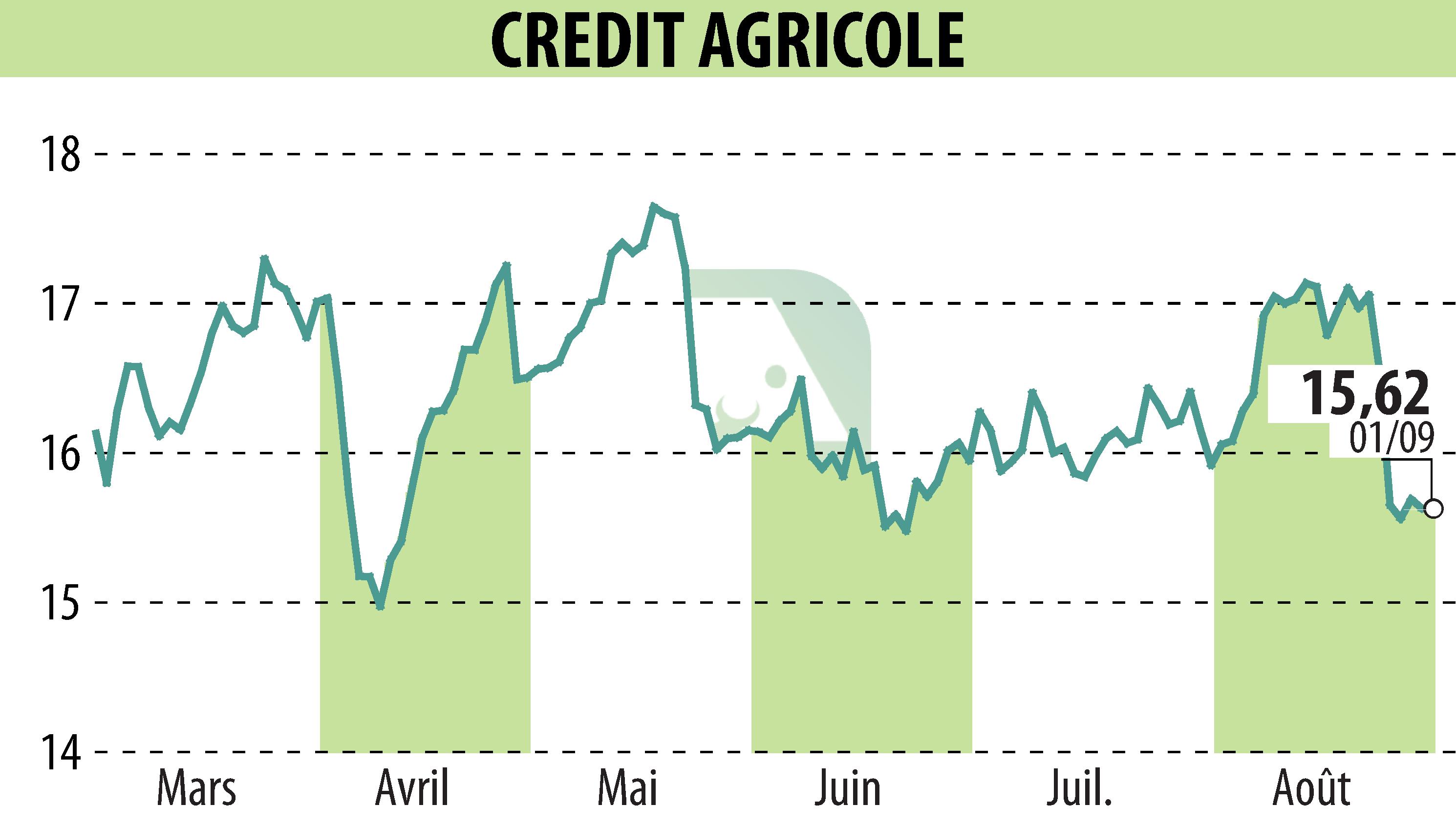

on CREDIT AGRICOLE (EPA:ACA)

Crédit Agricole S.A. Announces Tender Offers for Perpetual Notes

Crédit Agricole S.A. has unveiled its plan to buy back two series of outstanding perpetual notes: USD 8.125% Undated Deeply Subordinated Additional Tier 1 Fixed Rate Resettable Notes and GBP 7.500% of the same category. This effort aims to optimize capital management and liquidity.

The tender offers will close on 8 September 2025, with the settlement expected by 11 September 2025. Participation requires holders to tender notes through a guaranteed delivery procedure. Offers are contingent upon issuing new deeply subordinated notes, subject to satisfactory market conditions.

Details on participation can be found in the Offer to Purchase, available online. These notes are expected to enhance Crédit Agricole's financial structuring, although the action is not open to all investors due to regional legal restrictions.

R. P.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all CREDIT AGRICOLE news