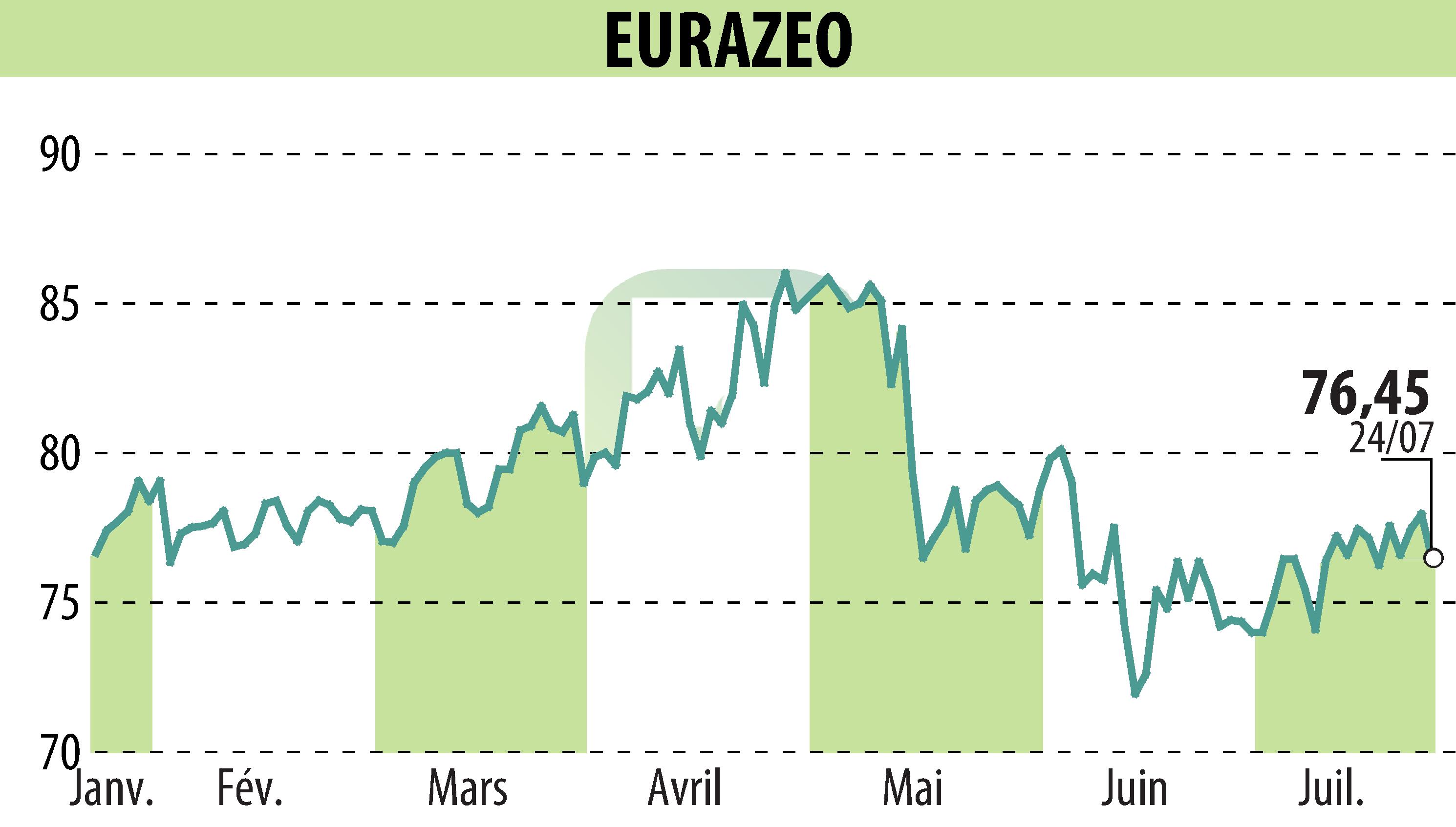

on EURAZEO (EPA:RF)

Eurazeo Reports Robust Strategic Execution and Strong H1 2024 Results

On July 25, 2024, Eurazeo highlighted significant achievements in asset management and realizations for the first half of 2024. The company raised €2,105 million from third parties, reflecting a 63% year-over-year increase. Fee Paying Assets Under Management (FPAUM) grew by 10% to €25.8 billion, with management fees rising 8% to €204 million.

Realizations reached €1.6 billion, tripling from H1 2023. Significant divestments included Amolyt Pharma and Onfido, which saw impressive returns. The net value of the investment portfolio remained stable at €8.0 billion, despite a small fair value loss of 0.6%.

Despite a net loss of €105 million, the financial position remained strong, with gearing at 13%. Furthermore, Eurazeo reinforced its ESG leadership, being ranked among the world's most sustainable companies and excelling in diversity, equality, and inclusion.

The successful launch and closing of several impact funds, like the €706 million Transition Infrastructure Fund, display Eurazeo's continued commitment to sustainable investments.

R. E.

Copyright © 2024 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all EURAZEO news