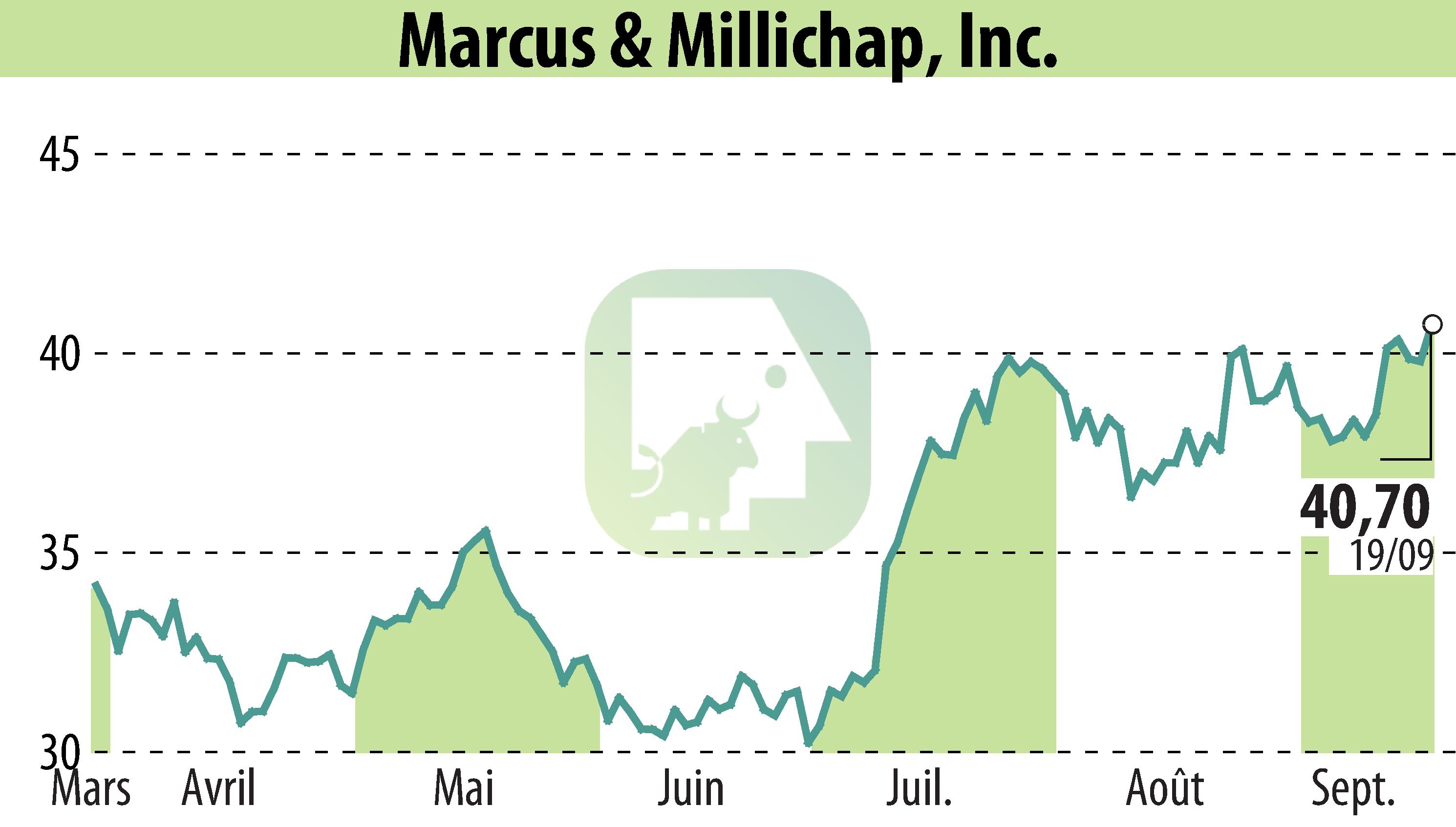

on Equity Multiple Inc (NASDAQ:MMI)

EquityMultiple Sees Opportunities Following Federal Rate Cuts

NEW YORK, NY - EquityMultiple, a real estate investment technology platform, has shared its perspective on the Federal Reserve's recent decision to reduce its key interest rates by 50 basis points. This move is seen as a significant opportunity in real estate markets. As capital markets recalibrate, EquityMultiple aims to offer unique opportunities to individual real estate investors.

The Federal Reserve's aggressive rate hikes had previously suppressed real estate activity, impacting commercial real estate values and increasing borrowing costs. With rates now trending downward, EquityMultiple is preparing its investor network for a potential market rebound. CEO Charles Clinton noted that rate cuts generally favor real estate investments by decreasing debt costs and boosting profitability.

EquityMultiple offers various opportunities for individual investors, including real estate private equity and private credit. This diversified strategy positions the firm to benefit from the new interest rate environment. Historically, rate reductions increase property valuations and create favorable refinancing opportunities, especially in resilient sectors like multifamily real estate.

Chief Investment Officer Marious Sjulsen highlighted that over $1 trillion in commercial real estate loans are maturing by 2026, which could lead to a surge in refinancing activities. Additionally, private credit has become a compelling asset class as alternative lenders like EquityMultiple fill the gap left by traditional institutions.

As inflation eases and rates stabilize, commercial real estate assets are expected to benefit. EquityMultiple's strategies will focus on sectors poised for recovery, utilizing proprietary data to guide investors through the remainder of 2024. The firm remains committed to providing tools and opportunities for informed decision-making in a dynamic market.

R. P.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all Equity Multiple Inc news