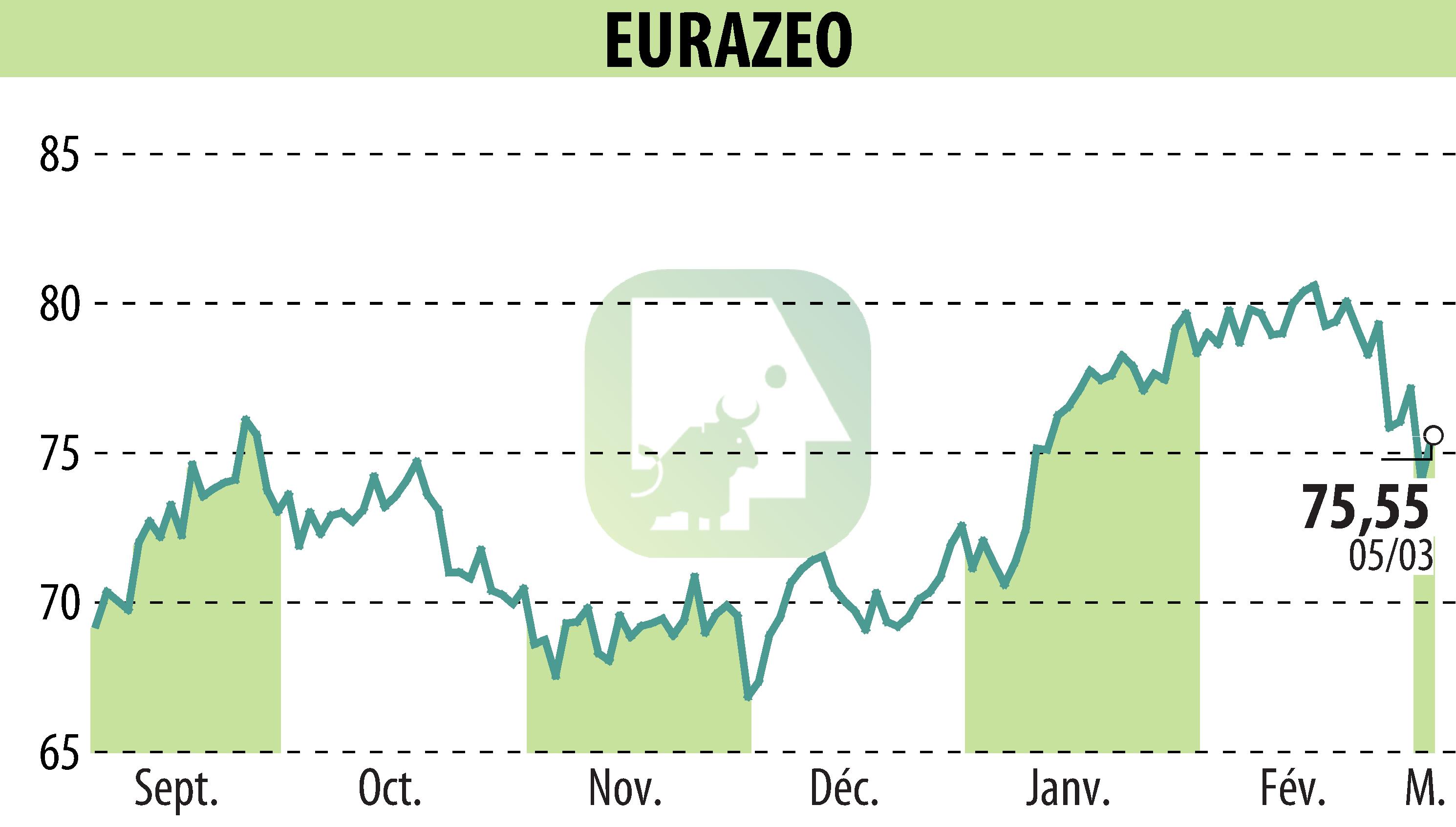

on EURAZEO (EPA:RF)

Eurazeo Delivers Strong Performance in 2024 Under Strategic Plan

Eurazeo reported robust performance in 2024, marking the first year of its 2024-2027 strategic plan. The company achieved significant momentum in asset management, with third-party fundraising reaching €4.292 billion, a 23% increase from the previous year. Fee-Paying Assets Under Management grew by 8% to €27 billion, and management fees saw a 7% rise to €421 million.

Realizations saw a notable upswing, tripling to €3.4 billion, while asset deployment increased to €4.6 billion. Despite legacy asset impairments affecting value creation, the portfolio's solid performance, including a 27% rise in Buyout EBITDA, suggests a positive outlook for future value creation.

Financial results revealed a net income group share of -€0.4 billion. Shareholder returns are set to accelerate with a proposed 10% dividend increase and a doubled share buyback program. Eurazeo’s focus on sustainability and impact investments remains strong, with significant progress in portfolio decarbonization and successful impact fund initiatives.

R. P.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all EURAZEO news