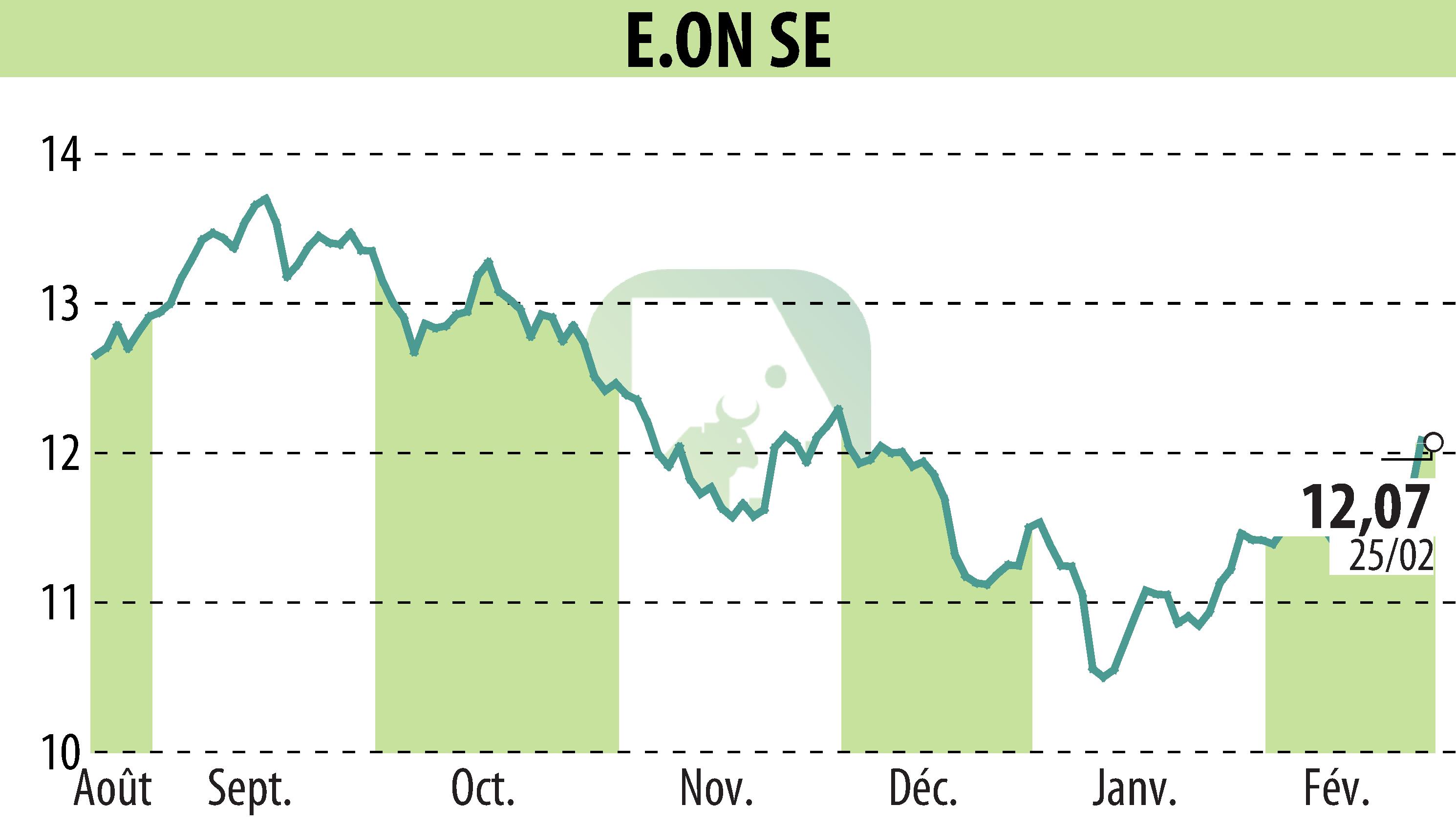

on E.ON SE (isin : DE000ENAG999)

E.ON Achieves Strong Earnings with Record Investments in Energy Transition

E.ON SE concluded its fiscal year with impressive earnings and substantial investments to drive Europe's energy transition. The company reported an adjusted Group EBITDA of €9.0 billion and adjusted net income of €2.9 billion, aligning with its earnings guidance. Investments increased by approximately €1 billion to a total of €7.5 billion, emphasizing the need for network expansion and digitalization.

The energy networks division saw an increase in adjusted EBITDA to €6.9 billion, while the energy retail division experienced a decline. E.ON's strategic investments included €5.8 billion in energy networks, boosting infrastructure across Europe. The firm plans to invest €43 billion between 2024 and 2028, provided the regulatory framework remains supportive.

Despite uncertainties, E.ON projects further growth for 2025, with expected adjusted Group EBITDA up to €9.8 billion. Long-term targets foresee EBITDA surpassing €11.3 billion by 2028, driven by significant infrastructure investments. A proposed dividend increase reflects E.ON's commitment to shareholder value.

R. E.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all E.ON SE news