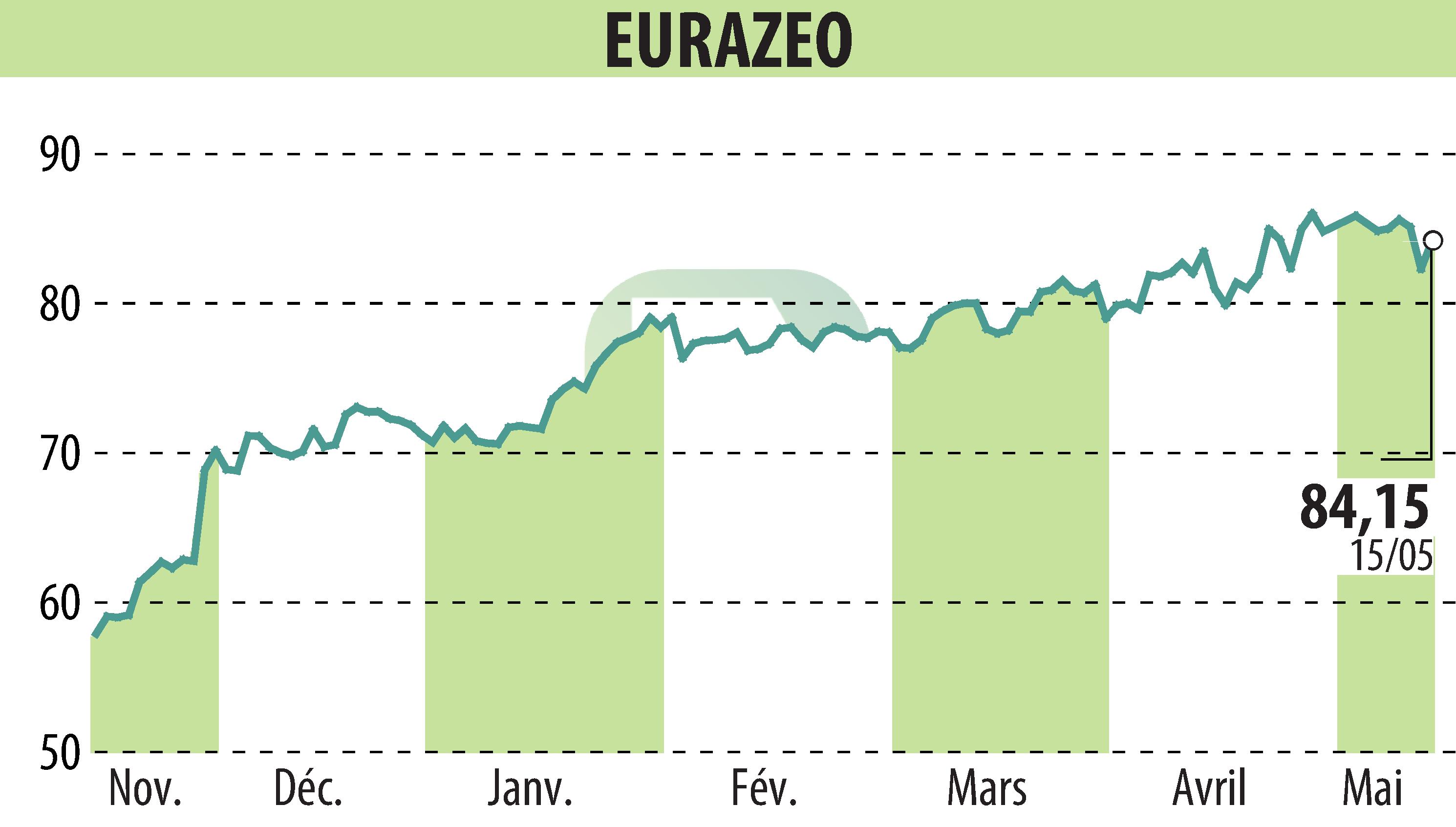

on EURAZEO (EPA:RF)

Eurazeo Reports Robust Growth in Asset Management for Q1 2024

Eurazeo, the investment company, exhibited significant growth in its asset management sector with an 8% year-over-year increase in Assets Under Management (AUM), reaching €35 billion in Q1 2024. This growth includes an 11% increase in third-party assets, amounting to €25.6 billion in fee-paying AUM. Management fees saw a €100 million gain, marking a stable performance from the balance sheet and a 10% increase from third parties.

Furthermore, the company reported a 20% increase in realizations compared to the first quarter of 2023, achieving €0.4 billion. The performance of portfolio companies also surged, with buyout companies generating a 9% revenue growth and growth companies 19%. The solid foundation in its financial strategies and market positioning contributes extensively to these results. Additionally, the investor engagement is reflected in the successful €210 million raised from third parties in this quarter.

The investment group also underlined its commitment to sustainable growth by launching the Eurazeo Planetary Boundaries Fund (EPBF) and improving its CDP climate rating to A. On the shareholder front, Eurazeo announced a dividend payment of €2.42 per share and executed a quarter of its annual €200 million share buyback program, highlighting confidence in its fiscal strategies and future market positioning.

R. E.

Copyright © 2024 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all EURAZEO news