May 23rd, 2024.

R. P.

Copyright © 2024 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all Covivio Hotels news