on TOUR EIFFEL (EPA:EIFF)

Eiffel Tower Company: 2024 Outlook and Financial Strategies

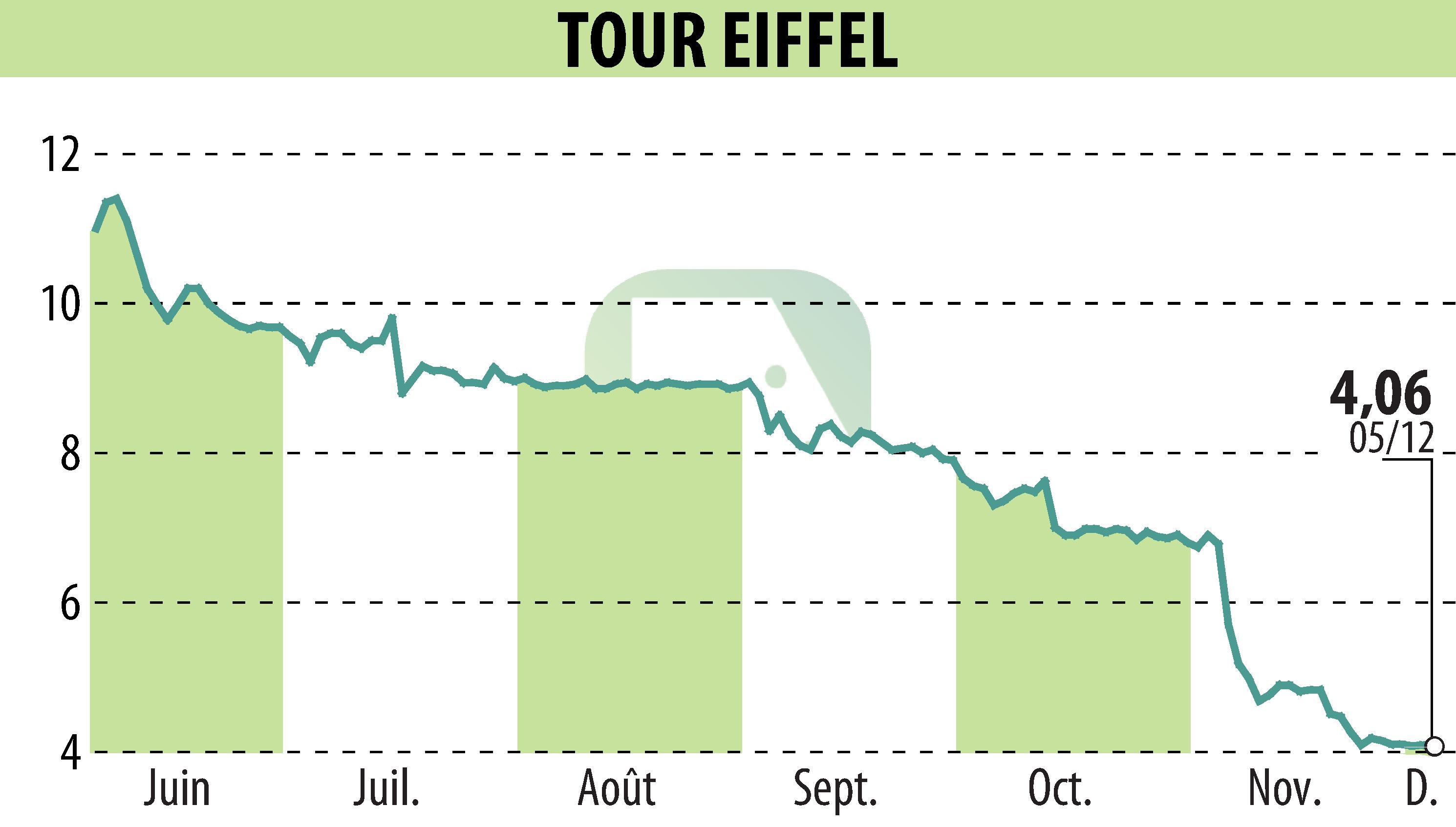

Société de la Tour Eiffel has unveiled its forecasts for the end of 2024, including an estimate of the value of its real estate portfolio. Following significant sales in Paris and Montigny, the value of the assets is estimated at €1.593 billion for the end of 2024, marking a decrease of 6% compared to the previous year. These adjustments reflect current market conditions and efforts to reposition the real estate portfolio.

The company expects its net asset value to decline by 15-20%, mainly due to pressure on leasing activity. Despite the signing of new contracts, the net balance remains negative. The financial occupancy rate is expected to fall to 76%, influenced by asset sales and low occupancy of new facilities.

In view of these challenges, a capital increase of EUR 600 million with preferential rights is proposed for the maintenance of financial covenants and future stability. This increase aims to avoid default on upcoming debt maturities. The company hopes, through this measure, to cover its short-term refinancing needs and seize market opportunities in the medium term.

R. P.

Copyright © 2024 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all TOUR EIFFEL news