on DATAGROUP IT Services Holding AG (ETR:D6H)

DATAGROUP Announces Measures to Boost Shareholder Value

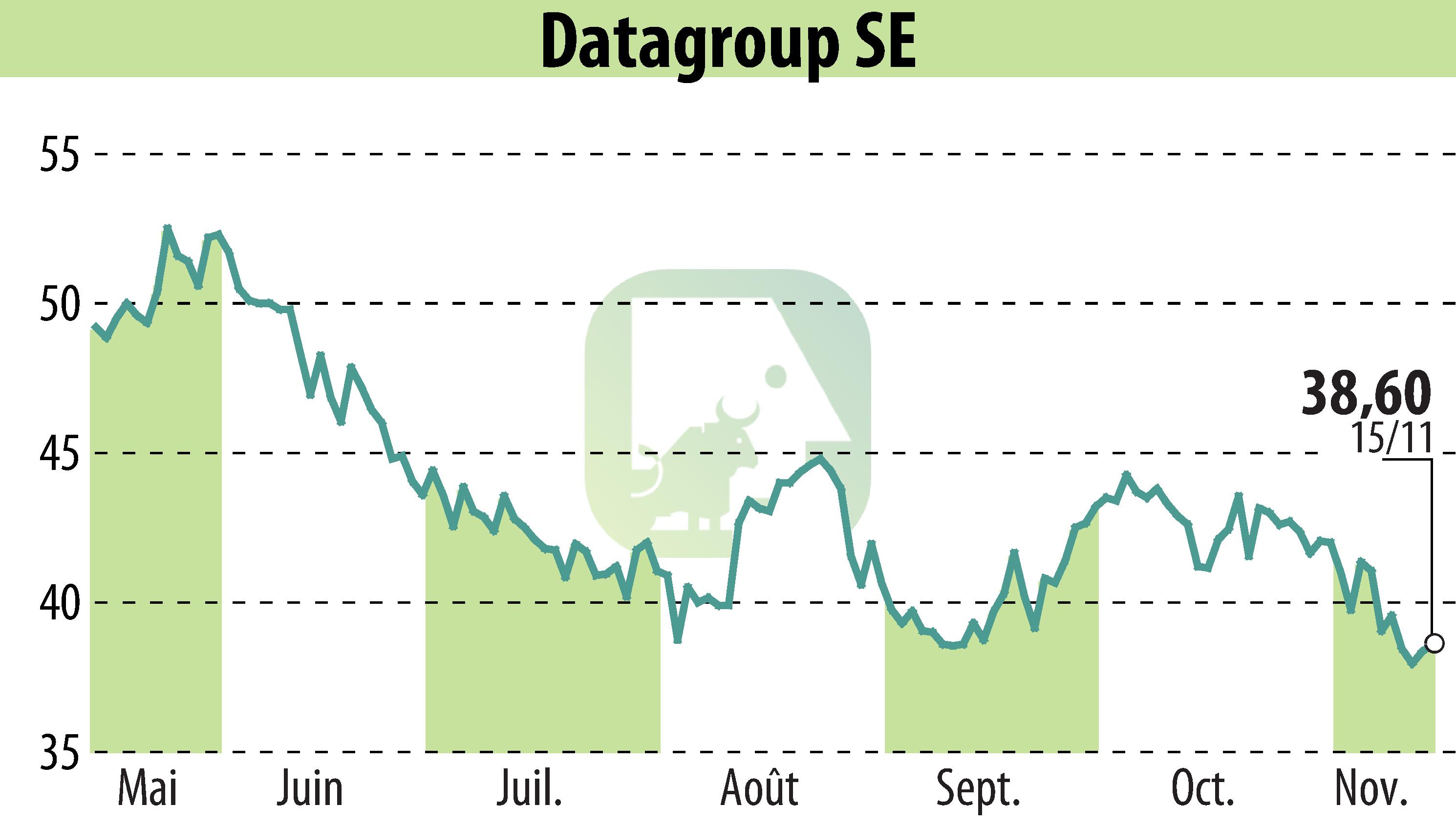

DATAGROUP SE has unveiled a strategic plan aimed at enhancing shareholder value. Key actions include a share buyback of up to 9.79% of its share capital and contemplating a spin-off of its digitalization subsidiary, Almato AG. The spin-off seeks to enhance the market positioning of both entities, with Almato also planning an IPO. Furthermore, dividends will be suspended to support these initiatives.

The company intends to transition its listing to the m:access segment of the Munich Stock Exchange. This change is positioned as a strategic move to adjust to regulatory expectations while maintaining transparency. DATAGROUP also confirmed its financial guidance, with anticipated revenues for FY 2023/2024 ranging from EUR 510-530 million.

This package is expected to consolidate DATAGROUP's focus on its CORBOX IT outsourcing service, aiming for robust business performance despite current market conditions.

R. E.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all DATAGROUP IT Services Holding AG news