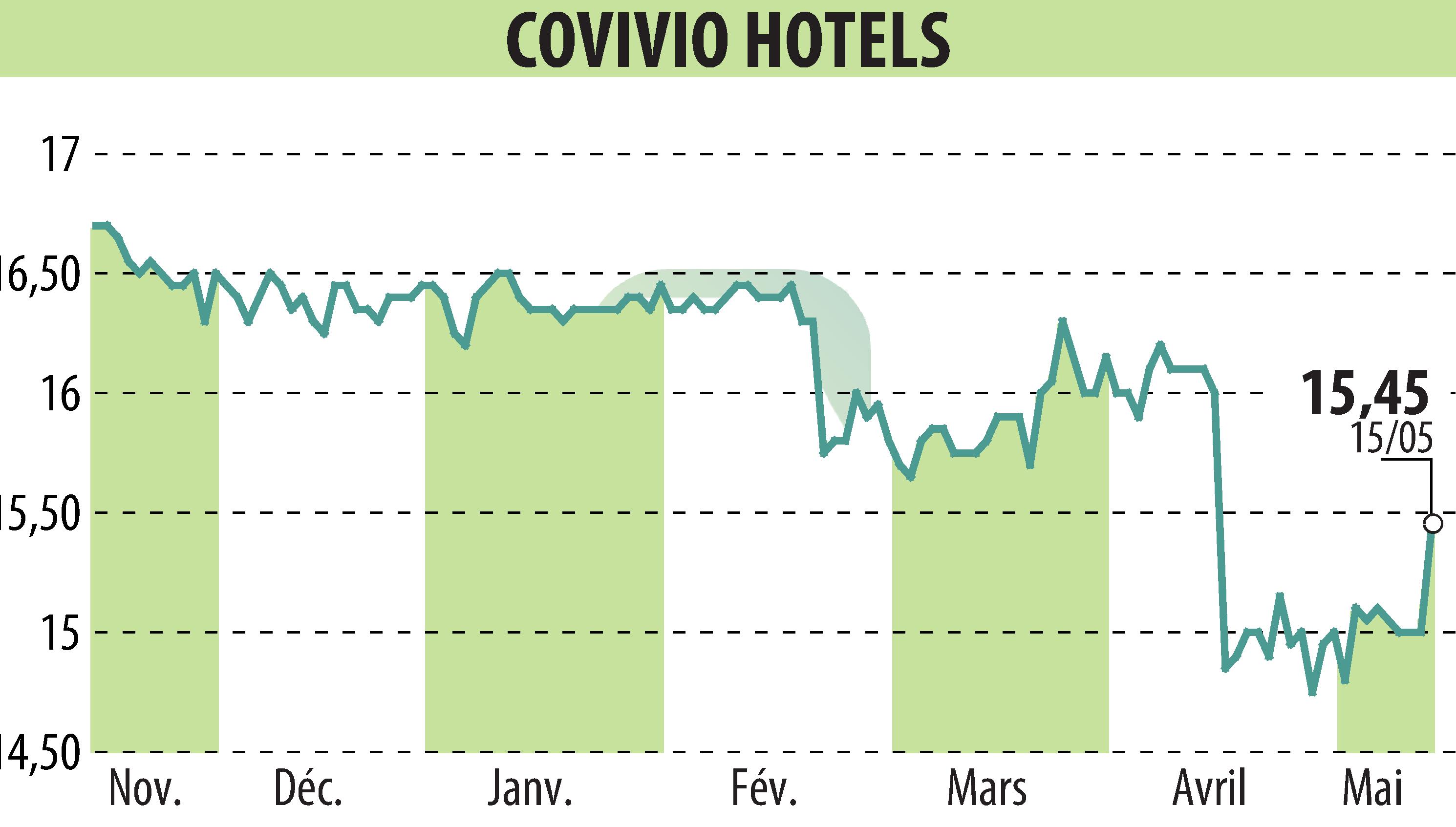

on Covivio Hotels (EPA:COVH)

Covivio Hotels Issues €500 Million Green Bond

Covivio Hotels has successfully executed a €500 million Green Bond issuance, set to mature in May 2033. The Green Bond was significantly oversubscribed, with demand nearly four times the offering size, highlighting strong investor confidence and interest in the hotel sector.

The proceeds from this bond will specifically fund or refinance properties within the Eligible Green Hotel portfolio, in alignment with the Green Financing Framework utilized by Covivio. This move underlines the company's commitment to sustainability in the hospitality industry.

The terms of the bond include a spread of 148 basis points over the mid-swap and a coupon rate of 4.125%. Additionally, Covivio plans to convert the fixed rate to a floating rate, leveraging their robust hedging strategies. This strategy aims to maintain Covivio Hotels’ favorable average interest rate, which stood at 2.4% at the end of 2023.

This financial maneuver is designed to bolster Covivio Hotels’ balance sheet by extending its debt maturity, reaffirming its financial stability as supported by a stable BBB+ rating from Standard & Poor's.

The bonds are slated for trading on the Euronext Paris, with trading expected to commence on May 23, 2024. This can ensure greater accessibility and liquidity for investors wishing to engage with Covivio Hotels’ green initiatives.

R. H.

Copyright © 2024 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all Covivio Hotels news