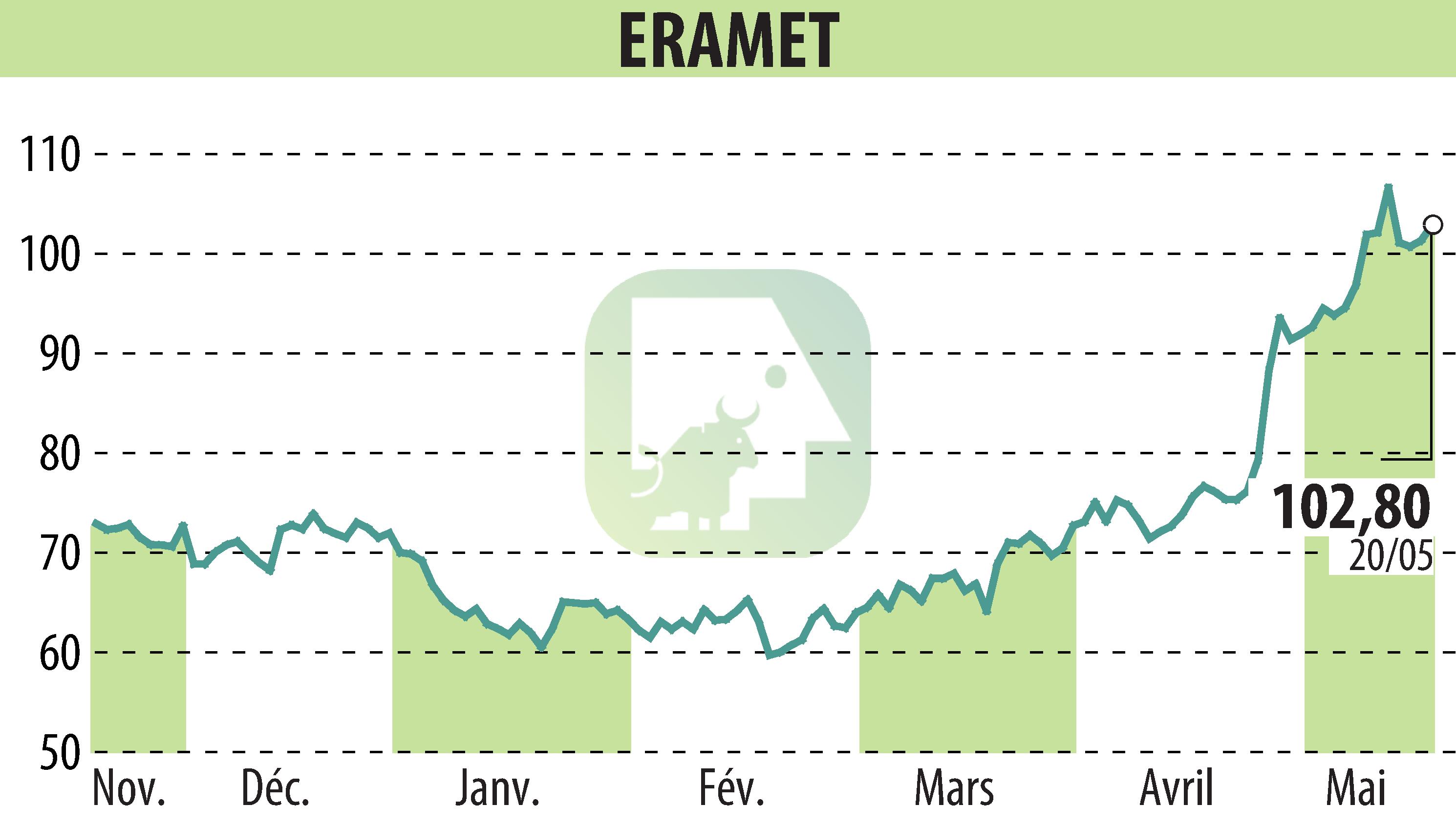

on ERAMET (EPA:ERA)

Eramet Launches Tender Offer to Repurchase Bonds and Plans New Sustainability-Linked Bonds

Eramet announced the launch of a tender offer to repurchase for cash its €300 million bonds due May 2025. Currently, €293.6 million of these bonds are outstanding and traded on Euronext Paris.

The company also intends to issue new sustainability-linked bonds in euros, dependent on market conditions, alongside the tender offer. The new bonds aim to extend Eramet’s debt maturity and manage its debt profile proactively.

The tender offer’s success is conditional upon the issuance of the new bonds, the proceeds of which will be used for general corporate purposes and to refinance the existing bonds. Priority allocation may be given to current bondholders who participate in the tender offer and wish to subscribe to the new bonds.

The final results of the tender offer will be announced shortly after its pricing, expected on 30 May 2024.

R. E.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all ERAMET news