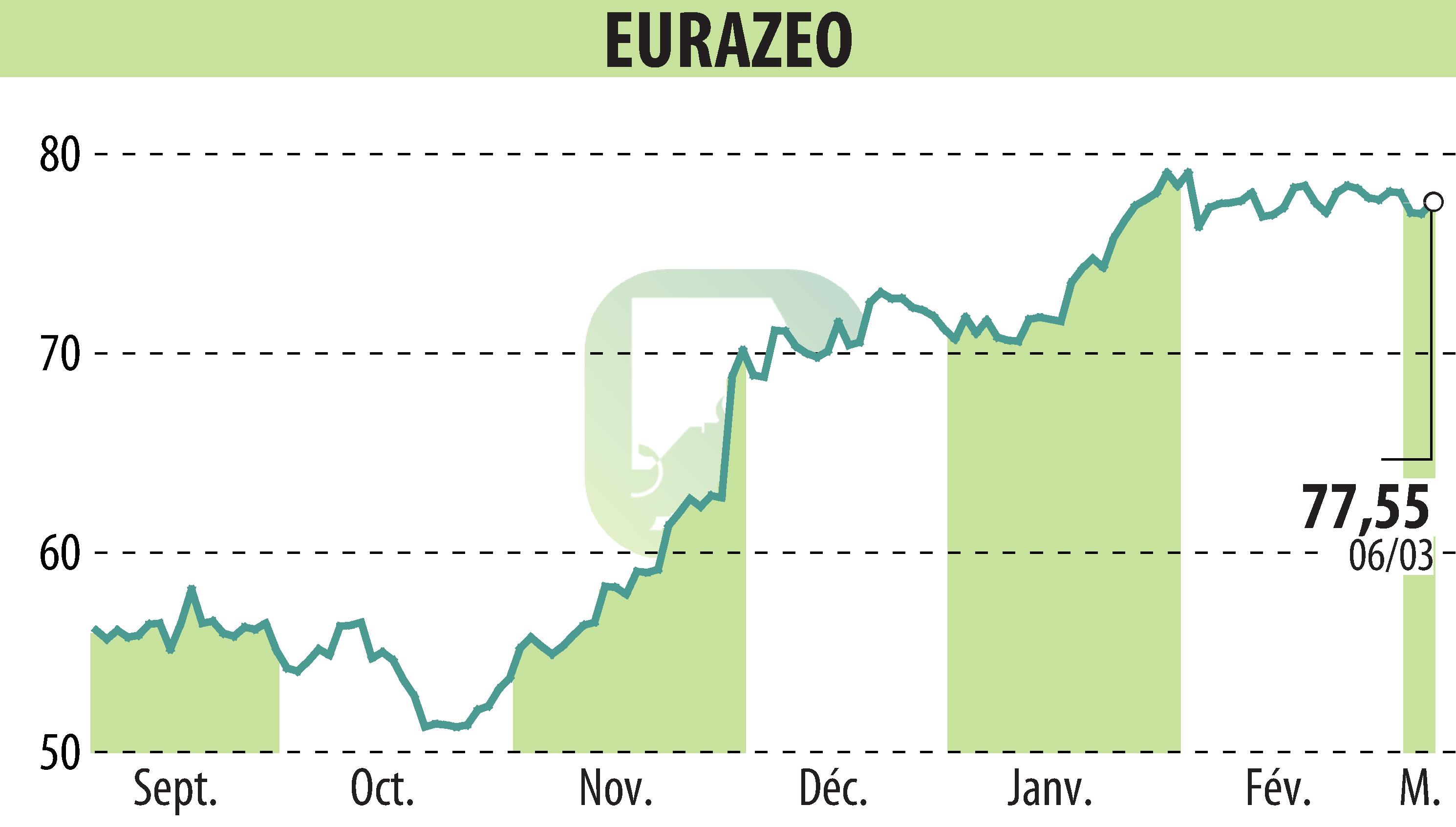

on EURAZEO (EPA:RF)

Eurazeo Reports Strong Growth in 2023 Annual Results

Eurazeo, a leading global investment group, announced its 2023 annual results, showcasing notable growth in asset management activities and an increased return for shareholders. The Paris-based company recorded a 9% year-on-year increase in Assets Under Management (AUM), reaching €35 billion, with third-party AUM up by 12%. The Fee Paying Assets Under Management (FPAUM) also saw a 12% increase to €25.8bn. Notably, third-party fundraising surged to €3.5bn, up 21% from the previous year, with management fees growing by 9% to €398m and Fee-Related Earnings increasing by 22% to €138m.

Eurazeo also reported strong financial results with a net income attributable to owners of the Company at €1.8bn, boosted by non-recurring items. The portfolio value creation stood at a 1% increase in 2023, with an annual growth of 17% over the last three years. The balance sheet remained robust, with limited net debt of €0.8bn.

Improved shareholder returns were highlighted, including a proposed 10% increase in the ordinary dividend to €2.42 per share and the launch of a new €200m share buyback program. New developments in ESG and impact were also emphasized, with successful impact-focused fundraising and 96% of active funds disclosed under Article 8 or 9 as per SFDR.

R. P.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all EURAZEO news