on WEDIA (EPA:ALWED)

First half 2024 results: Wedia maintains its stability

For the first half of 2024, Wedia announces consolidated revenue of €6.9 million, showing stability compared to 2023 after the sale of Galilée's activities in January. SaaS and Services revenues represent 81% and 19% of revenue respectively.

Gross operating surplus reached 19% of turnover thanks to a 10% drop in operating expenses. Current operating income remained stable at 469,000 euros. The group's net income, including the proceeds from the sale of Galilée, amounted to 1.568 million euros.

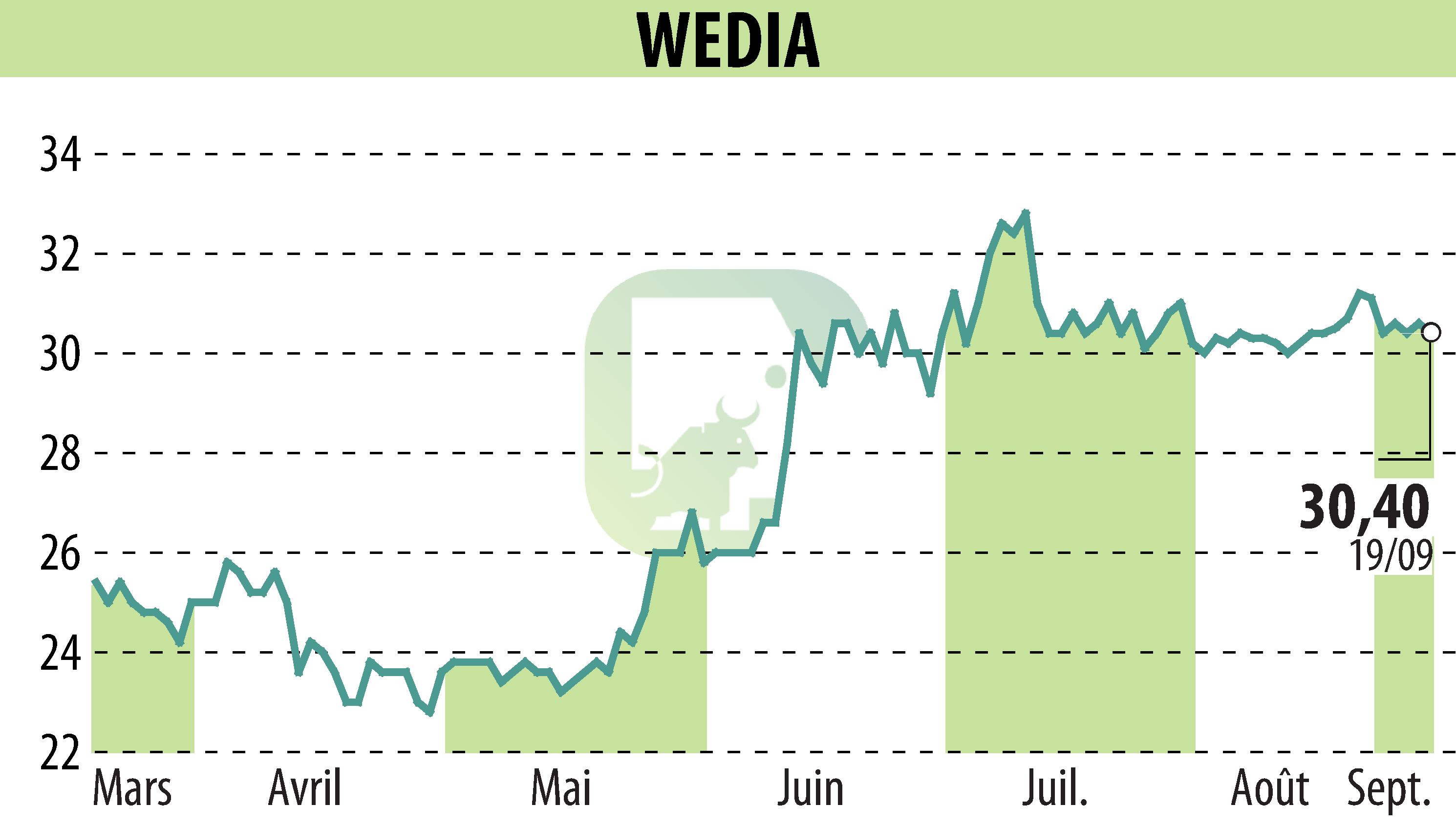

The Board of Directors of Wedia has given a favorable opinion to the Simplified Public Purchase Offer (OPAS) of Mercure. The latter will propose 30.50 euros per share, with a potential supplement of 1.25 euros in the event of reaching 90% of the capital.

A change in governance accompanies this offer with the resignation of three directors, replaced by representatives of Cathay Capital, now the majority shareholder with 57.2% of the capital.

R. P.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all WEDIA news