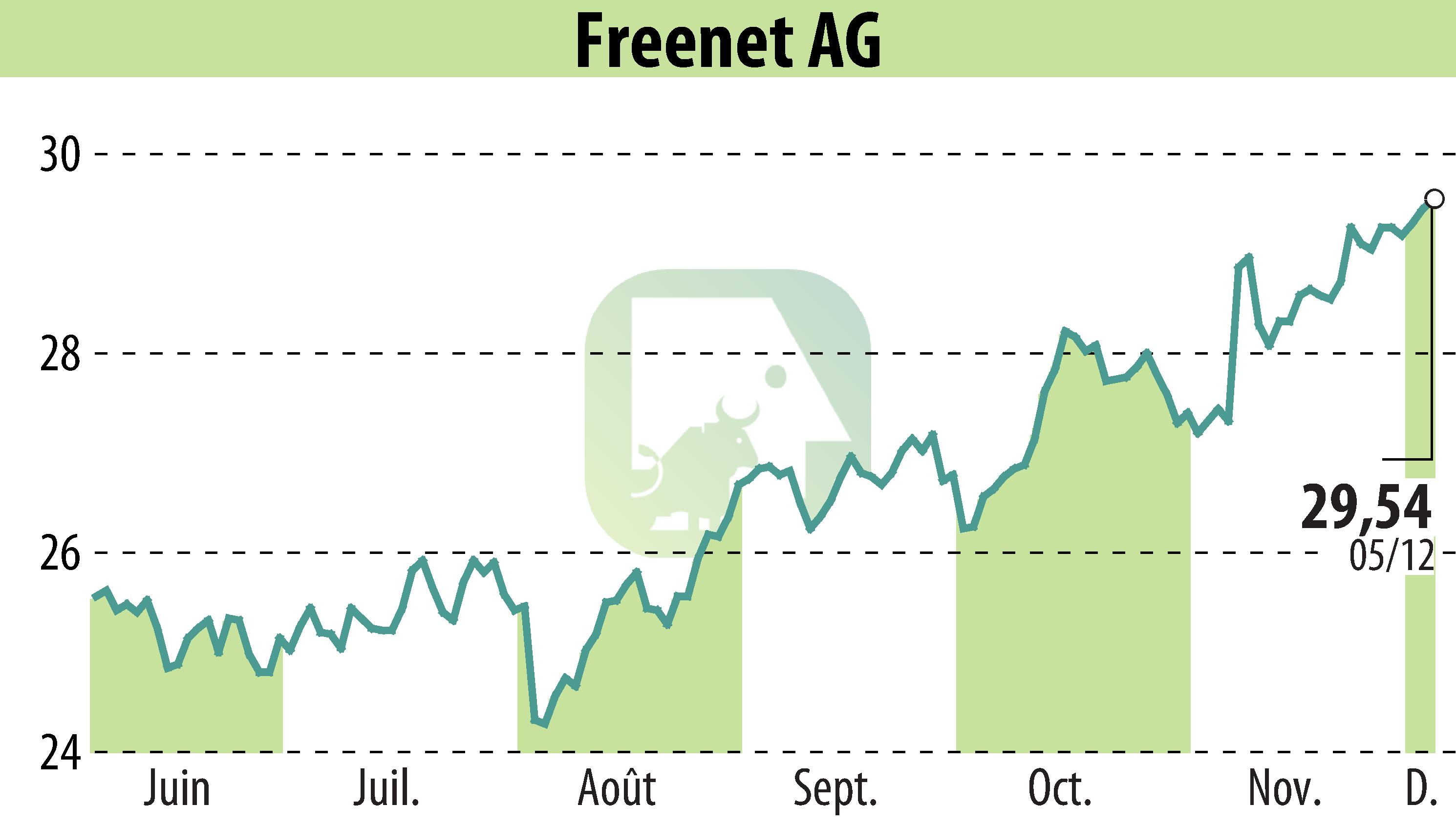

on Freenet AG (isin : DE000A0Z2ZZ5)

Freenet AG Boosts Financial Forecast Due to IP Address Sale

On December 5, 2024, Freenet AG announced an increase in its financial guidance for 2024. The company has raised its EBITDA projection to EUR 515-530 million, up from EUR 500-515 million. Similarly, the free cash flow forecast has been adjusted to EUR 285-300 million from the previous EUR 270-285 million. This revision is attributed to the one-time sale of IP addresses no longer essential for the company’s data center operations.

The sale is expected to bring in approximately EUR 32 million. This revenue will be reflected in two parts: roughly EUR 18 million in 2024 and EUR 14 million in 2025. The earnings from this transaction will be recorded under the Other/Holding segment of the company. The strategic sale highlights Freenet AG's proactive approach to enhancing its financial metrics.

R. P.

Copyright © 2024 FinanzWire, all reproduction and representation rights reserved.

Disclaimer: although drawn from the best sources, the information and analyzes disseminated by FinanzWire are provided for informational purposes only and in no way constitute an incentive to take a position on the financial markets.

Click here to consult the press release on which this article is based

See all Freenet AG news