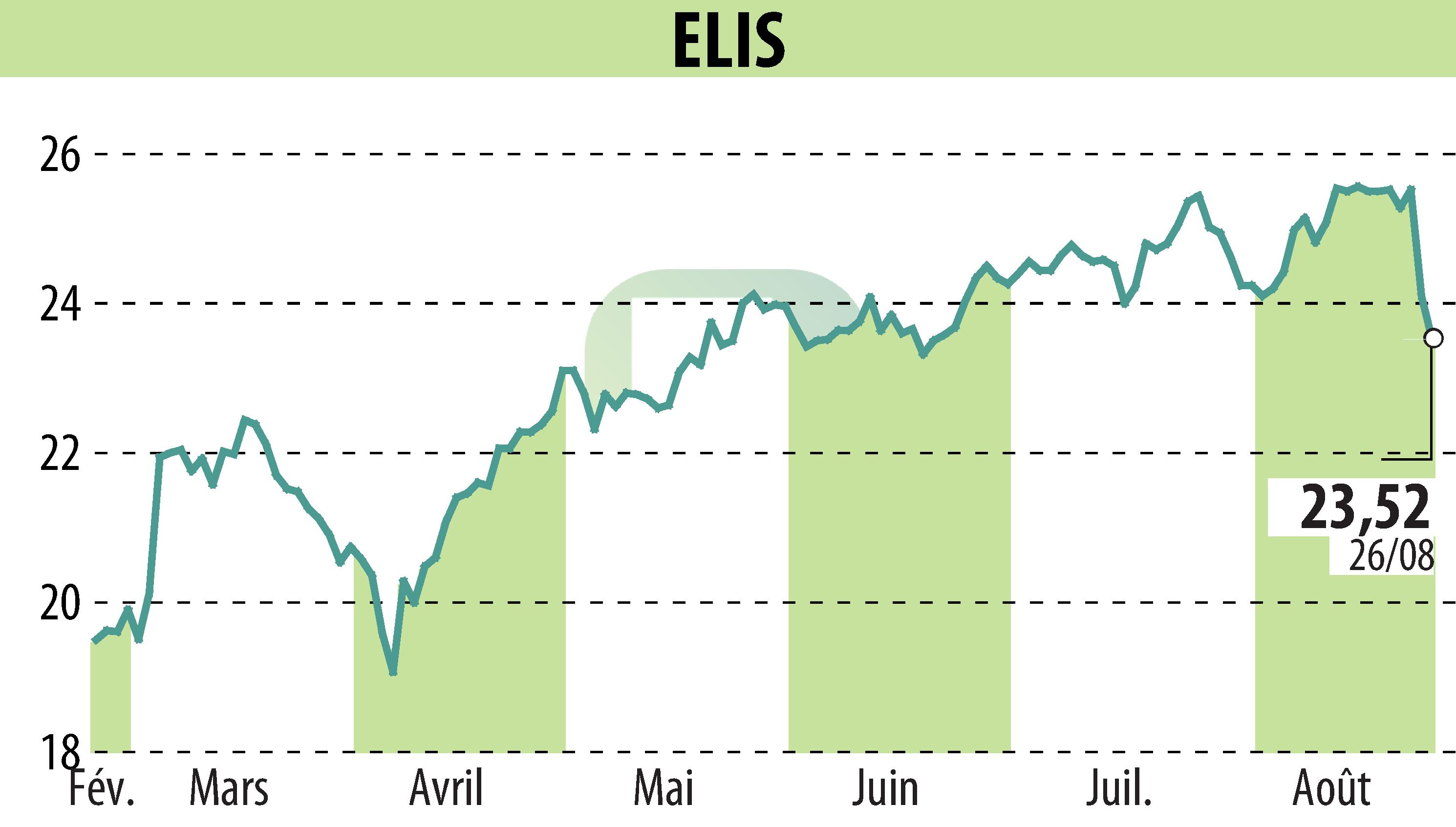

on ELIS (EPA:ELIS)

Elis successfully completes €350 million bond placement

On August 26, 2025, Elis, a company specializing in circular services, announced the successful placement of €350 million in bonds under its EMTN program. These senior unsecured bonds have a maturity of six years and a fixed annual coupon of 3.375%.

The strong investor demand reflects their confidence in Elis's resilient business model. The funds raised will primarily be used to refinance a previous €350 million bond maturing in February 2026.

Nine banks participated in the placement: Banco Bilbao Vizcaya Argentaria, Crédit Agricole CIB, CIC, Commerzbank, Danske Bank, HSBC, La Banque Postale, Natixis and Société Générale.

R. E.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all ELIS news