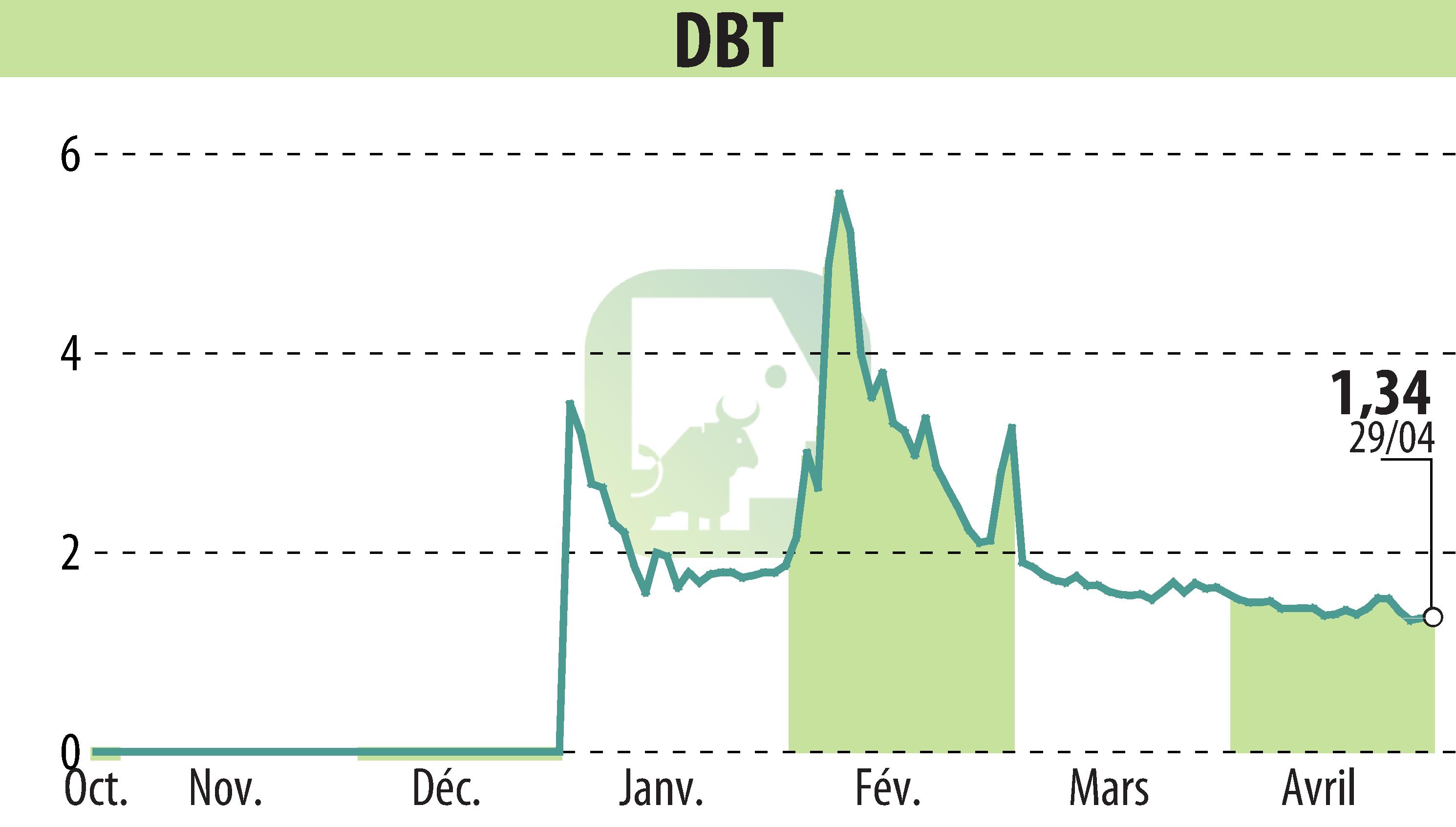

on DBT (EPA:ALDBT)

DBT announces its 2023 results and new developments for 2024

The DBT group, specializing in fast charging solutions for electric vehicles, presented its 2023 financial results, marked by an 8% increase in its turnover, reaching 10.7 million euros. However, the financial year was affected by non-recurring charges, resulting in a net loss of 9.196 million euros. The company reports significant investment in the development of its R3 charging network, with 55 sites operational at the end of the year.

At the start of 2024, DBT is focusing on the transformation of the group, including the finalization of a capital increase of nearly 8 million euros. This new financial injection stopped the use of dilutive financing by OCEANE. The company also began shipping its new range of Milestone® terminals and increased the number of its R3 sites by an additional 30 units.

The outlook for 2024 and subsequent years is positive, with a turnover target of 25 million euros by 2025 and 50 million in 2028. DBT is also targeting positive EBITDA for 2025 thanks to the increased deployment of its R3 network and improving the use of its facilities.

R. E.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all DBT news