on E-PANGO (EPA:ALAGO)

E-PANGO launches €4 million bond financing

E-PANGO announced the establishment of a bond loan which could reach 4 million euros over 48 months. This financing consists of bonds convertible or exchangeable into shares, with attached share subscription warrants. The first tranche of this financing was issued for 200,000 euros.

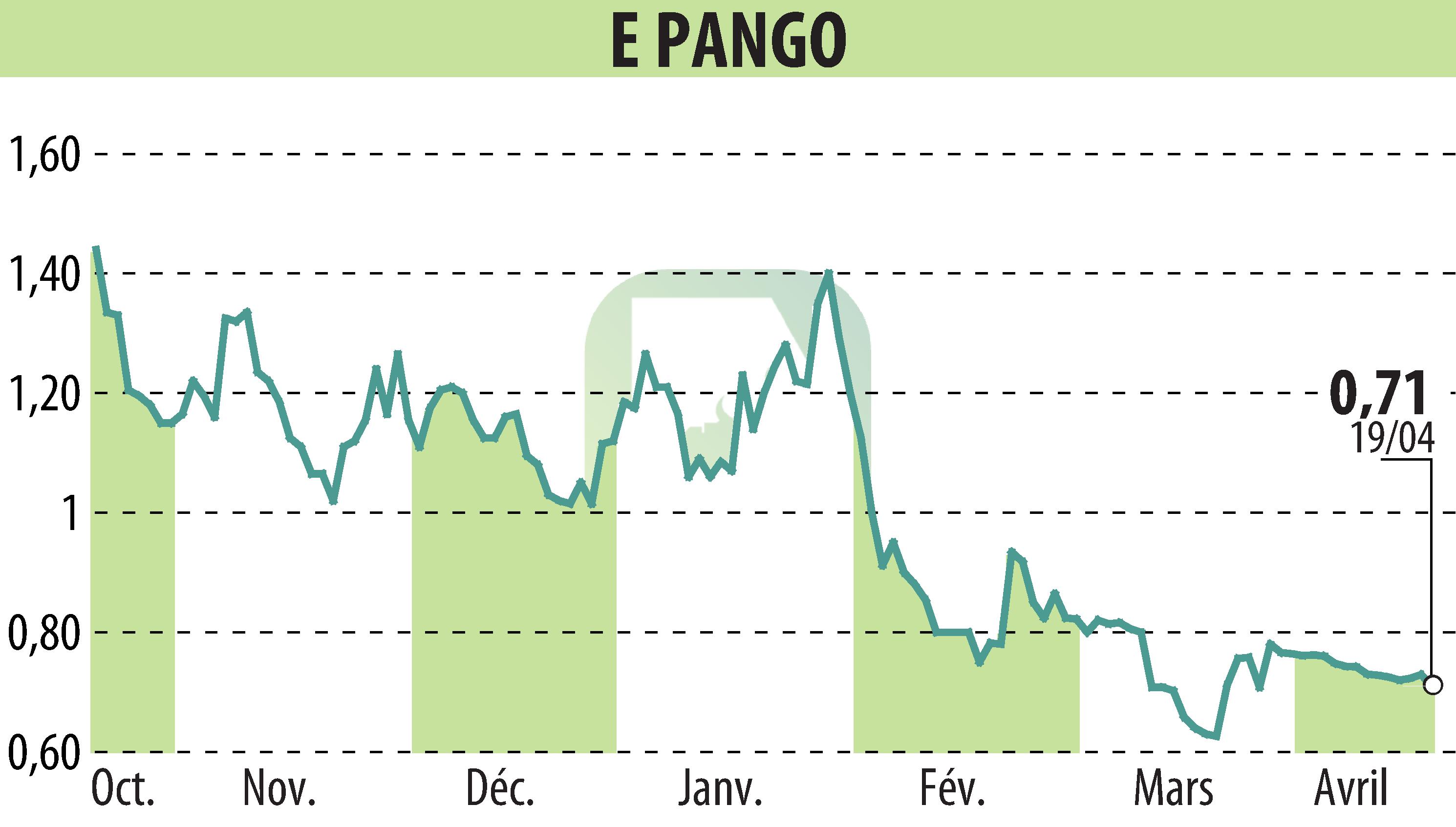

The main investor, Global Corporate Financial Opportunities 9, subscribed to 40 bonds convertible or exchangeable into shares (OCEANE) during this first tranche. The company warned that the new shares, resulting from the conversion of the bonds and notes, could be sold quickly on the market, potentially impacting E-PANGO's share price.

It is mentioned that E-PANGO does not intend to allow this investor to remain a shareholder in the long term. Current shareholders could therefore see their share diluted and the value of their investment reduced as a result of these share issues. The company, based in Paris, also stressed that this financial operation was the first of its kind that it had carried out, introducing specific risks for investors.

R. H.

Copyright © 2024 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all E-PANGO news