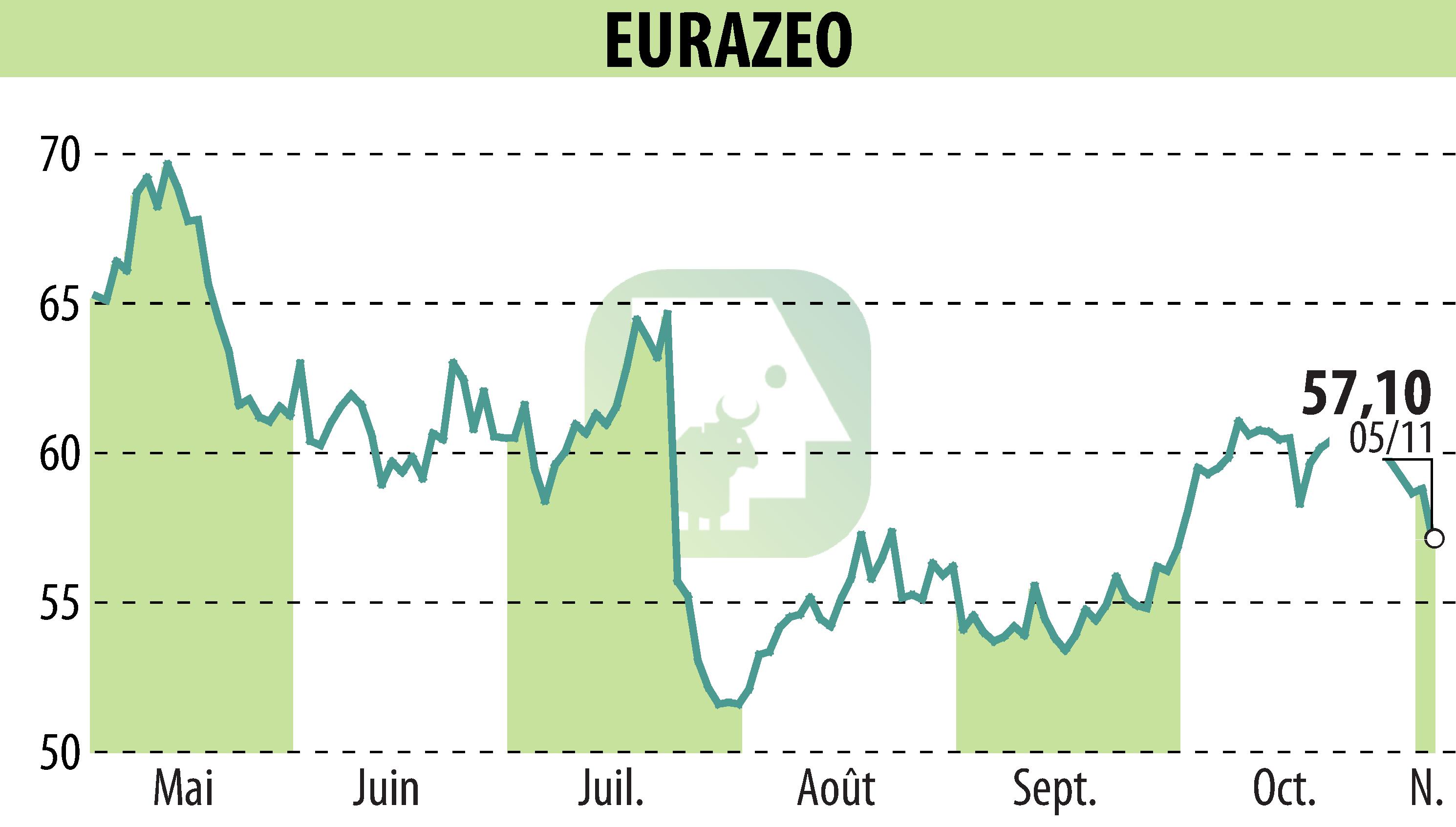

on EURAZEO (EPA:RF)

EURAZEO Demonstrates Robust Growth in Fundraising and Asset Rotation

Paris-based investment group EURAZEO reported strong progress in fundraising and asset management for the first nine months of 2025. Despite a challenging market, EURAZEO raised €3.2 billion, marking a 4% increase from the previous year. Assets Under Management (AUM) rose by 5% to €37.4 billion, with third-party AUM growing by 11%. Fee Paying Assets Under Management (FPAUM) reached €27.9 billion, also reflecting an 11% increase for third parties.

The company highlighted impactful deployments and realizations, with €3.9 billion deployed in growth sectors and notable realizations totaling €2.2 billion. Portfolio companies showed commendable revenue growth, with buyouts growing by 6% and the growth segment by 15%, driven by strong performances from recent investments.

EURAZEO remains focused on shareholder returns, advancing its share buyback program and maintaining strong deployment momentum within impact funds. The firm also announced significant achievements across various sectors, including AI and sustainable infrastructure.

R. P.

Copyright © 2026 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all EURAZEO news