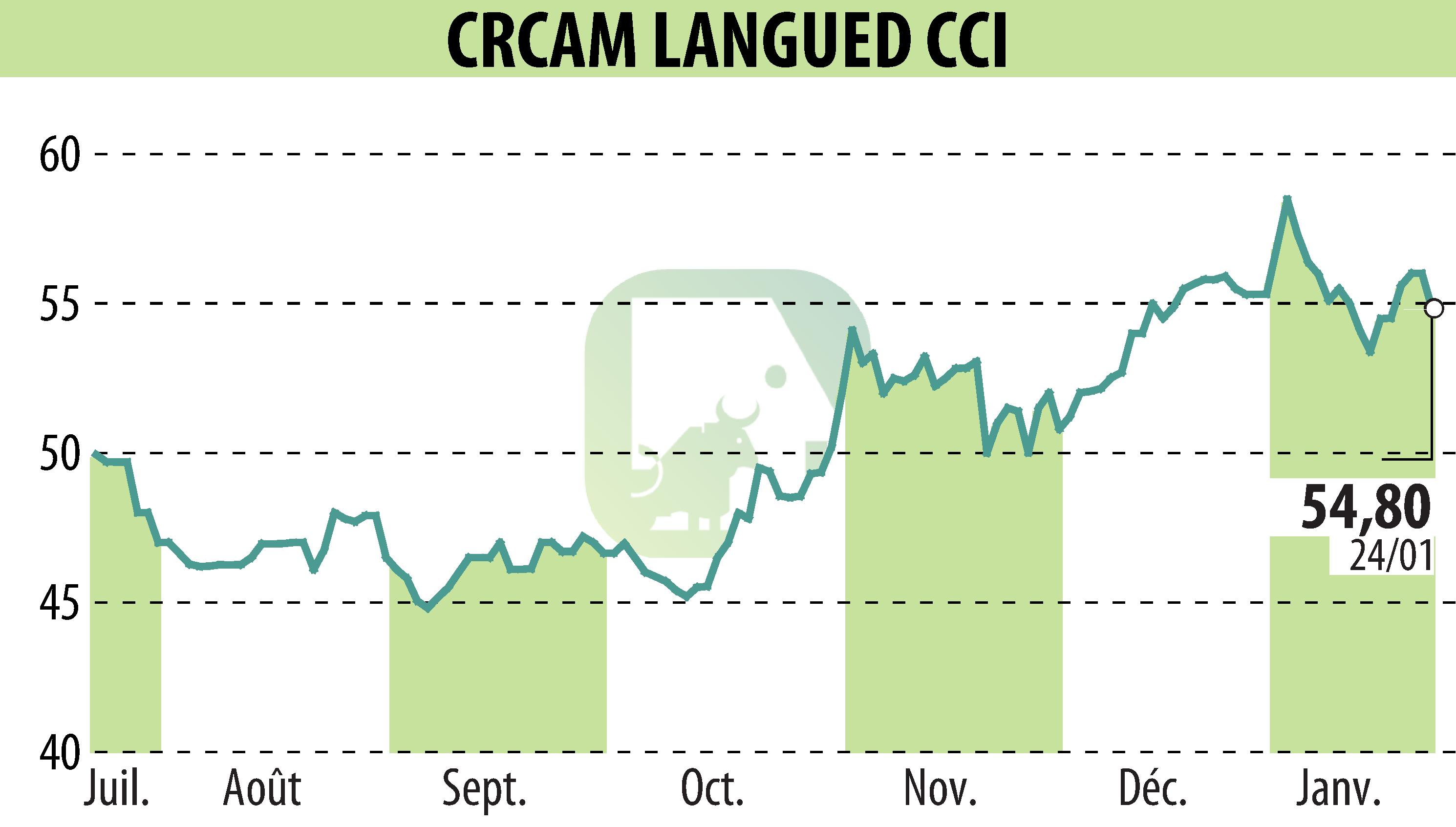

on CRCAM DU LANGUEDOC (EPA:CRLA)

Crédit Agricole du Languedoc: 2024 financial results

Crédit Agricole du Languedoc has announced its financial results for 2024. Outstanding loans decreased by 1.7%, reaching €26.967 billion, in a slowed housing market. On the other hand, outstanding collections increased by 2.3%, reaching €34.540 billion. The number of customers increased, with 46,500 new arrivals.

On the financial front, Net Banking Income fell by 4.2% to 633 million euros, while operating expenses decreased slightly. Consolidated net income stood at 173.3 million euros, down 1.3% compared to the previous year.

The Fund maintains a solid financial position with consolidated equity increased by 7.4% to EUR 5.451 billion. The solvency ratio is 23.33%, illustrating a stable and robust position for the future.

R. E.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all CRCAM DU LANGUEDOC news