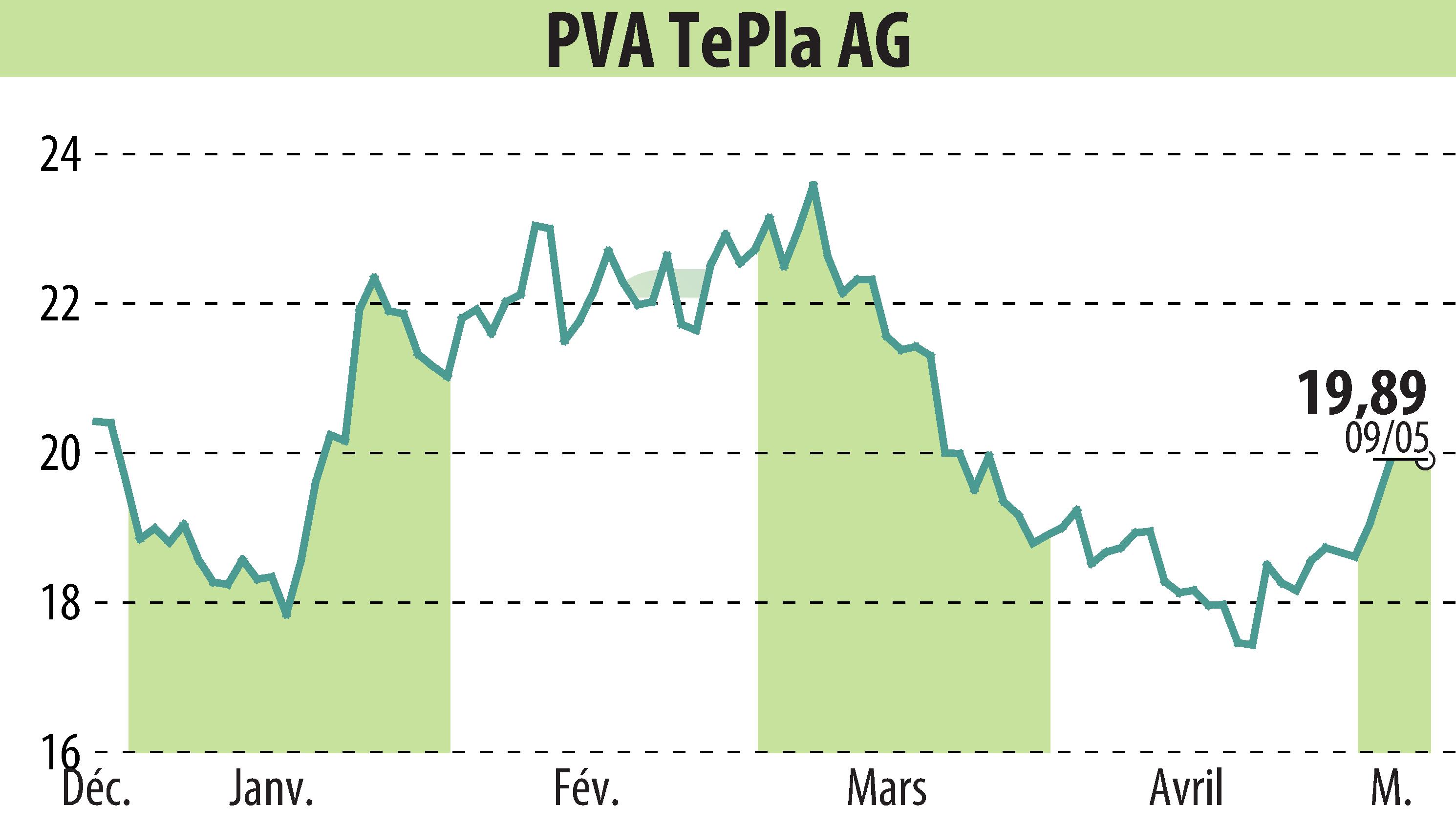

on PVA TePla AG (isin : DE0007461006)

Edison Initiates Coverage on PVA TePla with Positive Outlook

Edison Investment Research has initiated coverage on PVA TePla AG (TPE), a company that has evolved from a simple industrial systems seller to a significant player in materials technology and metrology solutions. PVA TePla is expected to achieve revenues close to €280 million in FY24, primarily fueled by its strong ties to the expanding semiconductor industry. This sector accounts for over two-thirds of its sales and is enhanced by demands from artificial intelligence, digitization, and e-mobility sectors.

The company benefits particularly from a surge in capital intensity within the semiconductor industry and widening end markets. However, despite its strategic positioning and growth trajectory, PVA TePla's market valuation still lags behind its peers. Currently, it trades at an FY25e EV/EBITDA of 6.8x, significantly lower than the averages of other European semiconductor equipment makers and advanced materials firms.

Edison's detailed analysis suggests that the market has not yet fully appreciated PVA TePla's transformation and growth potential, with their DCF valuation indicating a fair share price of €35.26. This undervaluation presents a unique angle for investors, particularly those interested in the high-tech industrial and semiconductor sectors.

R. P.

Copyright © 2024 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all PVA TePla AG news