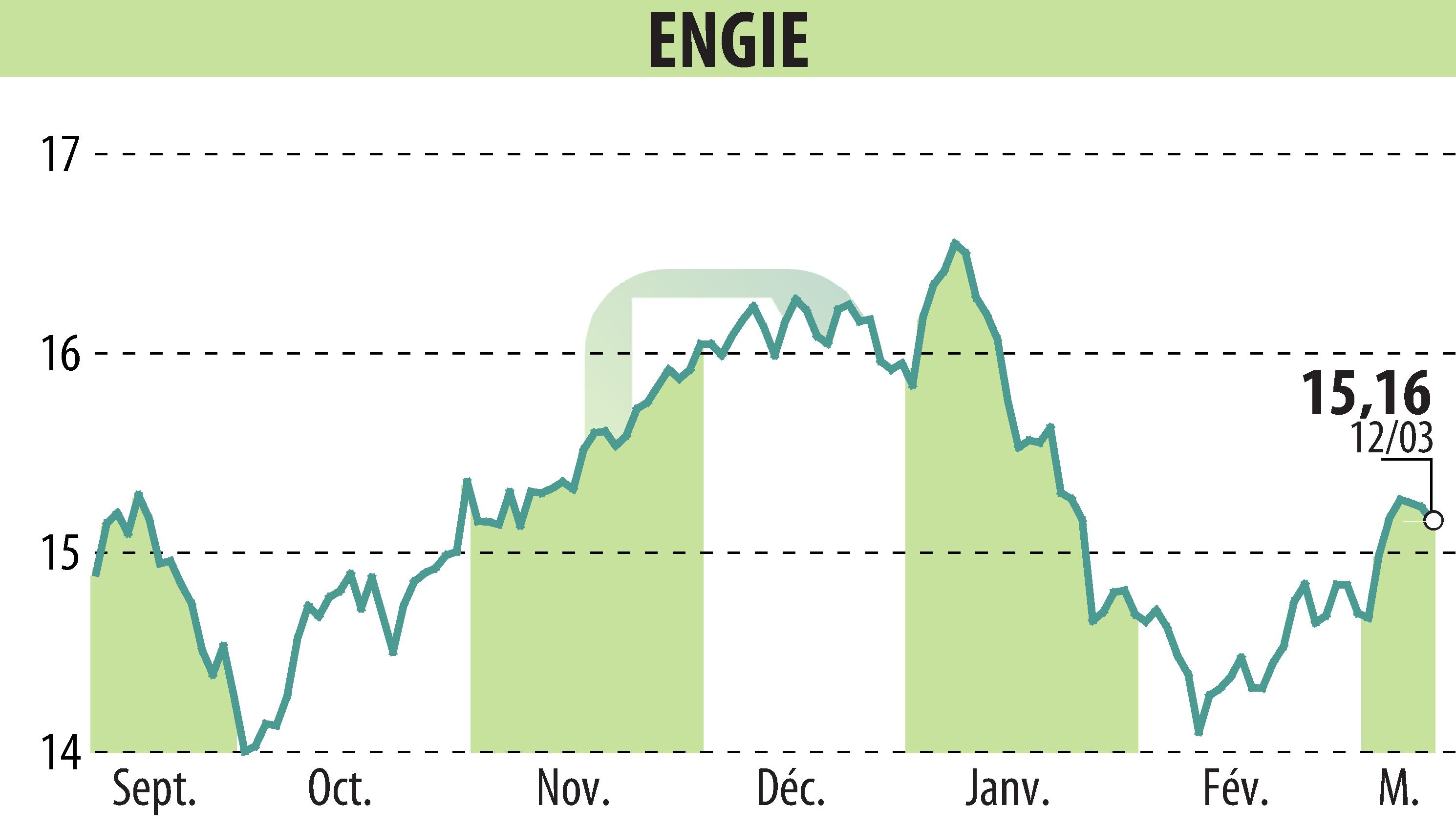

on ENGIE (EPA:ENGI)

ENGIE Announces Forward Sale of Its Residual Stake in GTT to Hedge Economic Exposure

ENGIE Group disclosed its plans to hedge its economic exposure related to its residual interest in Gaztransport & Technigaz (GTT), amounting to approximately 5.38% of GTT's share capital, through an 18-month forward sale agreement with Morgan Stanley Europe SE and Natixis. This arrangement, involving around 2 million GTT shares, allows ENGIE to sell its remaining stake at a pre-determined price on September 18, 2025, while maintaining full ownership and voting rights until the sale's maturity.

To secure their commitment under the forward sale agreement, the hedging banks will orchestrate a private placement of GTT shares to qualified investors through an accelerated bookbuild offering, equal to the total shares involved in the forward sale transactions. This offering aims to start immediately following the announcement and will finalize its terms at the conclusion of the bookbuilding process, exclusively targeting eligible qualified investors.

This move is part of ENGIE's enhanced divestment program announced on November 13, 2020, aimed at strategically reviewing its stakeholding options in GTT. This initiative previously included a series of sell-downs and the issue of exchangeable bonds, all directed towards reducing ENGIE's shareholding in GTT progressively. The final terms of this offering are slated to be disclosed by ENGIE on March 14, 2024, with the settlement and delivery expected by March 18, 2024.

R. P.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all ENGIE news