on TOUR EIFFEL (EPA:EIFF)

Financial Evolution of the Eiffel Tower Company in 2024

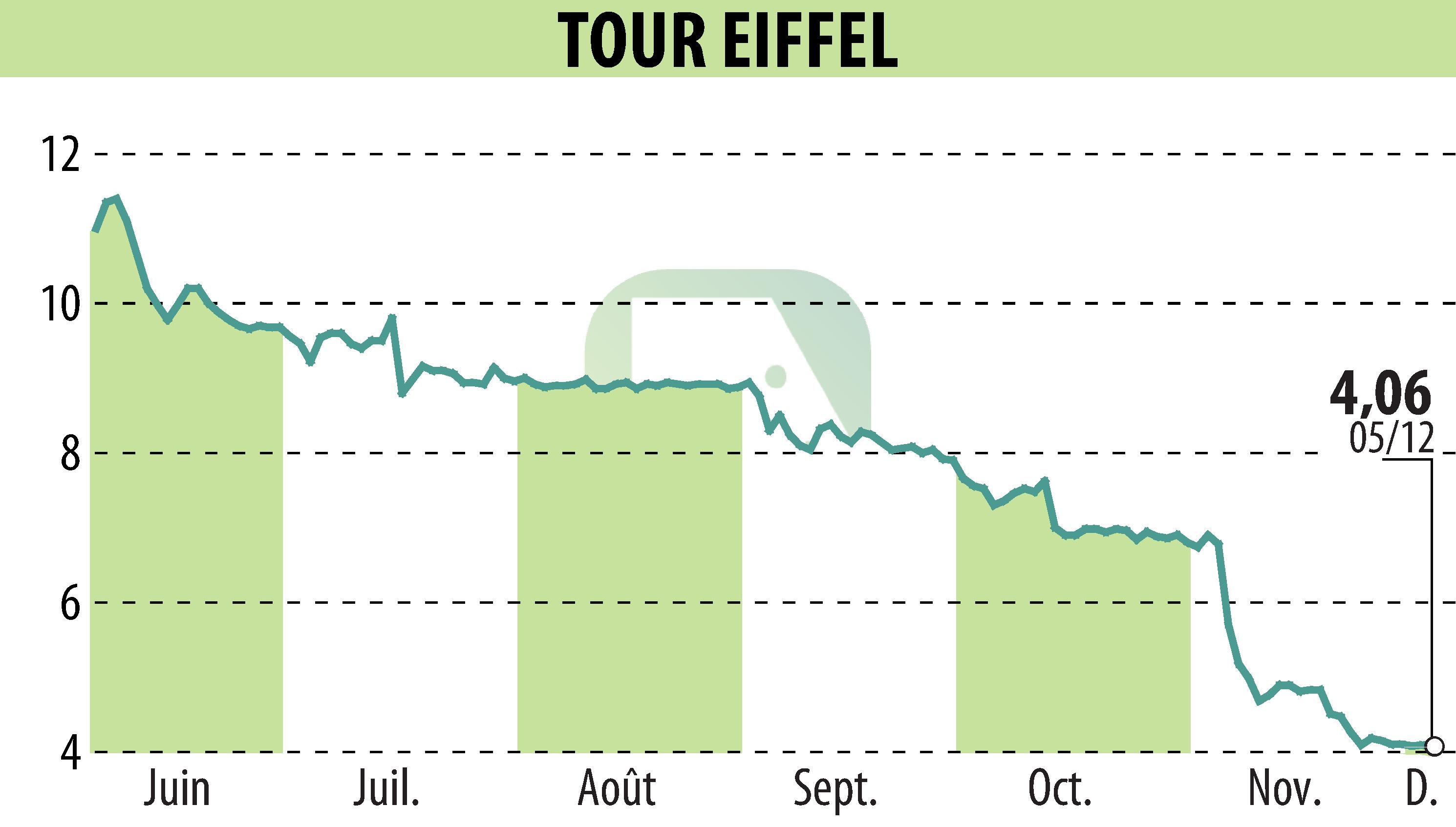

Société de la Tour Eiffel expects the value of its real estate assets to decline by around 6% by the end of 2024. As of June 30, the value stood at €1,669 million, but is expected to drop to €1,593 million by the end of the year. This decline reflects current market conditions and repositioning efforts.

The financial occupancy rate is also expected to fall to 76%. The Company anticipates a decrease of 15 to 20% in its revalued net assets. A decline in rental activity contributes to this dynamic, with a net balance of -€4.4 million in annualized rents.

To address these challenges, a capital increase of €600 million is planned, with the support of the SMABTP Group. This measure aims to stabilize the financial structure and meet short-term deadlines.

R. H.

Copyright © 2024 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all TOUR EIFFEL news