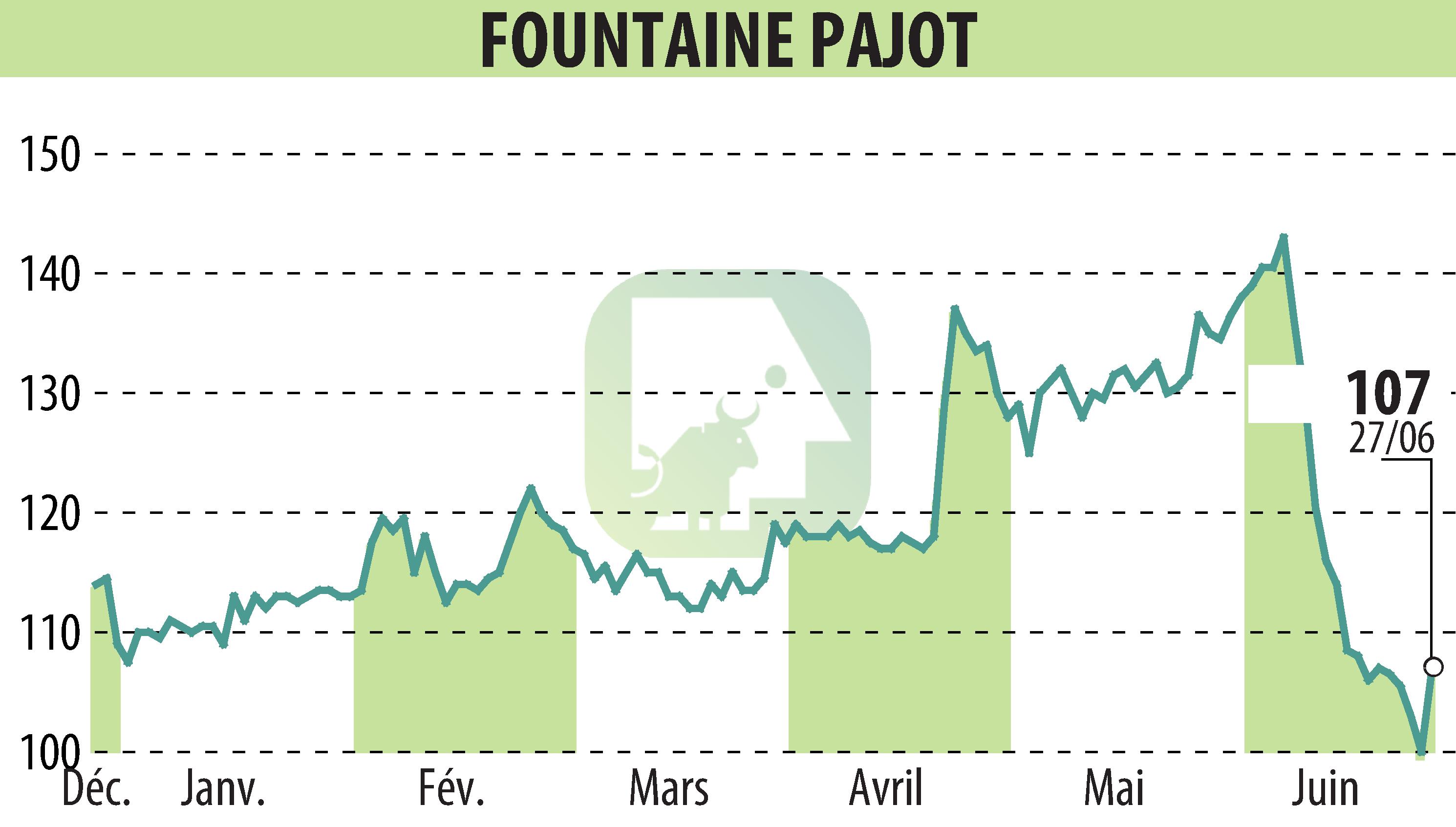

on FOUNTAINE PAJOT (EPA:ALFPC)

FOUNTAINE PAJOT: Progress of the Odyssea 2024 Plan and Results of the First Half of 2023/24

FOUNTAINE PAJOT announces significant progress in its Odyssea 2024 strategic plan, structured around three pillars: social, environment and investments. More than 100 new employees have joined the company and significant efforts have been made to develop hybrid electric solutions. At the same time, production capacities are being expanded, with investments in fitting carpentry.

The first half of 2023/24 shows solid growth with turnover up 48%, reaching €164.9 million. Gross Operating Surplus amounts to €29.8 million, while net profit, Group share, amounts to €13.5 million. These results are driven by a deep order book and successful launches.

The Group's financial structure remains robust with a positive cash flow margin of €25.7 million. Inventories increased in anticipation of deliveries in the second half of the fiscal year. Investments continue, particularly in production capacities and new products.

For 2023/24, FOUNTAINE PAJOT anticipates a new year of profitable growth, despite a market marked by a wait-and-see attitude among customers. The Group continues to look to the future with confidence, basing its strategy on innovation and adjustment of its product offering.

R. H.

Copyright © 2025 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all FOUNTAINE PAJOT news