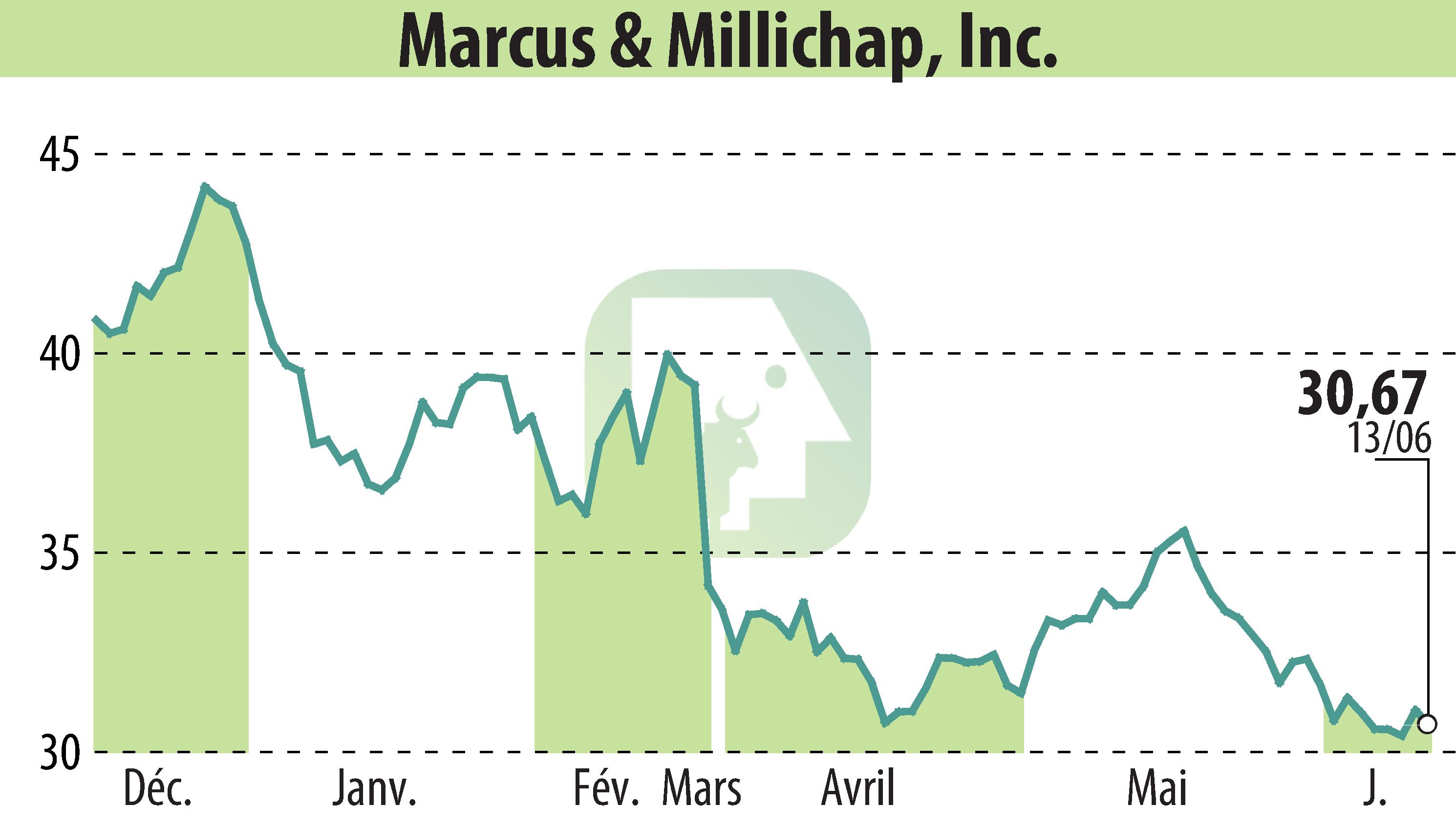

on Equity Multiple Inc (NASDAQ:MMI)

EquityMultiple Identifies Opportunities in Commercial Real Estate Sectors

EquityMultiple, a leading real estate investment platform, remains focused on diverse commercial real estate assets like essential retail, industrial properties, and multifamily housing. With the market presenting dislocation-based opportunities, the firm sees this as an opportune time for individual LP investors to re-enter.

EquityMultiple aims to democratize access to high-quality real estate investments. The platform offers accredited investors the chance to invest in essential retail and industrial sectors, expected to provide growth and stability, and multifamily housing, backed by macroeconomic trends.

Current market conditions suggest a low point, presenting investment opportunities. By targeting essential retail, industrial assets, and multifamily housing, EquityMultiple aligns its strategy with strong, resilient sectors.

CEO Charles Clinton highlights the firm's commitment to essential retail and industrial sectors, driven by robust demand and stable rental growth. These sectors are critical to economic infrastructure and can offer attractive risk-adjusted returns.

The firm's recent investments include a retail project in Charleston, SC, anchored by Planet Fitness and a partnership with O'Connor Capital Partners. The industrial sector benefits from e-commerce growth, while multifamily housing offers stability due to housing shortages and strong renter demand.

R. H.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all Equity Multiple Inc news