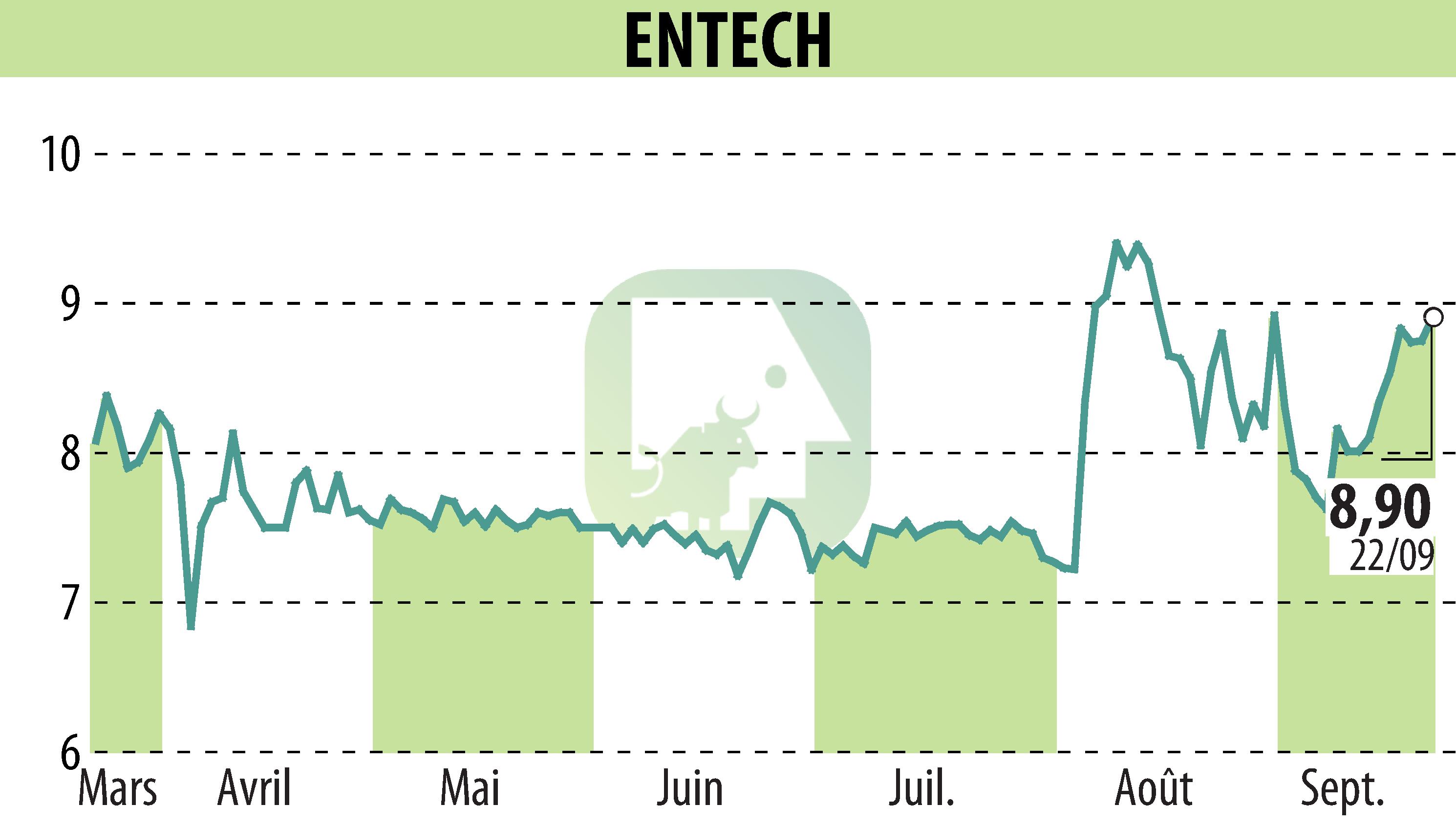

on ENTECH (EPA:ALESE)

Entech maintains its path to profitability in the first half of 2025

Entech, a specialist in renewable energy storage and management, recorded strong momentum in the first half of 2025. Order intake reached a record level of €100 million, which should support growth in the second half. Revenue stood at €27.5 million, up 9% compared to the equivalent period in 2024.

The Entech Solutions segment is growing by 30%, while Entech Construction remains the majority shareholder with €19.4 million in revenue. Entech Energy & Services is launching a portfolio of photovoltaic projects, with strategic investments. EBITDA is positive, at €0.3 million, highlighting good cost management. Entech confirms its 2025 objectives with expected revenue of €80 million.

R. P.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all ENTECH news