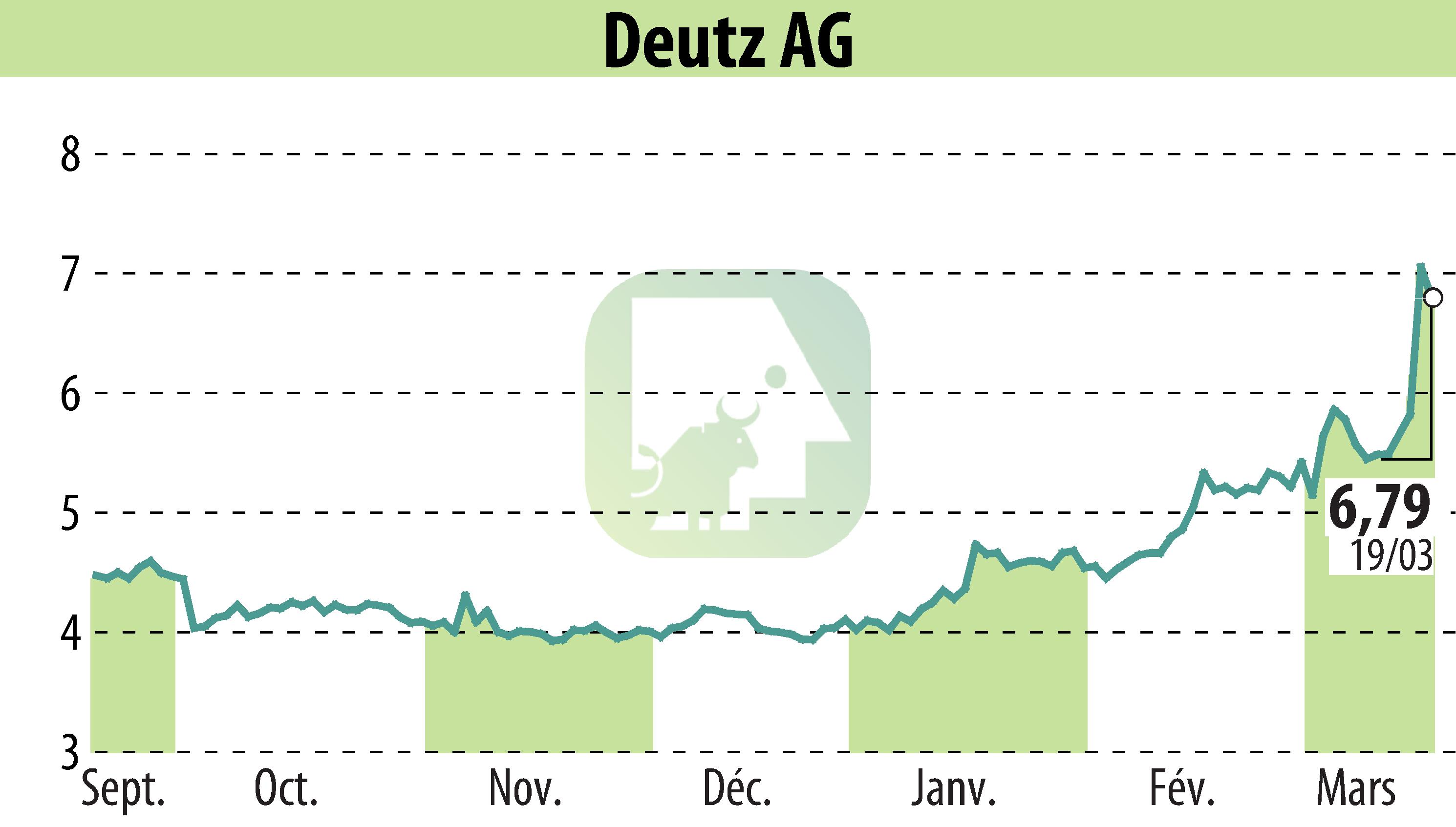

on DEUTZ AG (ETR:DEZ)

DEUTZ Navigates a Challenging Year

DEUTZ AG has reported a steady performance in 2024 despite facing a tough economic climate. Revenue fell by 12.1% to €1,813.7 million, yet the company achieved an adjusted EBIT of €76.7 million, marking a 4.2% EBIT margin. The increase in new orders by 4.4% to €1,827.1 million was driven by strategic acquisitions including Blue Star Power Systems and certain assets from Rolls-Royce Power Systems.

The year witnessed the sale of the underperforming subsidiary Torqeedo, easing financial pressures. The firm's Dual+ strategy, focusing on portfolio diversification and efficiency, has shown early success. DEUTZ aims to boost revenue to €4 billion by 2030 while streamlining operations through a reduction of 300 jobs, aiming for a €50 million annual cost cut by 2026.

The 2025 outlook anticipates revenue between €2.1 billion and €2.3 billion, with an EBIT margin of 5.0% to 6.0%, buoyed by market recovery hopes and cost-control measures.

R. H.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all DEUTZ AG news