on Nanohale AG (isin : DE000A1EWVY8)

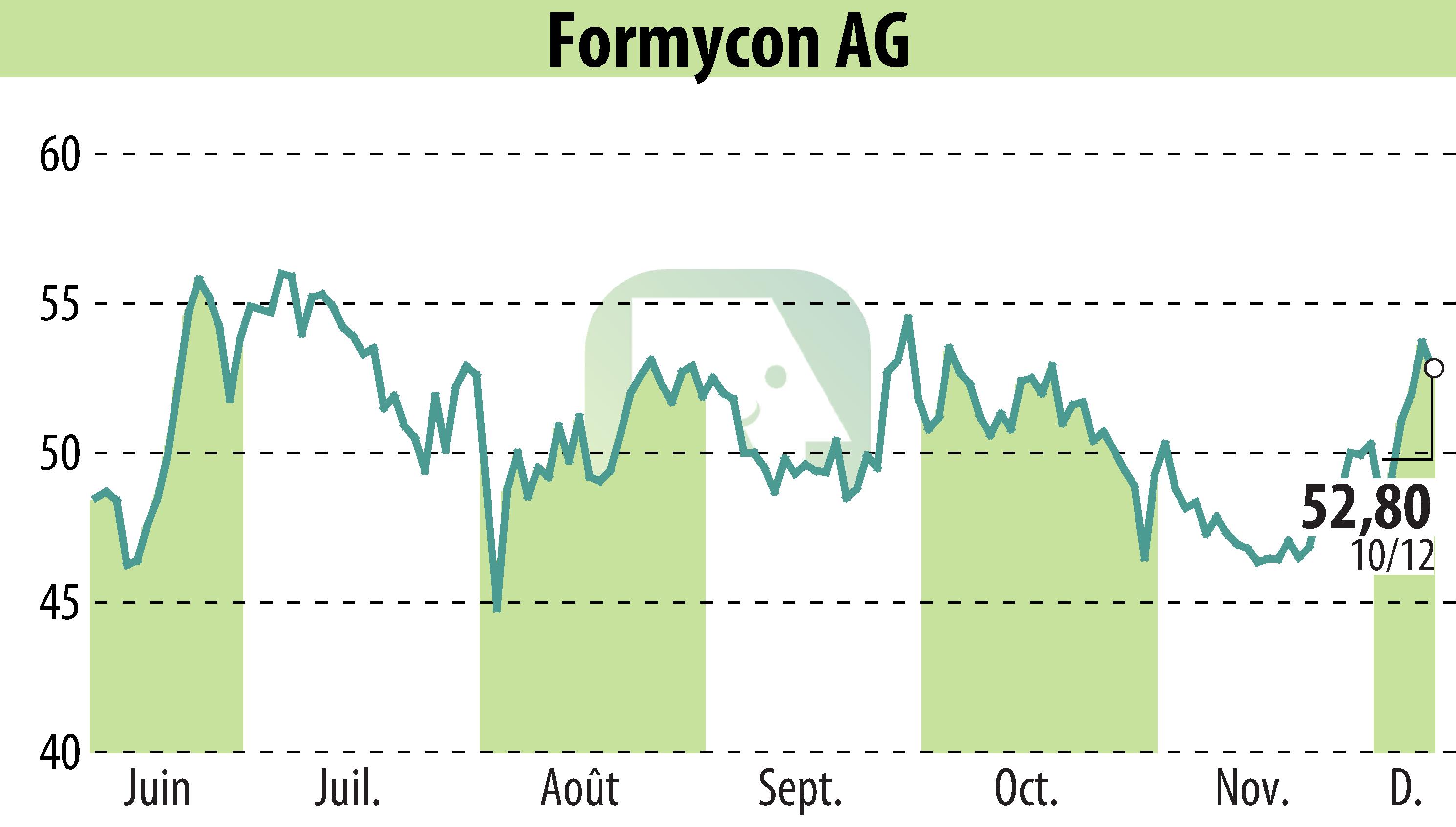

Formycon AG Maintains Strong Growth Prospects Amidst Challenging Market Conditions

First Berlin Equity Research has reiterated its "Buy" rating for Formycon AG, maintaining a target price of €82. Despite a 31.7% drop in revenue to €41.1 million due to decreased milestone income, the firm remains optimistic about the company's future. The decline was linked to the winding down of development for FYB201 and FYB203 biosimilars.

FYB201, launched in 2022, continues to generate revenue, while FYB203 is expected to launch next year, pending ongoing litigation outcomes. The upcoming launch of the Stelara biosimilar, FYB202, is particularly significant after securing FDA and EMA approvals. Johnson & Johnson's lack of a successor product provides a competitive edge for Formycon.

Royalty income from FYB202 could reach triple-digit million euros by 2026, offering a lucrative opportunity compared to FYB201's expected €15 million royalties. This potential growth supports the current favorable stock valuation.

R. P.

Copyright © 2024 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all Nanohale AG news