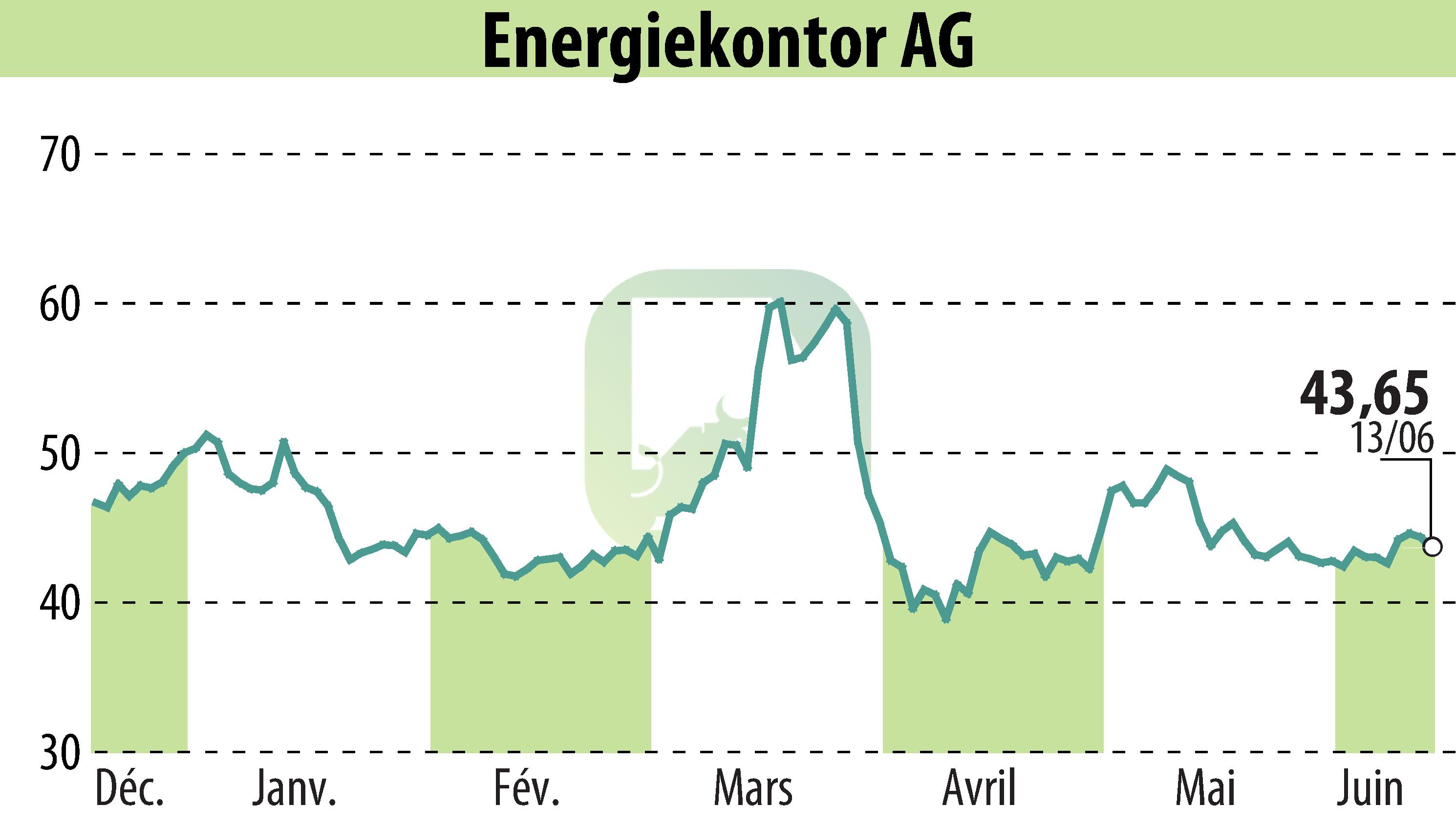

on Energiekontor AG (ETR:EKT)

Energiekontor AG: Wind Farm Sale Boosts Profit Outlook

Energiekontor AG recently received a "Buy" recommendation from First Berlin Equity Research GmbH. Analyst Dr. Karsten von Blumenthal increased the target price to €105, up from €104. Energiekontor completed the sale of a 46 MW wind farm project in Scotland to Uniper UK. This transaction is expected to generate a pre-tax profit of at least €15 million, contributing significantly to the company's 2025 profit guidance of €70 million to €90 million.

The Scottish wind farms leverage excellent wind conditions while incurring only onshore construction costs, enhancing profitability. Energiekontor plans further similar sales in 2025. The company currently has 17 approved wind farm projects totaling 800 MW in Scotland and a UK pipeline of 3.5 GW. Attractively priced with a P/E of 8x and EV/EBIT of 6x for 2026, the stock offers over 140% upside potential.

R. P.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all Energiekontor AG news