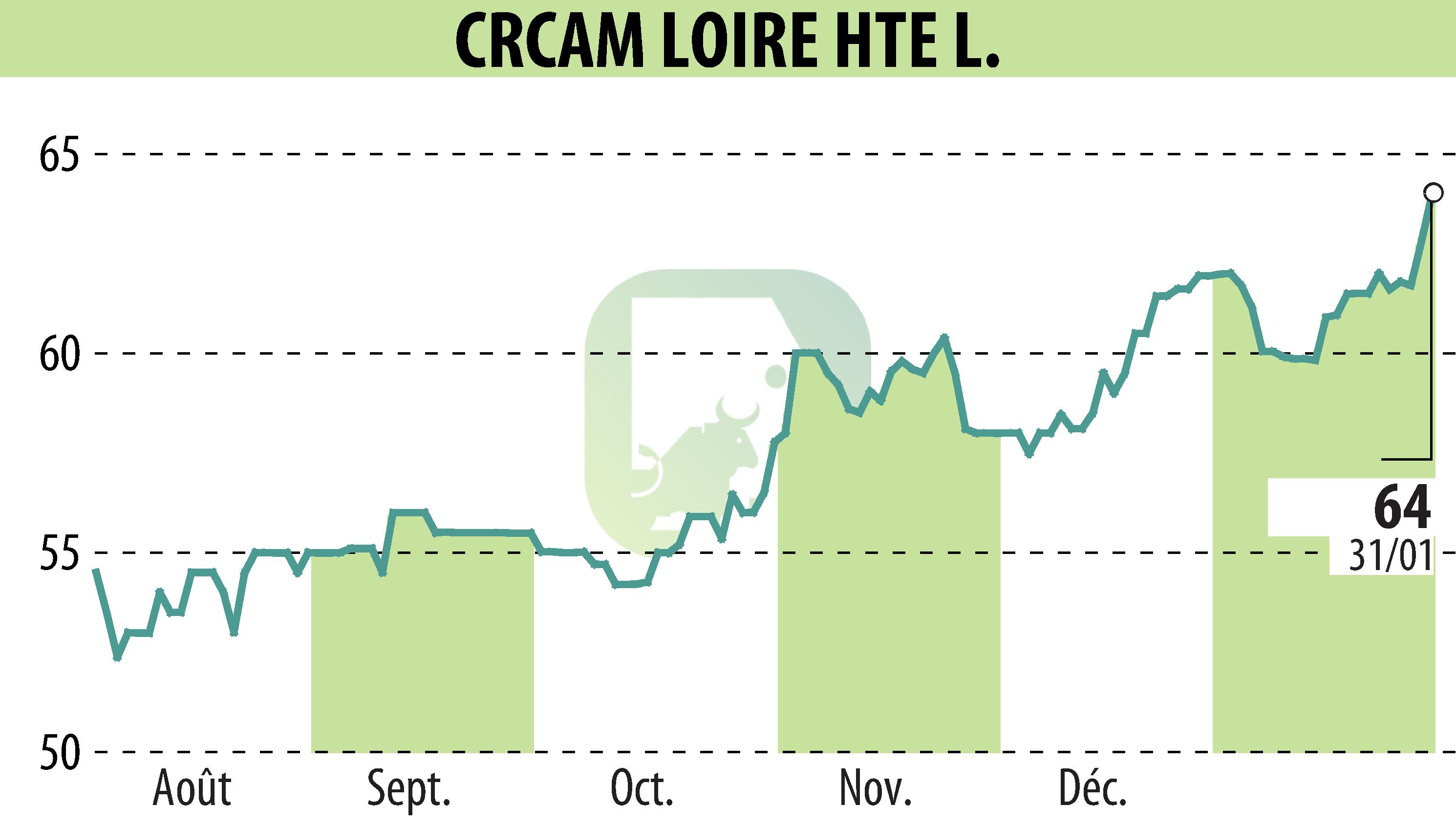

on CREDIT AGRICOLE LOIRE HAUTE LOIRE (EPA:CRLO)

Crédit Agricole Loire Haute-Loire: Financial report for 2024

In 2024, Crédit Agricole Loire Haute-Loire maintained sustained activity. With 1,397 employees, the bank strengthened its ties with its customers by combining human and digital services. Outstanding collections increased by 1.5%, reaching €16.5 billion, despite a sluggish real estate market. Customer loans remained stable at €10.3 billion thanks to the diversification of loans, while housing loans increased slightly by 0.3%.

Net Banking Income increased by 2.8% to reach 277.2 million euros, although the Global Intermediation Margin decreased slightly. The cost of risk is controlled despite a slight increase in impaired receivables. Consolidated net income, Group share, increased by 14.9% to 77.8 million euros.

The group's financial strength remains strong, with an overall solvency ratio of 29.51% as of September 30, 2024. Finally, the Board of Directors is proposing a dividend of €2.83 per CCI for 2024.

R. E.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all CREDIT AGRICOLE LOIRE HAUTE LOIRE news