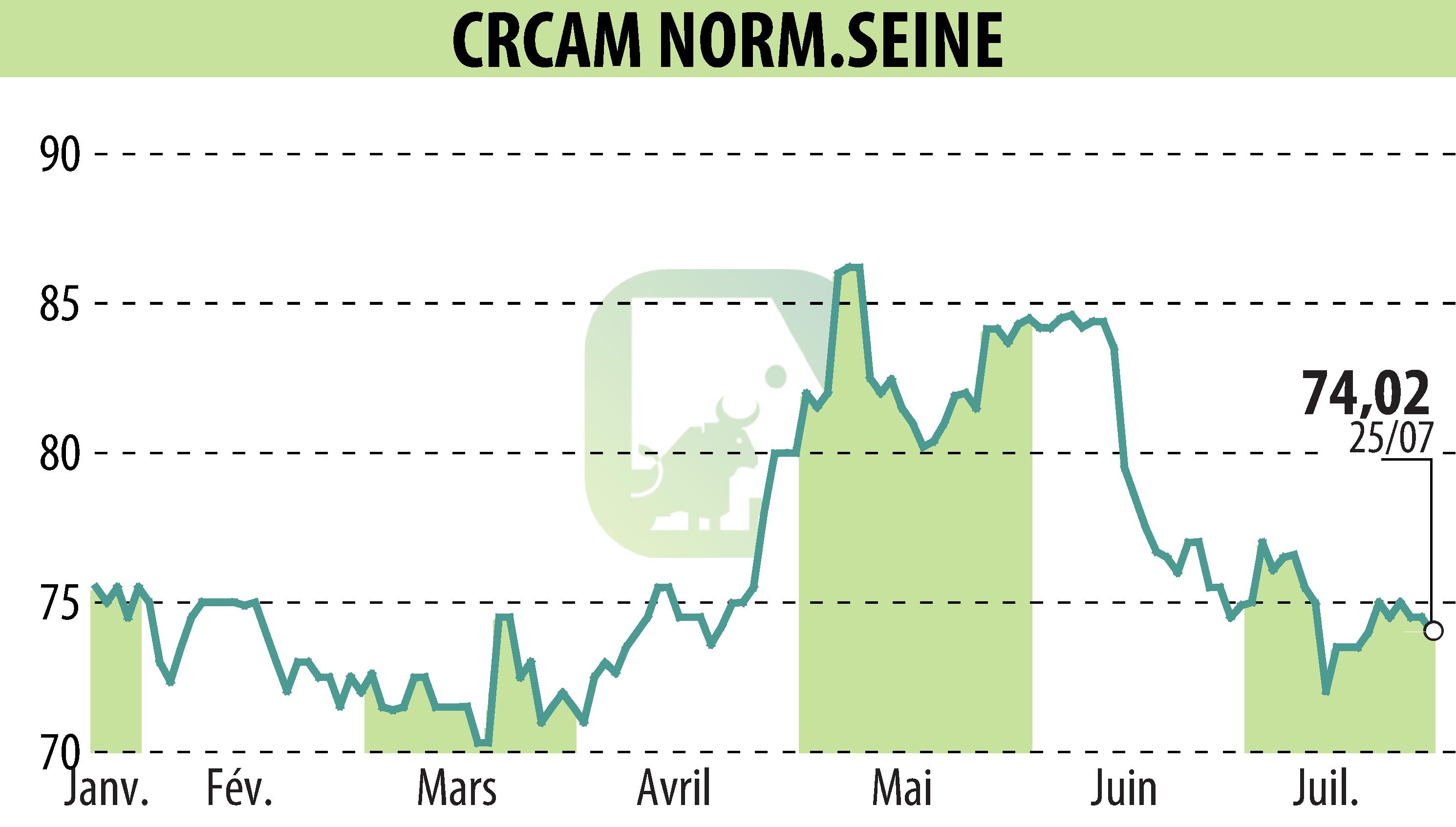

on CREDIT AGRICOLE DE NORMANDIE SEINE (EPA:CCN)

Crédit Agricole Normandie-Seine: Financial results for the first half of 2024

As of June 30, 2024, Crédit Agricole Normandie-Seine displays resilient commercial activity despite an uncertain economic context. Outstanding loans remain stable at 17.06 billion euros, while savings increase by 4.1%, reaching 21.9 billion euros.

The number of customers increased by 0.6% with 14,500 new arrivals. The insurance portfolio also recorded growth, totaling 481,000 contracts. The company consolidates its status as a mutual bank by attracting 6,000 new members.

The financial results show an increase in net banking income of 1.6 million euros over one year. The social net income stood at 60 million euros, an increase of 2.9 million euros. The consolidated net profit increased by 10.7%, reaching 58.7 million euros.

With a Basel III solvency ratio of 24.34% and an LCR liquidity ratio of 121.55%, Crédit Agricole Normandie-Seine far exceeds regulatory requirements. The company, recently recognized as mission-driven, continues its commitment to sustainability and supporting its customers.

R. E.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all CREDIT AGRICOLE DE NORMANDIE SEINE news